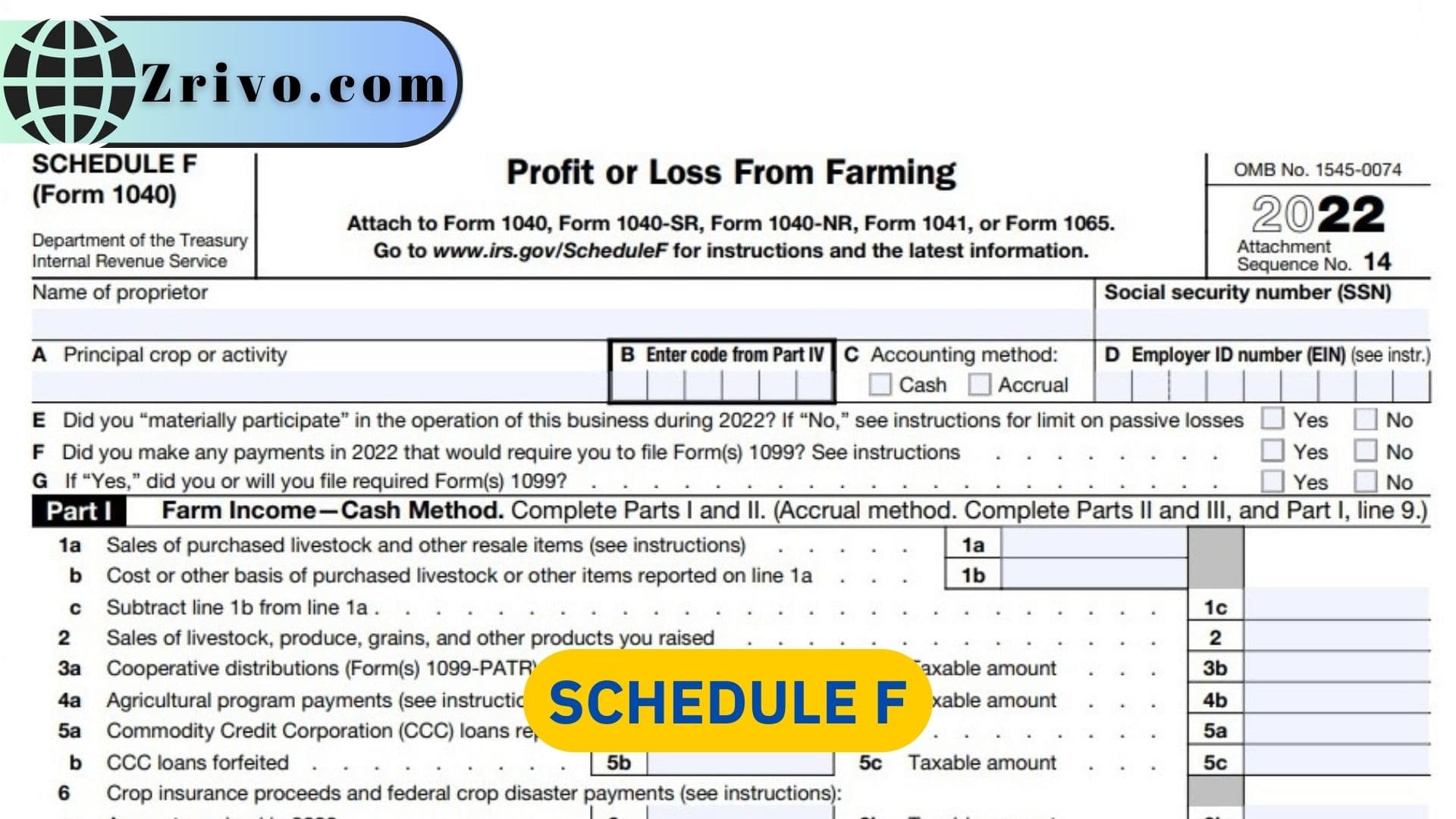

Schedule F is like Schedule C, required for sole proprietors and single-member LLC businesses, except that it only applies to farming activities. You must include Schedule F on your return if you earn income from farming activities such as growing crops, raising livestock, or breeding fish. Unlike Schedule C, farmers can deduct the costs of livestock and feed, seeds and fertilizer, wages paid to employees, interest paid on loans used for farm-related expenses, equipment depreciation and utilities, and insurance premiums.

Who Must File Schedule F?

Whether you must file Schedule F depends on three factors:

- What type of agricultural business you have.

- How much money you earn from your farming operation.

- Whether you are self-employed or work for someone else.

You must also decide whether to report your income on a cash or accrual basis, which can affect the amount you pay in taxes. The IRS defines a farmer in a broad sense, covering people who grow crops, raise livestock, and operate farms or agribusinesses such as plantations, nurseries, orchards, and ranches. However, the IRS does not include veterinarians, pet kennels, or wineries in its definition of farmers for tax purposes. For example, a farmer who produces vegetables and fruits for the market must use Schedule F to report his or her net income from the sale of those products. This includes the profits a farmer makes from selling the vegetables and fruits grown on the farm and the costs of processing the products for sale.

Additionally, farmers who receive payments from government programs, such as organic certification and disaster-related programs, also must report their shares of income on Schedule F. This can include income from payments received from government agencies or agricultural cooperatives. To help you determine which of your agricultural activities require filing a Schedule F, check out the IRS Publication 225: Farmer’s Tax Guide and speak with a local accountant. They can assist you with your tax planning and provide the tools to help you file your Schedule F correctly.

The key to successfully filing Schedule F is ensuring that you accurately record your business expenses and revenues for the year. This is important because you can then use this information to determine the profit or loss for your farm for tax purposes. Schedule F is one of several forms that farmers must fill out when they file their tax returns with the IRS. The other forms include Forms 1040, 1040NR, 1041, 1065, or 1065-B.

What can I report on Schedule F?

Aside from deductible costs and expenses, you can also claim reimbursed expenses as income on your Schedule F. This may include things like the cost of organic certification and refunds from government programs. However, if you don’t need to reimburse yourself for expenses, you can avoid claiming these on your Schedule F. You can also reduce your expense amount by a percentage of any reimbursements you receive in the year that you file. As the owner of a farming business, you must report your gross income and total expenses on Schedule F. The income you earn includes the gross proceeds from the sale of goods, services, or crops raised on your property (including livestock and nursery products).

If your farming business generates any other forms of income, such as custom farm work or services, barter income (at fair market value), or refunds or distributions from a government program or co-op, you will need to report that income on Schedule F as well. The most common deductions on Schedule F include expenses for land, buildings, and equipment used in your farming operation. You can also claim other expenses, such as advertising, legal and professional fees, vehicle and equipment repairs and maintenance, insurance, and travel.