The Domestic Production Activities Deduction is a tax deduction for pass-through entities. It is similar to the QBI deduction that is available for individuals. The DPAD is calculated using gross receipts and expenses incurred in producing or selling eligible products or services. In some cases, a taxpayer may have to allocate the gross receipts of an individual item to remove nonqualifying embedded service income or determine the qualified income portion of a component of an item. To compute the DPAD, taxpayers need to use the methods described in the Form 8903 instructions. If you use a software to file a return, the DPGR reported on line 1 of the Form 1120 must match the DPGR reported on line 15 of Form 8903.

Individuals, Partnerships, S Corps, cooperatives, estates, or trusts that are not EAG must file Form 8903 to figure out DPAD. Exceptions exist for some consolidated groups and for agricultural and horticultural cooperatives. Therefore, these entities can’t net patronage losses with nonpatronage income and must figure their DPAD separately on Schedule G, Form 1120-C.

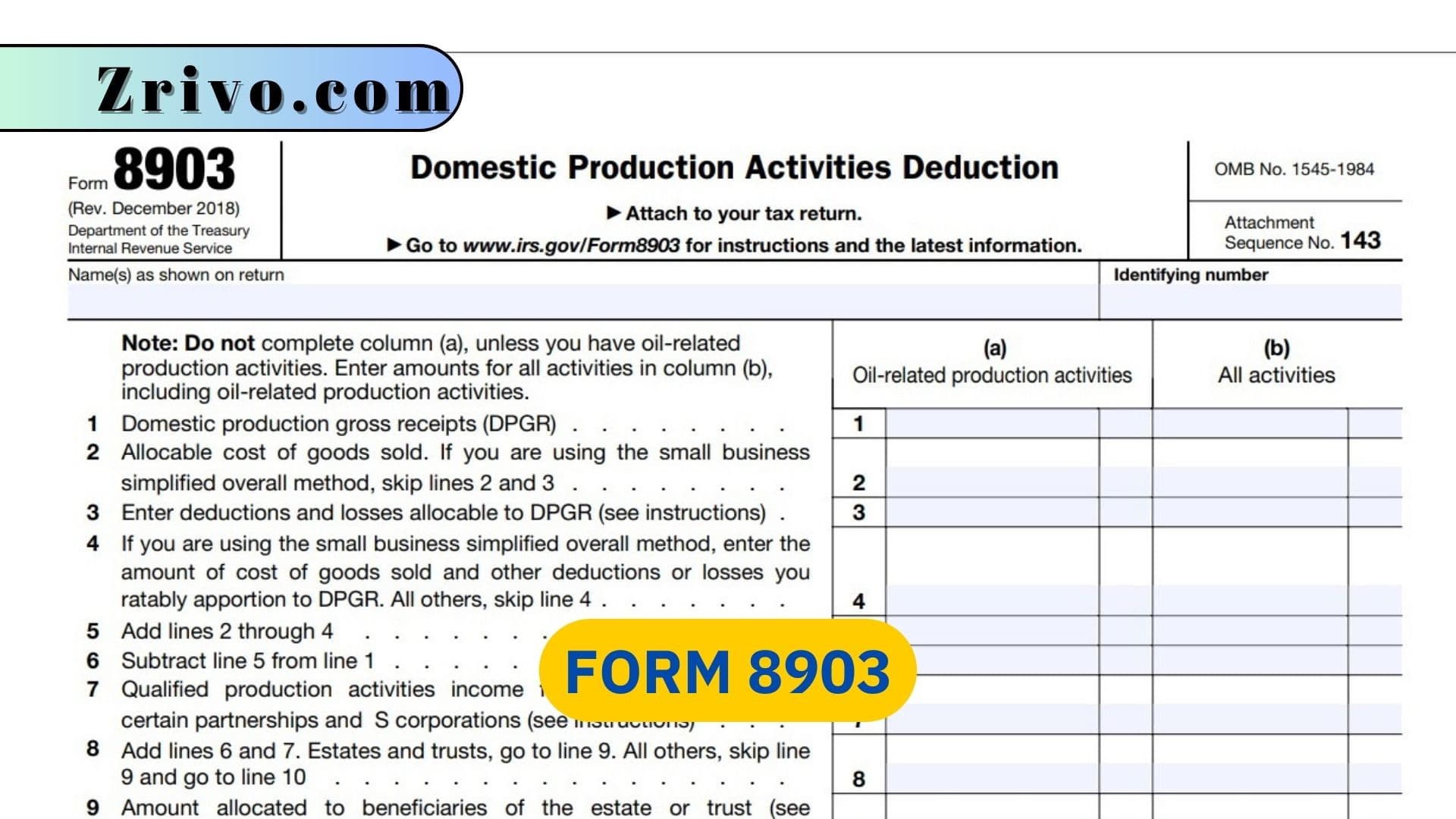

How to Complete Form 8903?

A consolidated group must choose one of its members to file Form 8903 as the reporting member. The reporting member completes lines 1 through 25 for the consolidated group and attaches a schedule showing how it figured out its DPAD. The consolidated group also must enter its QPAI on line 25.

An EAG must determine its DPAD by allocating its gross receipts between qualifying and nonqualifying activities. This may be necessary to remove any nonqualifying embedded service income or to determine the qualified income portion of a component of an item. The EAG must also report its unused DPAD on line 26.

Agricultural and horticultural cooperatives aren’t required to net their DPAD with nonpatronage income but must instead figure their unused DPAD on line 25 of Form 8903. To do this, the cooperative must compare its DPGR reported on line 2 of Form 8903 to its gross receipts or sales less returns and allowances shown on line 1 of Form 11.

Estates and trusts that allocate their QPAI and/or Form W-2 wages to beneficiaries must reduce the amounts they report on lines 8 and 18 of Form 8903 by the portions allocated to the beneficiaries. For more information, see the instructions for completing Form 8903 for estates and trusts, earlier under Definitions and Special Rules.