Investment tax credits are typically claimed by businesses but can also be utilized by sole proprietors and certain pass-through entities like partnerships and Subchapter S corporations. Form 3468 is used to calculate tax credits for qualified commercial energy improvements, such as solar systems. Credits on this form are generally claimed by businesses such as corporations, partnerships, and sole proprietors that own shares of pass-through entities such as Subchapter S corporations; then, these credits are divided among their partners or shareholders and included on individual returns as total credits owed; this should come directly from your business informing you what to include on Form 3468 to claim your share.

Businesses and sole proprietors alike may claim these credits. Individuals often claim them to reduce their personal income taxes, while corporations claim them to lower corporate tax liabilities. Taxpayers owning shares in partnerships and Subchapter S corporations often share in these credits equally among all owners – this type of “pass-through entity” should have information detailing how they should claim their portion on Form 3468.

In general, the amount of credit that your business receives depends on its use of the property. For instance, public utilities typically receive more credit than residential customers.

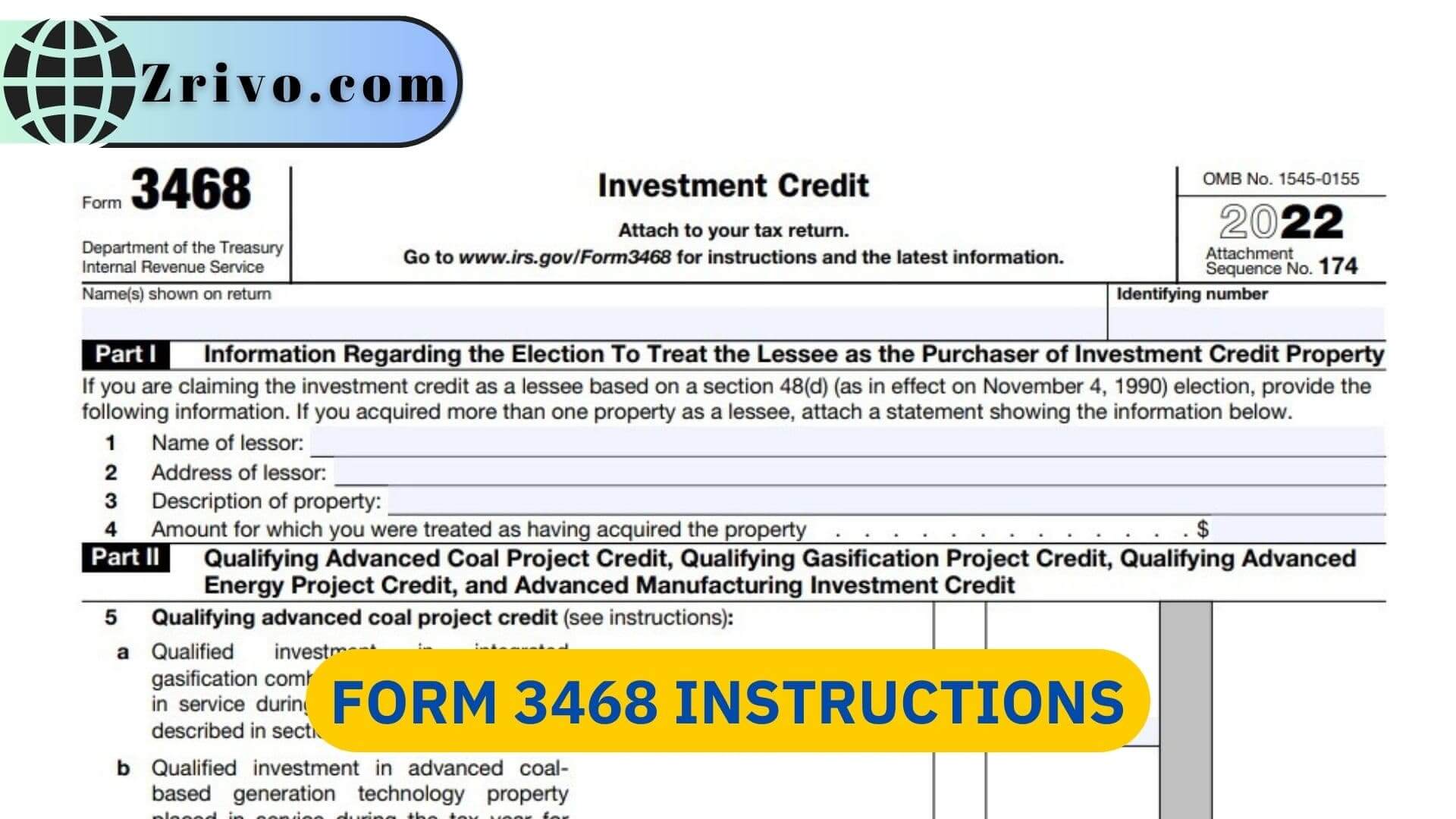

How to fill out Form 3468?

Calculating your Investment Credit can be done on Form 3468 and then carried over as part of the General Business Credit, which contributes to Form 3800 for business tax credits and, for individuals, Schedule 3.

- Complete the relevant sections of the form based on the credits you are claiming. You may need to provide information about your investments, including the type of property, the date it was placed in service, and the credit rate or amount.

- Follow the instructions on the form to calculate the amount of each credit you can claim. Read the instructions carefully and consult any relevant IRS publications, such as Publication 946 (How to Depreciate Property), to ensure you’re calculating the credits correctly.

- After you’ve completed Form 3468, you’ll need to transfer the credit amounts to your tax return. Depending on your tax situation, you may need to report the credits on different forms, such as Form 3800 (General Business Credit) or your income tax return (Form 1040 or 1040-SR).

- When you file your tax return, make sure to attach Form 3468 along with any other required forms or schedules.

Form 3468 has different sections for each credit claim. For example, Lines 12b, 12c, or 12d of Form 5695 is where you report solar energy property.