Form 6252 is used to report income received from an installment sale. It allows a seller to defer taxes on a sale until the payment is received. This is beneficial for both parties because it allows the buyer to pay for a property over time and helps the seller avoid paying taxes on the full sale amount immediately. When reporting an installment sale, the first thing you need to do is determine whether or not it is a capital gain or a regular income. You can do this by examining the contract price and calculating the cash received in connection with the sale. Then, you need to sum all the costs of advertising, a lawyer’s services, and other expenses related to the sale. The total value of the property must then be added to this amount and divided by the contract price in order to arrive at the gross profit number.

How to File Form 6252?

Once you have determined the amount of the gain, you need to enter it on Form 6252. This will help you calculate the amount of tax that will be owed. You will also need to enter the sale date and the buyer’s name. In addition, you will need to provide a description of the property and the selling expenses that were incurred.

For C-Corporations, the information entered on the 6252 screen is combined with the information reported on the 4797 and Schedule D screens to calculate the net short-term and long-term capital gains. This is then reported on the appropriate business forms; 1065, 1120S, or 1120.

How to Fill out Form 6252?

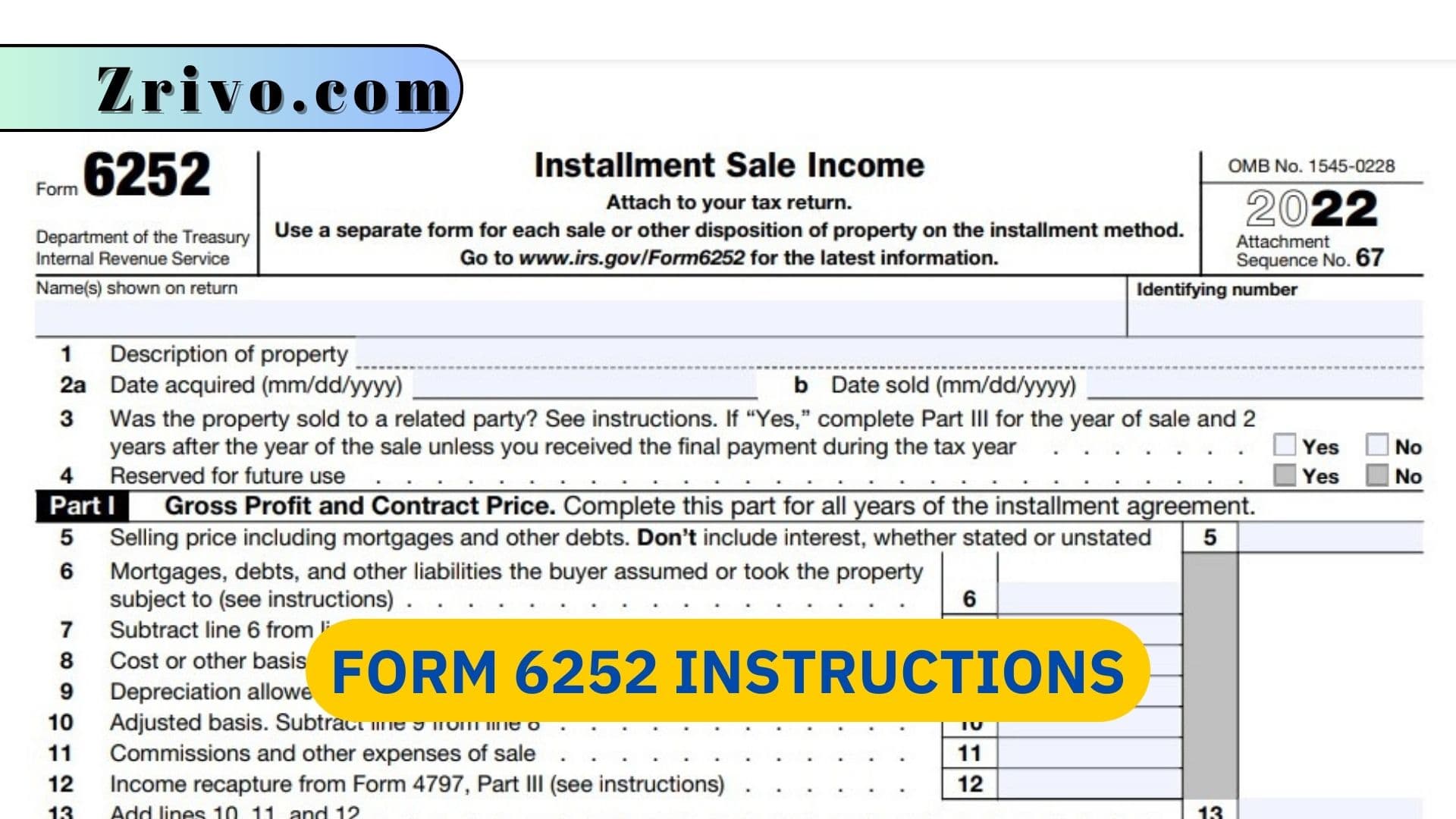

In order to fill out Form 6252, you can follow the Form 6252 Instructions below:

- The first section of Form 6252 covers basic information, including the type and description of the property.

- You must also include the date of acquisition and sale and the gross profit from the transaction.

- In addition, you must complete the form if your property is subject to capital gains treatment. If you’re selling a personal residence, this is particularly important.

- You must fill out special fields if you sell the property to a related party. This includes members of your family or any business entity that you control.

- You must also fill out Form 6252 if the sale is taxable under the cancellation of indebtedness rules.

In the third part of the form, you must determine how much of each payment is interest. You can use this information to calculate your total taxable income for the year. This is true even if the agreement with the buyer does not include an interest payment.

If the property you’ve sold qualifies for long-term capital gain treatment in the year of the sale, it will continue to be treated as such through each subsequent payment you receive. The same is true for short-term gains on the disposition of certain types of property.