When workers have been misclassified as independent contractors, they can use Form 8919 to report the amount they believe should have been withheld from their pay. This will ensure that their Social Security earnings are correctly credited to their record. If you are a recruiter who provides contract staffing services, it is your responsibility to determine whether your workers are employees or independent contractors. If you are unsure, you should use Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. If you determine that a worker is an employee, you must file Form 8919 to report any uncollected Social Security and Medicare taxes on their wages. You should also enter the total from line 6 on your worker’s tax return. This will ensure that the worker’s earnings are properly credited to their Social Security account. It will also keep you from being held liable for the employee’s uncollected Social Security and Medicare taxes.

Form 8919 Reason Codes

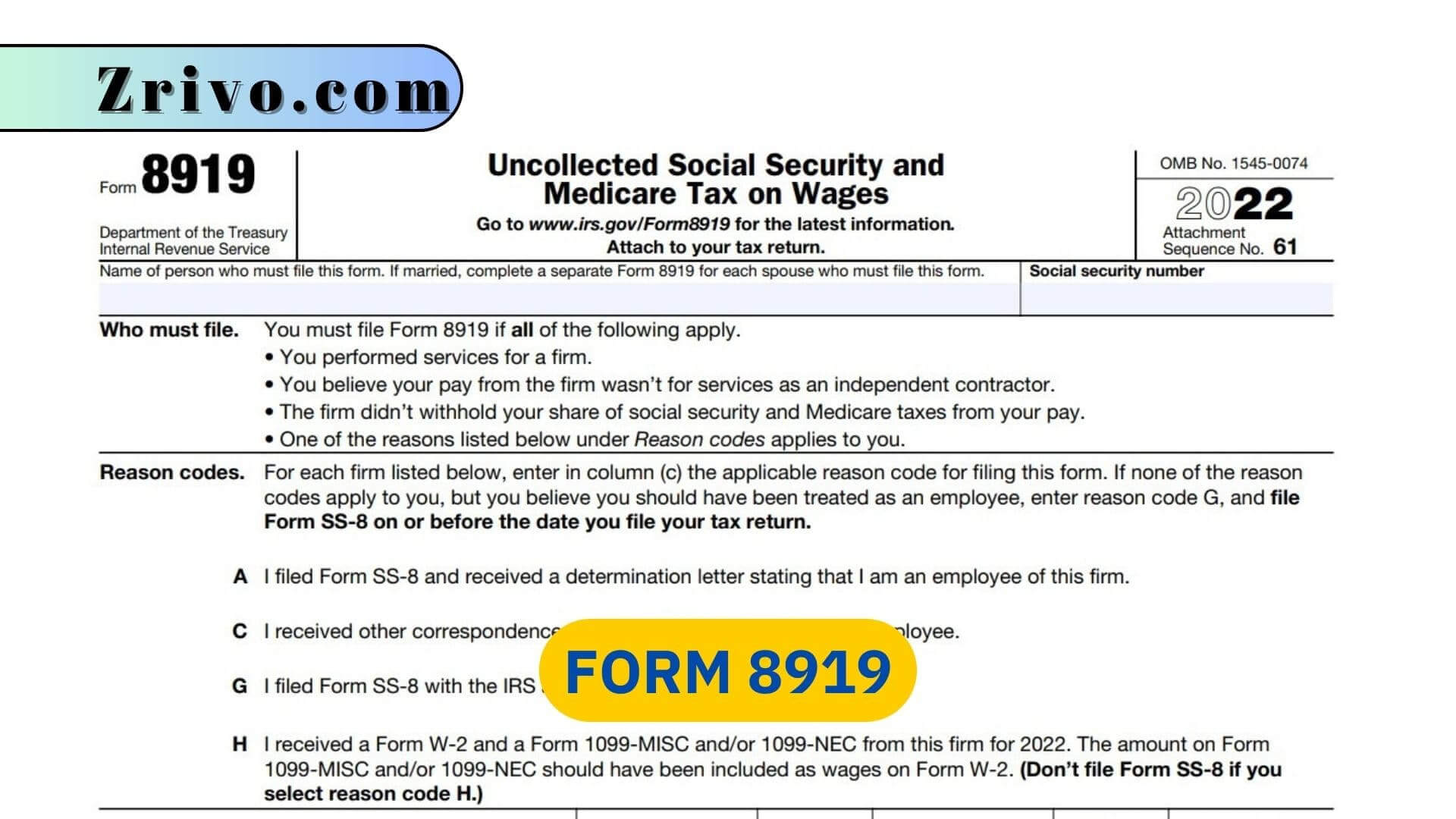

Workers should file Form 8919 after submitting Form SS-8 and receiving a determination that they are employees. They must select one of the following Reason Codes:

A. I filed Form SS-8 and received a determination letter stating that I am an employee of this firm.

C. I received correspondence from the IRS stating I am an employee.

G. I filed Form SS-8 with the IRS and haven’t received a reply.

H. I received a Form W-2 and a Form 1099-MISC and/or 1099-NEC from this firm for 2023. The amount on Form 1099-MISC and/or 1099-NEC should have been included as wages on Form W-2. (Don’t file Form SS-8 if you select reason code H.)

How to File Form 8919?

If you were misclassified as an independent contractor and didn’t have FICA taxes (Social Security and Medicare) withheld from your paychecks, you must file Form 8919 to figure out the amount you owe. The form requires you to provide information about the firm that misclassified you and your job duties. Then, you must list your total wages for the year and calculate the Social Security and Medicare taxes you missed.

Depending on the circumstances, you may choose to fill out either IRS Form 8819 or Form 8919. Form 8919 is used for figuring and reporting uncollected Social Security and Medicare taxes on wages, while Form 4137 is used to report and calculate the Social Security and Medicare taxes owed on tips.

To file IRS Form 8919, you must identify the firm that misclassified you as an independent contractor and explain why they did so. You also must indicate the applicable reason code in the top section of the form and include your name, address, Social Security number, and date of birth.

Workers who were misclassified as independent contractors and did not have Social Security or Medicare taxes deducted from their paychecks must file Form 8919 to determine and report their share of the uncollected employment taxes. This can save them thousands of dollars in employment tax their employer should have paid them.

For this tax form, employees must provide a number of details, including the employers they worked for and their pay information. Then, they must list all the wages that are subject to Social Security and Medicare taxes. This includes salaries, wages, tips, and railroad retirement benefits. Generally, the total amount of each should be included in column (f) of line 6 of the form. This figure must also be included on lines 3 and 9 of IRS Form 1040 or Form 1040-SR and line 1a of Form 1040-NR.

Generally, this form is used for people who have received Forms W-2 from their employer but received a Form 1099-MISC for bonuses and commissions that should have been reported on their W-2. This is usually because the person filed Form SS-8 and was told by the IRS that they are an employee or did not receive a response to their SS-8.