Form 8594 (Asset Acquisition Statement Form) is a document that is used to report the sale of business assets. It is filed by both the buyer and seller of the business assets. Form 8594 allocates the purchase price among seven different classes of assets that make up a business or trade. The allocation is binding on the buyers and sellers. However, both parties can challenge the allocation if they disagree.

Generally, each type of asset in a business is treated differently for tax purposes. Some of these assets include cash or deposit accounts, securities and equipment, and furnishings. In addition, the sale of a business often includes other types of intangibles. These intangibles are deemed to be part of the business and must be reported on Form 8594, along with other information such as customer lists, licenses, patents, and copyrights.

As a result, if you’re selling a business, you’ll need to report the value of the assets included in your business on Form 8594. This will help you determine whether you can depreciate and/or amortize the assets you sold. The IRS can audit your tax return to see if you’ve allocated the sale price of assets to different classes. This is why it’s important to use consistent treatment between your purchase agreement and your Form 8594. If the IRS finds that you’ve allocated the sales price of your business assets to different classes, it can challenge your allocation and impose penalties. This could cost you significant money.

To avoid this, make sure you properly appraise your business assets before selling them. This will allow you to accurately report the value of your business on Form 8594 and avoid any fines. You can also take advantage of trica equity management software to better track your business assets.

Who Must File Form 8594?

The IRS requires that both the buyer and the seller file Form 8594 when the sale of a business involves the transfer of assets, including those that may have goodwill or going-concern value attached to them. These assets are normally allocated in a written agreement and signed by both parties before the sale. The buyer and the seller must complete Parts I and III of Form 8594 and attach them to their income tax returns in the year the sale took place. However, both parties must also file Form 8594 if the amount allocated to any asset increases or decreases after the sale occurs.

This is due to the fact that it can be difficult to determine how a buyer or seller’s basis in assets changes when they purchase or sell a business. It is especially tricky to report the change in the amount of goodwill or going-concern value when the sale involves a large number of different assets. The IRS provides a variety of forms for filing information returns, but Form 8594 is one that is particularly important. This is because it breaks down the assets of a business into seven classes, each of which has different tax implications.

How to Fill Out Form 8594?

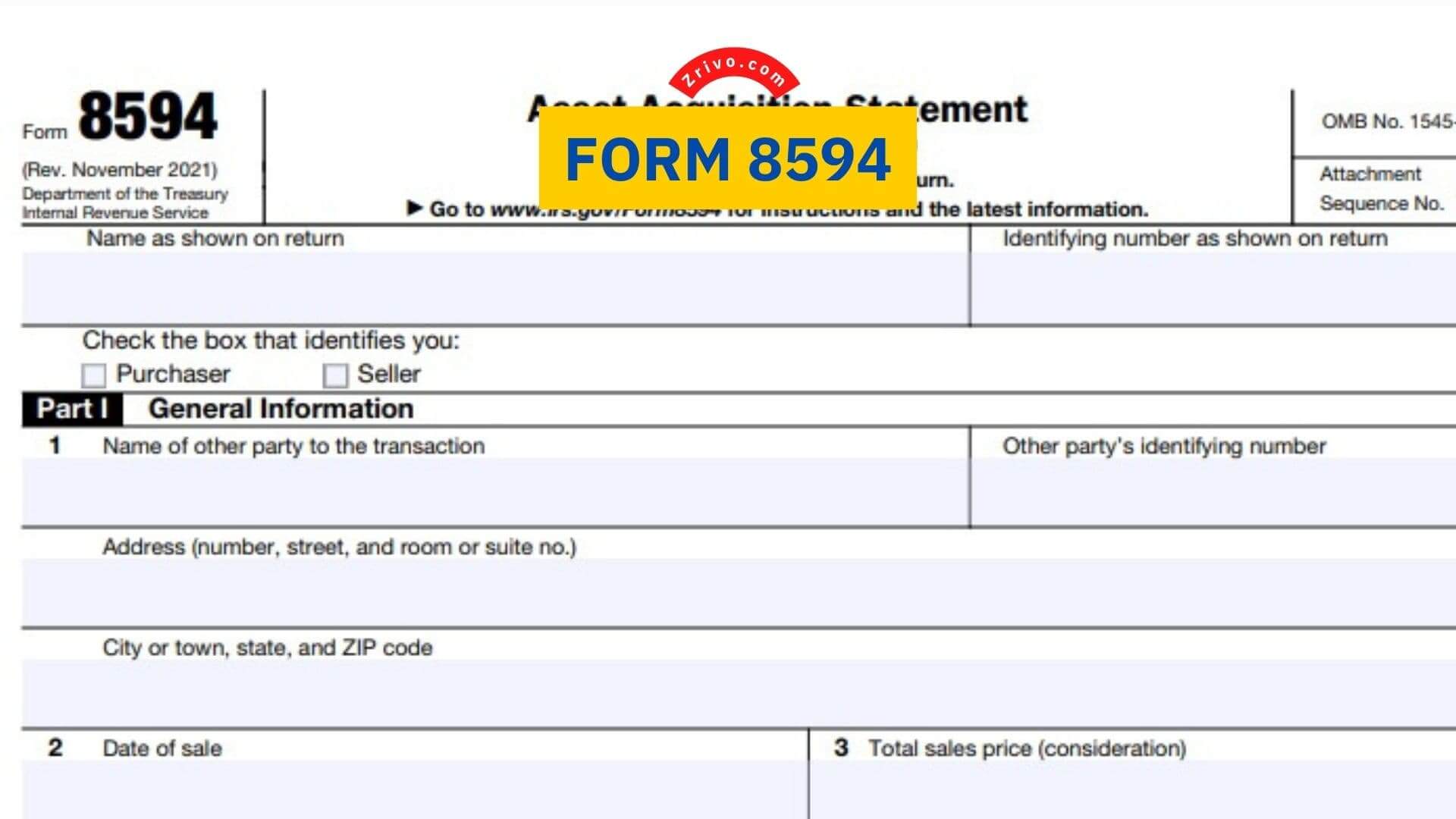

The IRS Form 8594 is relatively easy to fill out. Once you’re done with the filling process, attach it to your income tax return. There 3 different parts in the form:

- Part I General Information:

- Part II Original Statement of Assets Transferred

- Part III Supplemental Statement: Complete this part only if amending an original statement or previously filed supplemental statement because of an increase or decrease in consideration.