Expatriates that work overseas may be able to reduce their tax bill by filing IRS Form 2555. This is because the foreign-earned income exclusion allows certain US citizens to exclude a portion of their earnings from federal taxes. In order to qualify for this, expats must meet the bona fide residency and physical presence tests. The former involves living abroad for a full year, while the latter requires being present in a foreign country or countries for 330 days out of 365.

However, claiming this exclusion can be complicated, and expats often need to seek the guidance of a skilled tax CPA. A seasoned professional will help filers fill out the form properly so they can avoid any mistakes that could delay their deduction or cause larger issues at tax time. They may also suggest other supplemental documents to support the claim, such as employment statements and supplementary foreign-earned income forms.

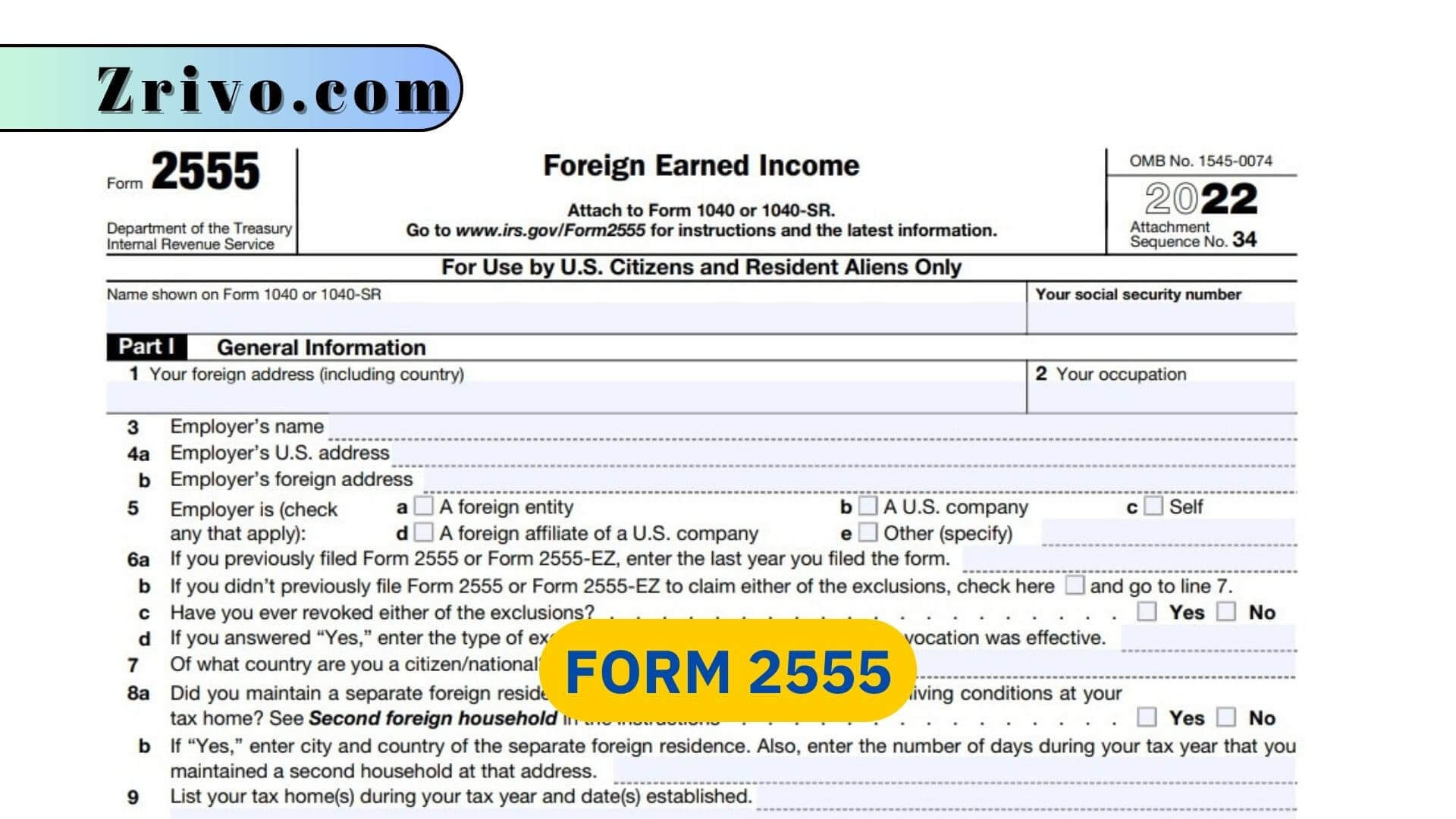

How to File Form 2555?

The form has several sections that require specific information and calculations. It takes a few hours to fill out, but it’s possible to use professional-quality tax preparation software to reduce the time needed to complete it. It’s important to follow the instructions carefully when filling out this form, and it is wise to consult an experienced expat tax CPA for assistance if you have any questions.

The first section of the form asks for general information about your situation and employment overseas. Then, it explains how to qualify for the FEIE by meeting either the bona fide residence test or physical presence test. Finally, it provides instructions on how to calculate your foreign housing exclusion or deduction. To do this, you must provide details about your salary and other earnings on line 19, as well as the fair market value of meals and lodging provided in camps by your employer on lines 21a and 21b

How to Fill out Form 2555?

To fill out Form 2555, you must provide information about your source of income and your foreign address. In addition, you will need to provide details about your foreign-earned income and deductions allocable to foreign-earned income. If applicable, you must also provide information about your housing exclusion or deduction. For those who do not qualify for the FEIE, there is a simpler version of the form called Form 2555-EZ. This form is only required if you have self-employment income or you are not filing for the foreign housing deduction. You should file Form 2555 at the same time you file your individual tax return.