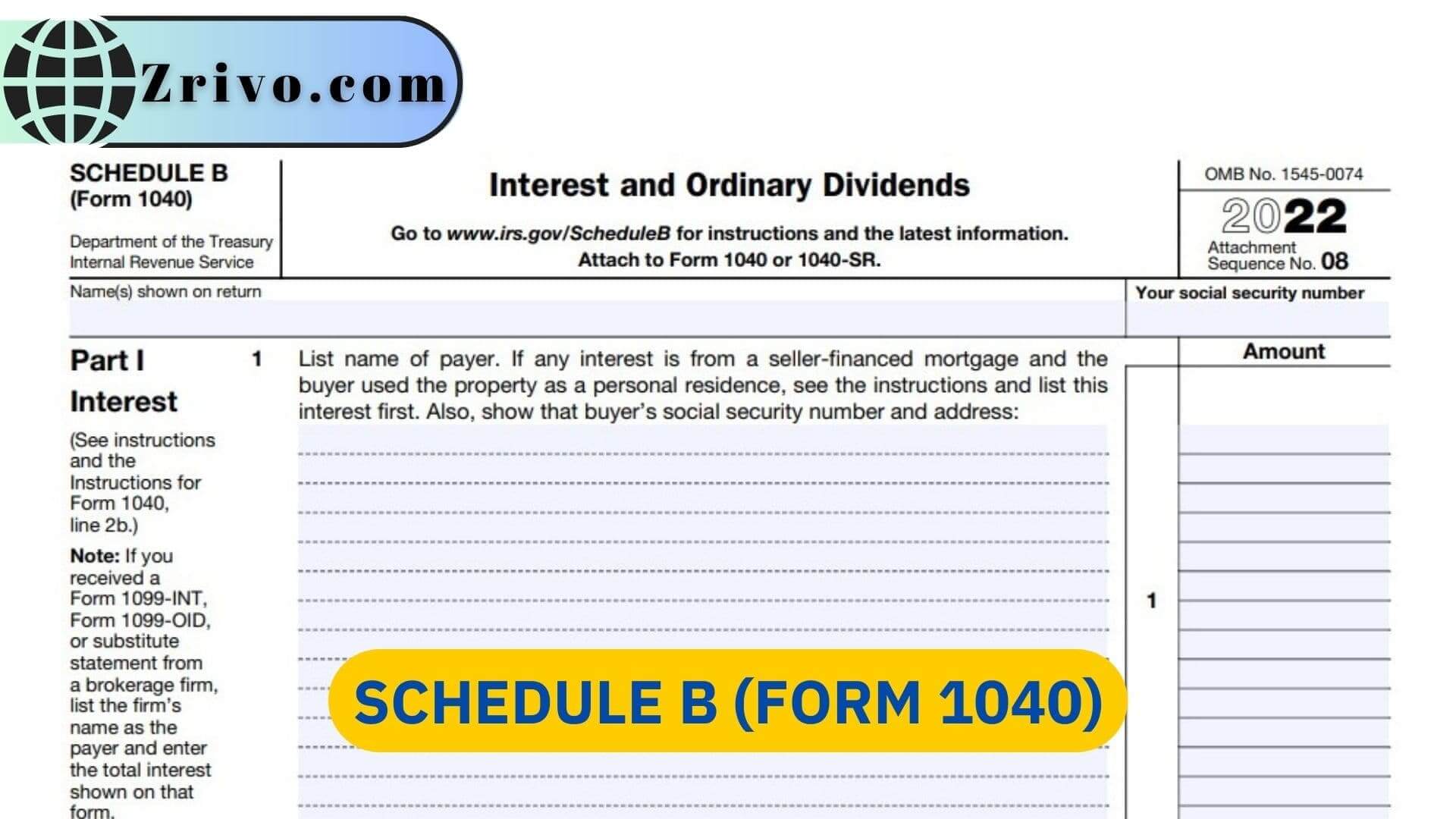

Schedule B (Form 1040) is a tax form used to report interest and dividend income. It can also be used to report certain foreign accounts. The IRS requires that you file this form when you receive more than $1,500 in qualified interest and ordinary dividends. This form uses information from Forms 1099-INT and 1099-DIV to calculate the amount you must pay in income taxes. The type of interest you earn depends on the kind of bank savings account, corporate bond, or other monetary assets you own. You will typically receive this information from your financial institution on Form 1099-INT. This information can help you determine whether or not you need to file Schedule B.

Most of the time, the interest you earn is taxable, but there are exceptions to this rule. For example, you may be able to exclude the interest you earn from certain Series EE or Series I U. savings bonds issued after 1989 from your taxes. You usually receive this information from your financial institution on e Form 1099-INT or a substitute statement from your brokerage firm. These forms list the names of the companies paying you the dividends and the amount of the dividends.

For the most part, you will want to include all of your ordinary dividends in this section of the form. This can include money you receive as a nominee, even if it was later distributed to others. You will also want to check this section if you had a foreign account during the year and did not file FinCEN Form 114, Report of Foreign Bank, and Financial Accounts. Having these foreign accounts and not reporting them on Schedule B could result in severe penalties.

How to fill out Schedule B?

- The first thing you should do is determine your filing status. You can do this by using a calculator that will allow you to enter your information and get a result.

- Depending on your income type, there are many different ways to fill out Schedule B. This includes determining the amount of income you earned, subtracting deductions, and listing taxable income and expenses.

A common way to fill out Schedule B is to use a tax schedule software tool to let you complete the entire form with a few simple clicks. These programs will also provide a template you can edit and change based on your needs. For example, you may want to highlight a section of content that is important to you. You can also remove sections of the form and substitute them with other information. If you have any questions about how to fill out Schedule B, contact the IRS for assistance. They can help you determine the best method to fill out this form and prepare your tax return.