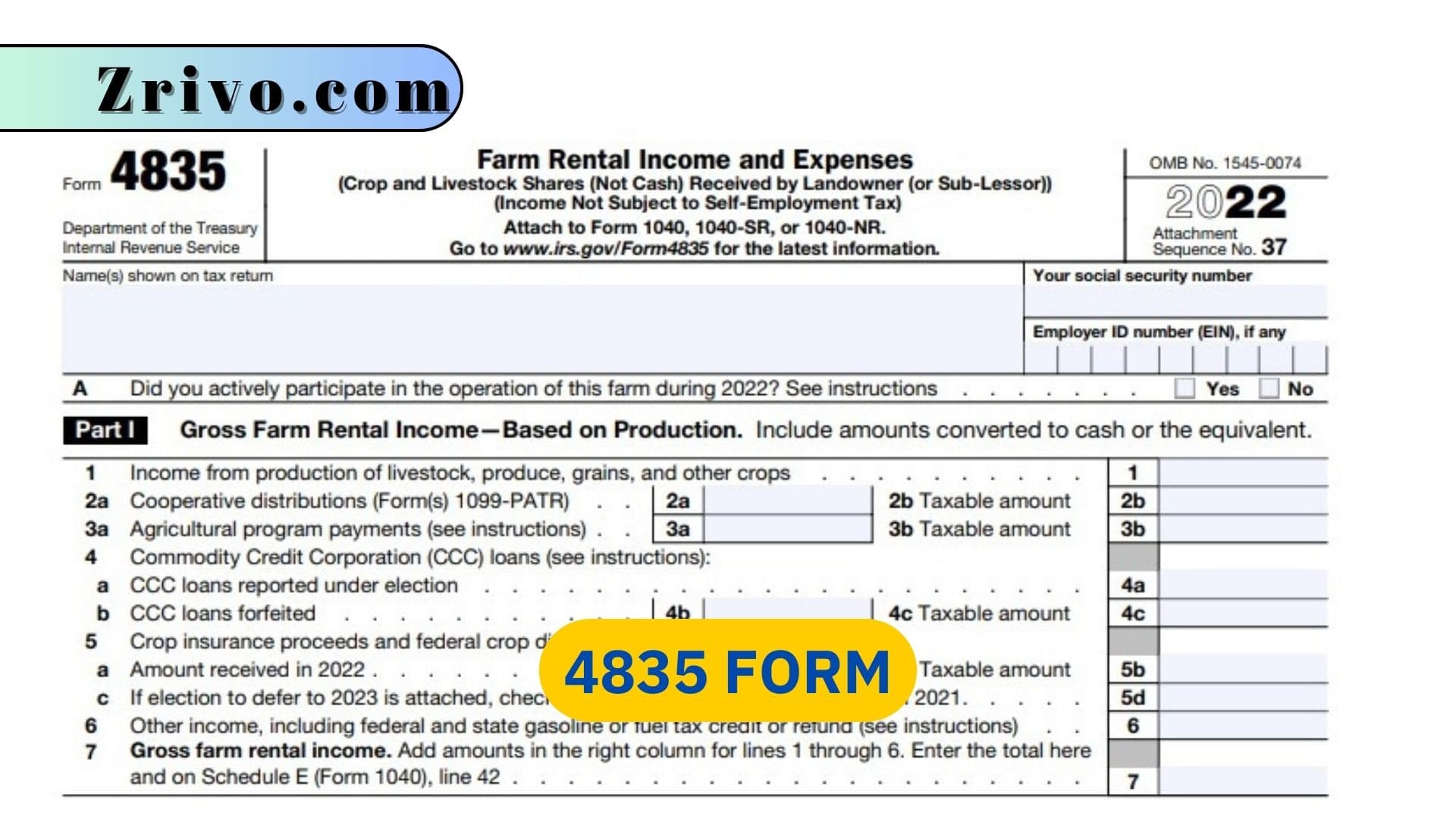

4835 Form is a tax form used to report farm rental income and expenses. It is filed with the farmer’s individual income tax return, usually Form 1040. An estate, trust, or S corporation should use Form 8825 instead. Farm taxpayers use this form to report income received from cash rents, crop shares, and other types of farm rental arrangements. They also report their allowable rental expenses, such as property taxes and mortgage interest. This form is similar to Schedule F but specifically designed for farmers who rent out their farmland.

Who Must file Form 4835?

The key issue in determining whether you must file Form 4835 is whether you materially participated in the operation and management of the farming business. Generally, you are a farmer if you participate for more than 500 hours in the activity during the tax year or if you meet the other material participation tests described in Pub. 225. You must also have a significant participation in one or more other significant activities. A landlord who is not a materially participating farmer may elect to report his or her share of the crop or livestock rental income on Schedule E rather than on 4835 Form. However, you can only do this if the rental income is from a qualified share-rental arrangement, as defined in section 447 and discussed in section 402(b) of the Internal Revenue Code.

How to file Form 4835?

In Part, I, show your gross farm rental income. This includes cash rents paid and crop or livestock shares received in lieu of cash rents. Also, include any market gain from the sale of any farm-related property or equipment. You may have to add in other amounts, such as rental expenses, including depreciation and fees charged for the use of teams or machinery. You should also include your deductible labor costs, such as wages and salaries, and the cost of materials used in production.

When you’re ready to fill out Form 4835, start by entering the total amount of cash rents and other amounts you received in exchange for using a farmer’s land or facilities. Then enter the total expenses attributable to this activity on Lines 8 through 30f (or Lines 10 through 32e if you capitalized expenses). The sum of these lines should equal the total of all other lines on the form.

Next, enter the total patronage dividends you received and any market gains from forfeited Commodity Credit Corporation loans. Also, report any income from the sale of breeding livestock or fees from renting farm machinery or land if not reported on Schedule F (Form 1040).

In most cases, you must report any such income in the year you actually or constructively receive it and deduct any expenses in the year you pay them. But there are some exceptions. See chapter 2 of Pub. 225 for details.