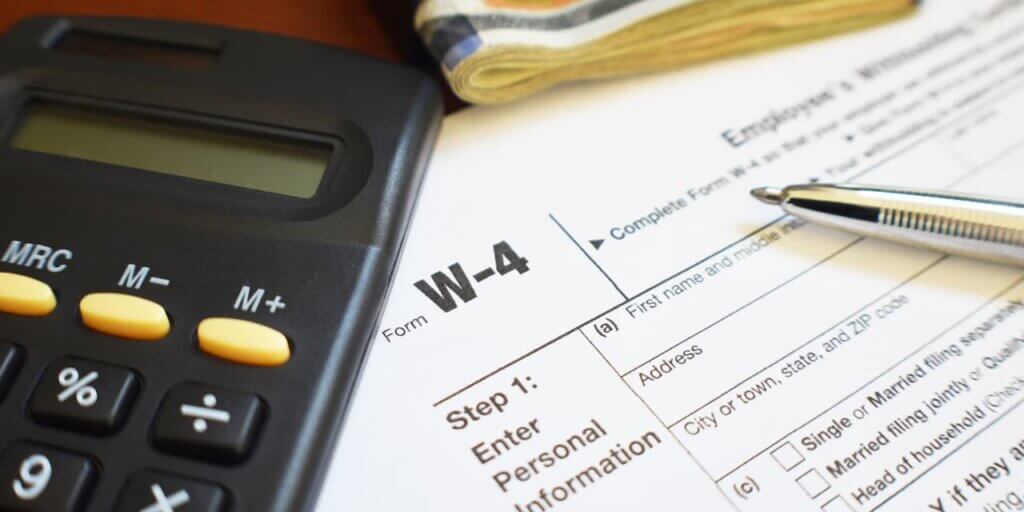

The Federal Income Tax Withholding Methods in Publication 15-T provide guidance for employers that pay wages subject to federal income tax withholding and employees who receive such wages. These regulations implement the changes in the Internal Revenue Code enacted by the Tax Cuts and Jobs Act (TCJA) and reflect the redesigned withholding allowance certificate (Form W-4).

In Publication 15-T, you will also find the withholding tax tables for each of your payroll periods and each employee’s taxable wages. Using these tables and the information on the employee’s Form W-4, you can calculate the amount to withhold for federal income tax.

Publication 15-T Federal Income Tax Withholding Methods

The Federal Income Tax Withholding Tables described in Publication 15-T show how much federal income tax an employer should withhold from wages. These tables are updated annually and should be reviewed every year to ensure compliance.

Using the Federal Income Tax Withholding Tables is a key component of keeping your business in compliance with employment taxes. In addition to providing the information you need to figure withholding amounts, this publication also explains important updates to the federal income tax withholding tables for 2020 and includes instructions for submitting Form W-4, W-4P, and Form W-4R electronically.

This publication also provides additional guidance for employers with respect to fringe benefits, such as accident and health coverage, adoption assistance, company cars, dependent care assistance, educational assistance, employee discount programs, group term life insurance, moving expense reimbursements, and health savings accounts.

In addition, this publication includes information about the employment tax treatment of certain payments made to ministers. Certain conditions exempt such payments from federal income, social security, and Medicare taxes.

If you are unsure whether you need to withhold federal income tax on payments made to ministers, contact the IRS. They will be able to help you determine if your ministers should be withheld from their pay or if they can pay their own employment tax on those payments.

When calculating employment taxes for your business, you will need to use the federal income tax withholding tables in Publication 15-T and any other IRS publications you might be using. These publications will help you keep your business in compliance with all of the various laws and rules that apply to the employment tax area.

The final regulations include four adjustments to the computation of withholding on wages based on the number of allowances data field from 2019 or earlier Forms W-4. These computational bridge entries will allow you to continue withholding based on the number of allowances from 2019 or earlier Forms W-4 as long as you apply the appropriate computational bridge entry for your employees.

Other Sections in Publication 15-T

Several sections of the IRS Publication 15-T address topics like Social Security and Medicare taxes. These taxes are generally withheld on your employee’s wages, but some employees may be exempt from these taxes. In addition, the publication contains special rules for certain types of payment and services.

You can also find information about your responsibilities as an employer for the Federal Unemployment Tax Act, or FUTA. The FUTA is a tax that applies to employers who have regular temporary or part-time employees.

To comply with the FUTA law, you must report and pay the FUTA tax on your employees’ wages if they were paid $1,500 or more in any calendar quarter of the year. You must also report and pay FUTA taxes on all regular part-time and temporary employees, including those who work on vacation or sick leave.

In addition, you have to report the wages of nonresident aliens working in the United States. You can withhold federal income tax on these wages using a computational bridge, which is a new optional approach.