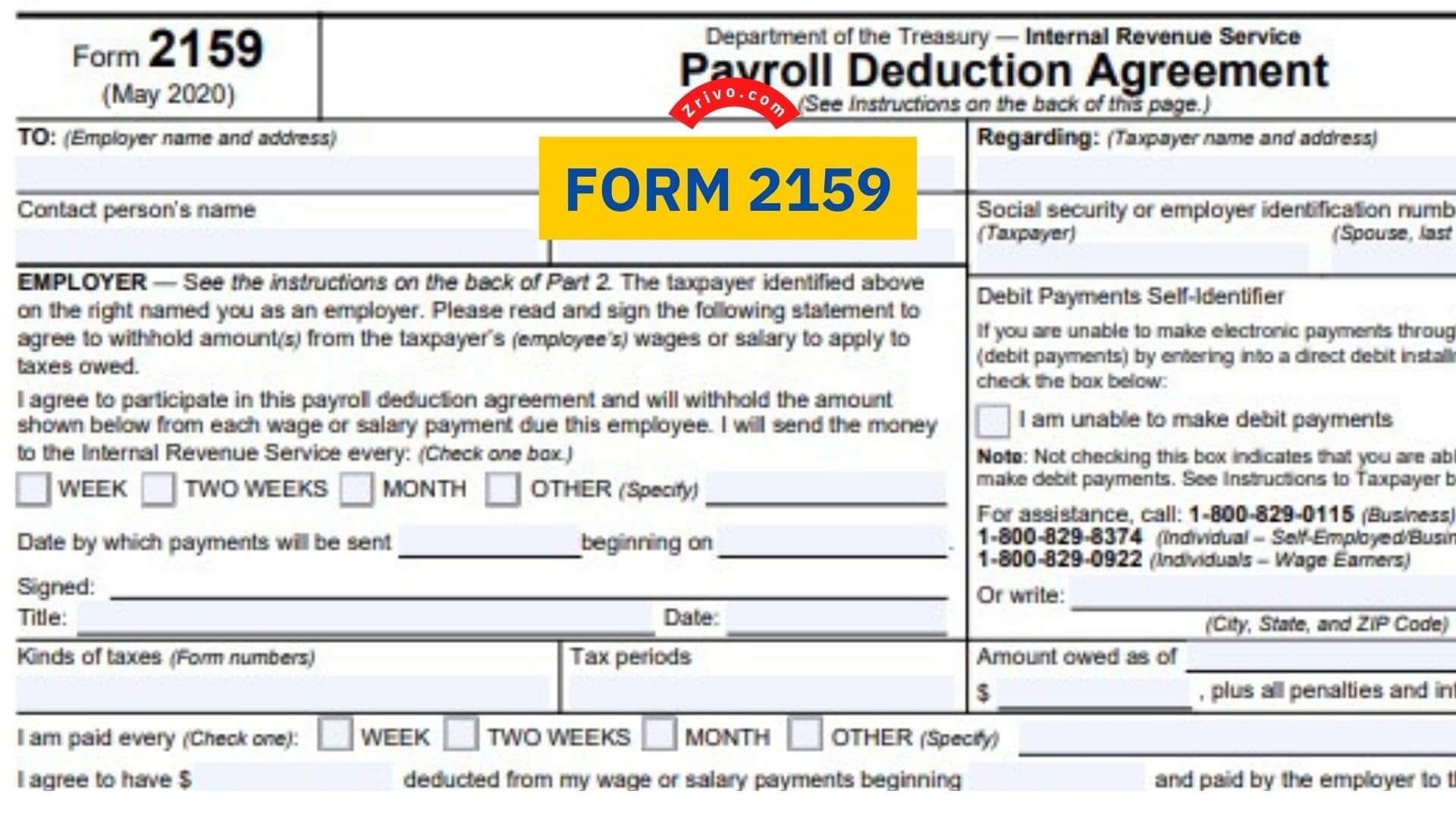

Form 2159 is a tax form that is used to establish an agreement between an employee and their employer to deduct an agreed-upon amount from their wages and pay it to the IRS. This is a very common way for employees to pay back their federal tax debts. The IRS prefers this method over direct debit or other payment arrangements. If your balance due is $2,500 or less, you are eligible to file Form 944.

This federal tax form requires you to report information on your business and the payroll taxes you have withheld. In addition, you are required to deposit these funds with the IRS.

How to File Form 2159?

You can complete Form 2159 online, by fax or email, or download it as a PDF. On some websites, you can add and edit text, insert images and checkmarks, drop new fillable areas, rearrange pages, and much more. Ultimately, you will have a well-prepared document to use for your tax purposes. The form is divided into three parts:

- Acknowledgment Copy

- Employer’s Copy,

- Taxpayer’s Copy

Each of these copies contains different instructions and is printed differently. It is important to review each part of the form carefully during the drafting process. It is also important to be sure that all of the information you provide is accurate and up-to-date. To complete your Form 2159, you must provide:

- Your name,

- Your Address

- Social Security number

- Employer information.

- The amount you want to pay each month

- The start date of the deduction.

Once you have entered the necessary details, you must sign the form. You can do this by typing, drawing a signature, or using your mobile device as a signature pad.