General business credit is made up of several different credits, such as investment credit, Work Opportunity Credit, and research credit. The purpose of Form 3800 is to help taxpayers determine the total amount of credits they are eligible for and to calculate the total general business credit. Form 3800 is generally used by individuals, partnerships, and corporations that engage in certain business activities, such as investing in new equipment, hiring employees from certain targeted groups, or conducting research and development activities. The credit can be used to offset taxes owed for the current year or carried back to prior or future years.

When completing Form 3800, taxpayers must provide information about their business activities and the specific credit(s) they are claiming. The form requires detailed calculations and may require additional supporting documentation. It’s important to note that Form 3800 is complex and may not be applicable to all taxpayers. It’s recommended to consult with a tax professional if you have questions about whether you are eligible for the general business credit or how to complete Form 3800.

How to Complete Form 3800?

Form 3800 is a complex tax form used to calculate the general business credit. Here are the general steps for completing the form:

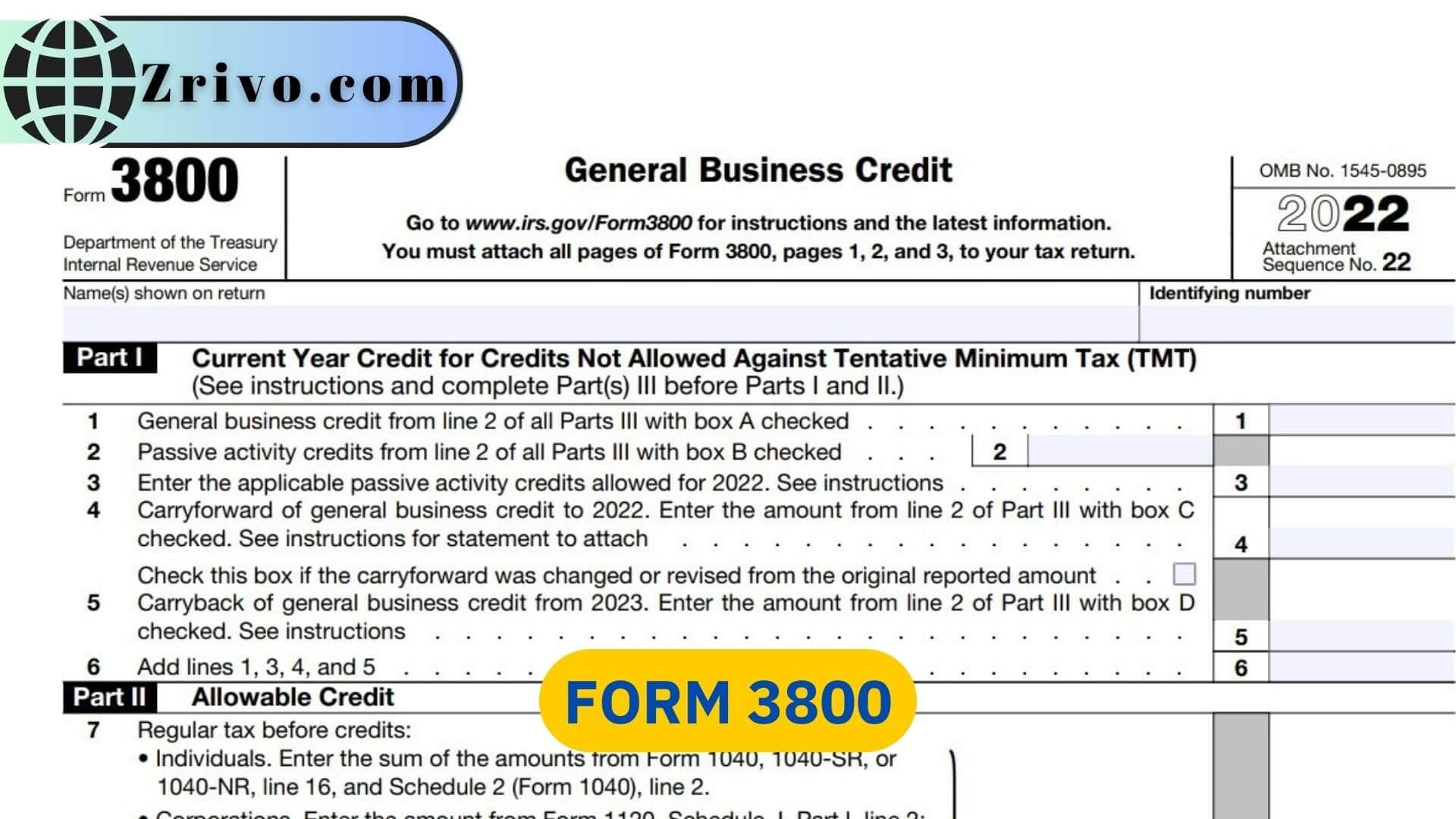

Form 3800 has 3 parts:

- Part I – Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

- Part II – Allowable Credit

- Part III – General Business Credits or Eligible Small Business Credits

- Before filling out Form 3800, gather all necessary information, such as records of business activities, expenses, and tax forms from the current and previous tax years.

- To determine the total general business credit, start by calculating each individual credit you are eligible for. Some common credits include Investment Credit, Work Opportunity Credit, and research credit. Once you have calculated each credit, add them up to determine your total general business credit.

- Part I of the form determines the amount of general business credit that can offset your tax liability for the current year. This section requires detailed calculations and may require additional supporting documentation.

- Part II of the form determines the amount of general business credit that can be carried back to prior tax years or forward to future tax years. This section also requires detailed calculations and may require additional supporting documentation.

- Include Form 3800 with your tax return: Once you have completed Form 3800, include all 3 pages of the form with your tax return for the current year.

It’s important to note that Form 3800 is complex, and the steps for completing it can vary depending on your specific business activities and the credits you are eligible for. It’s recommended to consult with a tax professional if you have questions about how to complete Form 3800 or whether you are eligible for the general business credit.