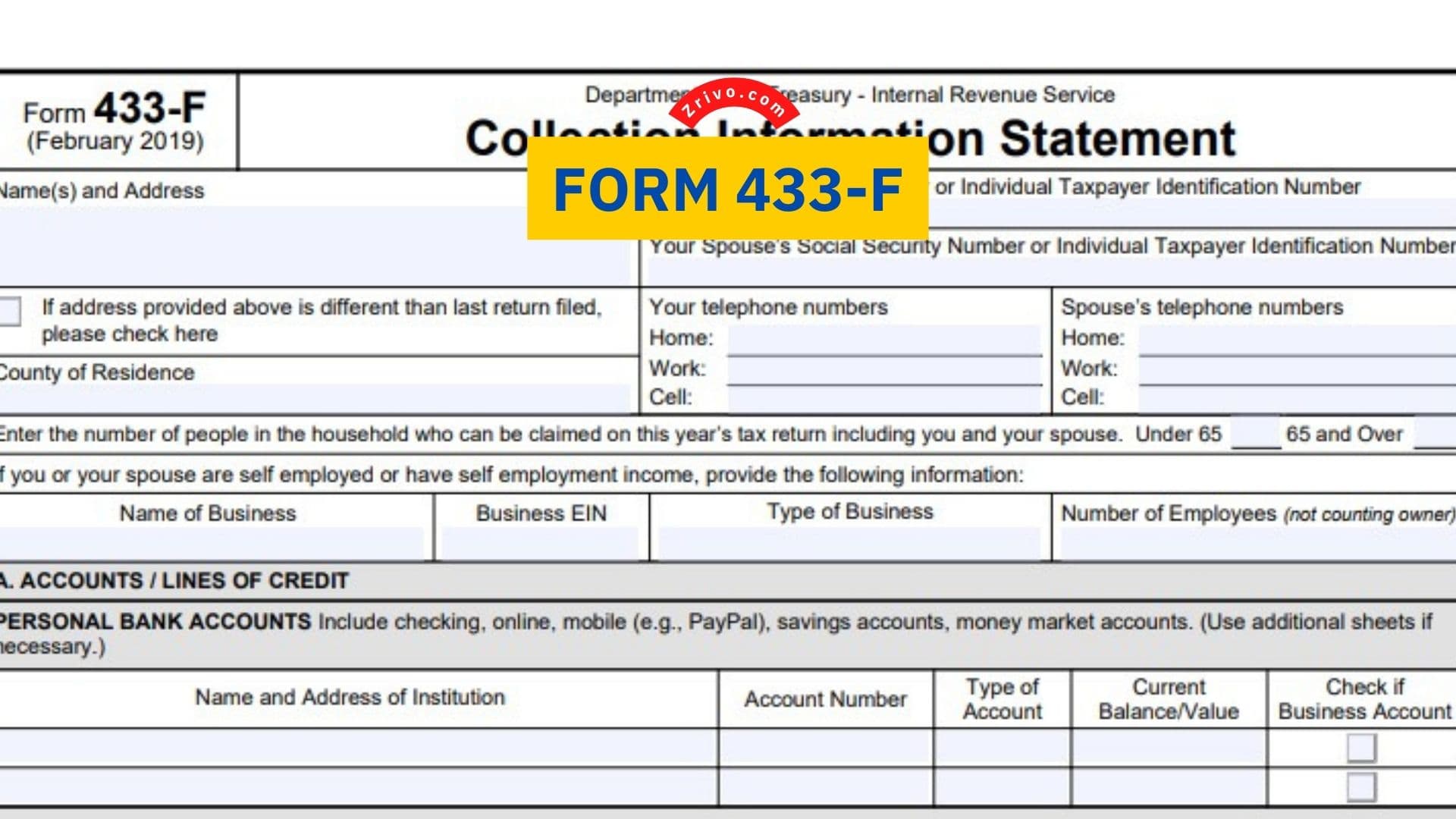

The IRS uses Form 433-F to determine if you qualify for payment plans and tax settlements. It is similar to Forms 433-A and 433-B but has fewer questions and is generally easier to fill out. Form 433-F is most often used when a taxpayer has a balance owing to the IRS less than $250,000, and their case has not been assigned to a Revenue Officer. It can also be used to negotiate a collection alternative (either an installment agreement or Currently Not Collectible designation) with IRS Automated Collection System call center employees. The IRS uses this form to determine if you qualify for an installment plan or Currently Not Collectible designation. It can be submitted with Form 9465 or by mail. It is a very important document for individuals who have back taxes and cannot afford to pay them in full.

It also includes a list of necessary living expenses and National Standards for allowable monthly amounts. These allowances are based on the cost of living in your area, the size of your family, your monthly income, and any assets you may own. However, 433-F has some limitations. Taxpayers are not allowed to claim more than the total National Standards for their monthly expenses and must provide documentation to substantiate their claims. In addition, the IRS can use the 433-F to decide whether a business is eligible for an offer in compromise. This process is more complicated than filling out the 433-F, but it can help a business resolve its debts without pursuing bankruptcy or other court orders.

How to fill out Form 433-F?

Form 433-F is one of the three collection information statements the IRS uses to collect financial information from taxpayers with tax debts. It is shorter than the other two forms, which are Form 433-A and Form 433-B, but it still requires a lot of detail about your financial situation.

It is important to complete this form accurately and honestly, as failure to do so could lead the IRS to take a more aggressive collection approach against you. A tax attorney can help you avoid mistakes and protect your personal information. They can also help you navigate the complicated world of tax debt and ensure that you receive all the benefits available.

- The first section of Form 433-F requires you to list your personal assets and liabilities. This includes your bank accounts, retirement accounts, profit-sharing plans, and any other types of financial accounts you may have. Additionally, you must list any real estate you own.

- Another section of the form asks you to provide information about your monthly income and expenses. You also have to give the IRS the names, addresses, and phone numbers of your business personnel.

- Finally, you must report any other financial information the IRS may need, such as impending lawsuits or debts you owe. This information is crucial to proving your ability to pay off the tax debt that you owe.

You can complete Form 433-F by hand or by using a software program. It is important to fill it out accurately and completely. If you have any questions, you can contact a professional tax relief company to help you complete the form. Here are all the information sections you need to report to the IRS on Form 433-F:

A. ACCOUNTS / LINES OF CREDIT

B. REAL ESTATE

C. OTHER ASSETS

D. CREDIT CARDS

E. WAGE INFORMATION

F. NON-WAGE HOUSEHOLD INCOME

G. MONTHLY NECESSARY LIVING EXPENSES

H. ADDITIONAL INFORMATION