Form CT-647, or the Farm Workforce Retention Credit Affidavit, is used by eligible farmers in New York State to claim a tax credit for hiring and retaining qualified employees in the agricultural industry. To be eligible for the Farm Workforce Retention Credit, farmers must have paid wages to qualified employees during the tax year in which the credit is being claimed. Qualified employees have worked for the farmer in agricultural employment for at least 500 hours during the tax year and have been employed by the same employer for at least 45 days.

To fill out Form CT-647, farmers must provide identifying information about themselves and their farming operation, as well as information about their qualified employees and the wages they paid during the tax year. The completed form should be filed with the farmer’s New York State tax return.

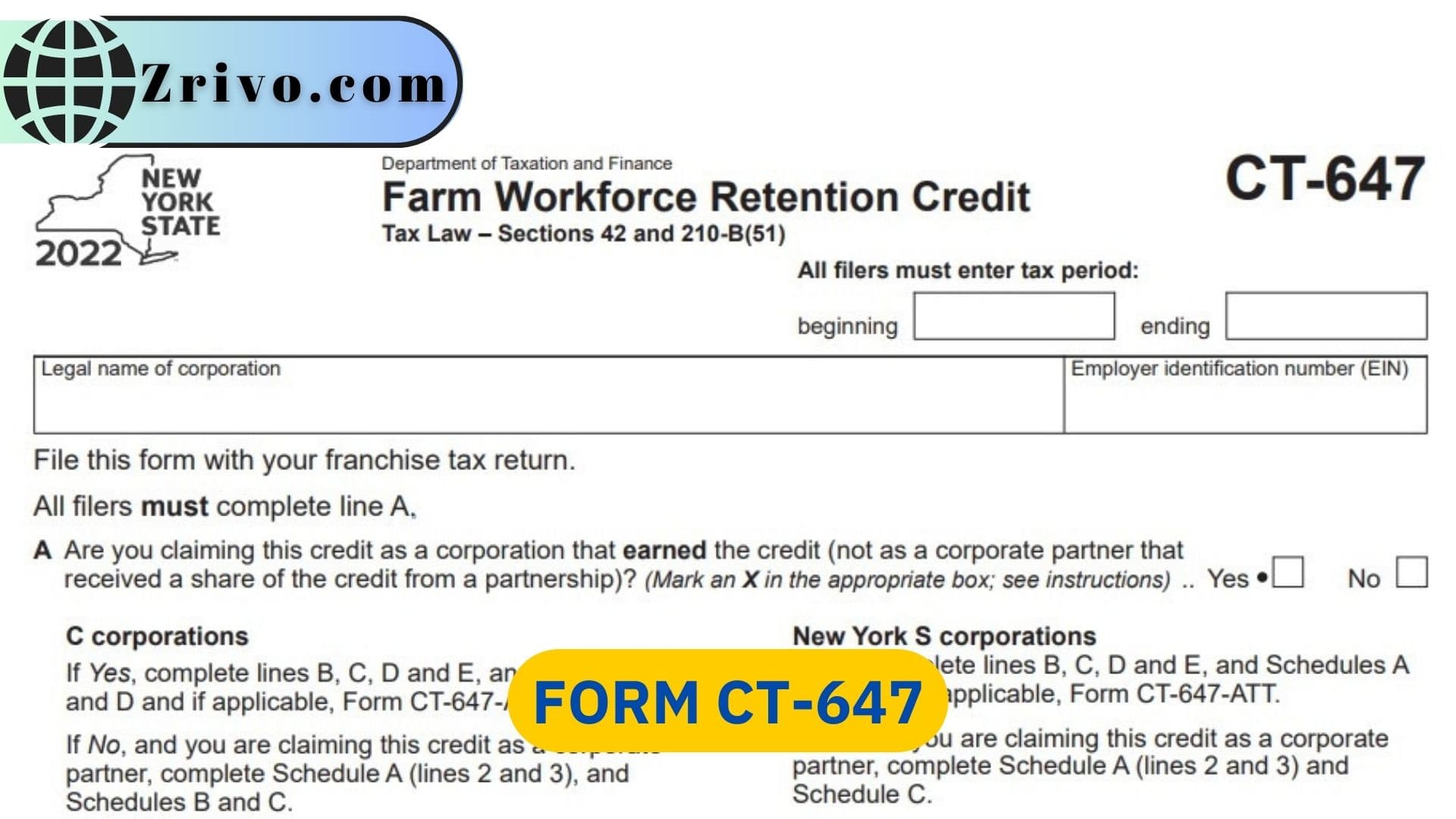

How to Fill Out Form CT-647?

- Enter the tax period.

- Enter Legal name of corporation.

- Enter the Employer identification number (EIN).

Line A: Are you claiming this credit as a corporation that earned the credit (not as a corporate partner that received a share of the credit from a partnership)? Yes, or No.

- C corporations: If YES, complete lines B, C, D, and E, and Schedules A, B, and D, and if applicable, Form CT-647-ATT. If NO, and you are claiming this credit as a corporate partner, complete Schedule A (lines 2 and 3) and Schedules B and C.

- New York S corporations: If YES, complete lines B, C, D, and E, and Schedule A and Schedule D and, if applicable, Form CT-647-ATT. If NO, and you are claiming this credit as a corporate partner, complete Schedule A (lines 2 and 3) and Schedule C.

Line B: YES, or NO.

- Form CT-3 and CT-3-A filers, complete Worksheet A in the instructions

- Form CT-3-S filers, complete Worksheet B in the instructions

- Is the amount shown on line 12 of Worksheet A or on line 14 of Worksheet B at least 0.6667? If you marked an X in the NO box, This means you do not qualify for this credit!

Line C:

- Enter the name, employer identification number (EIN), and physical address of the farm.

Line D:

- Enter the total number of employees claimed for this credit

Line E: Does line 11 of Worksheet A or line 13 of Worksheet B include more than 50% in income from the sale of wine or cider? YES, or NO.

As with any tax form, it’s important to carefully review the instructions and requirements before filling out Form CT-647 to ensure you are eligible for the credit and provide accurate and complete information. If you have any questions or concerns, consulting with a tax professional or the New York State Department of Taxation and Finance is a good idea.