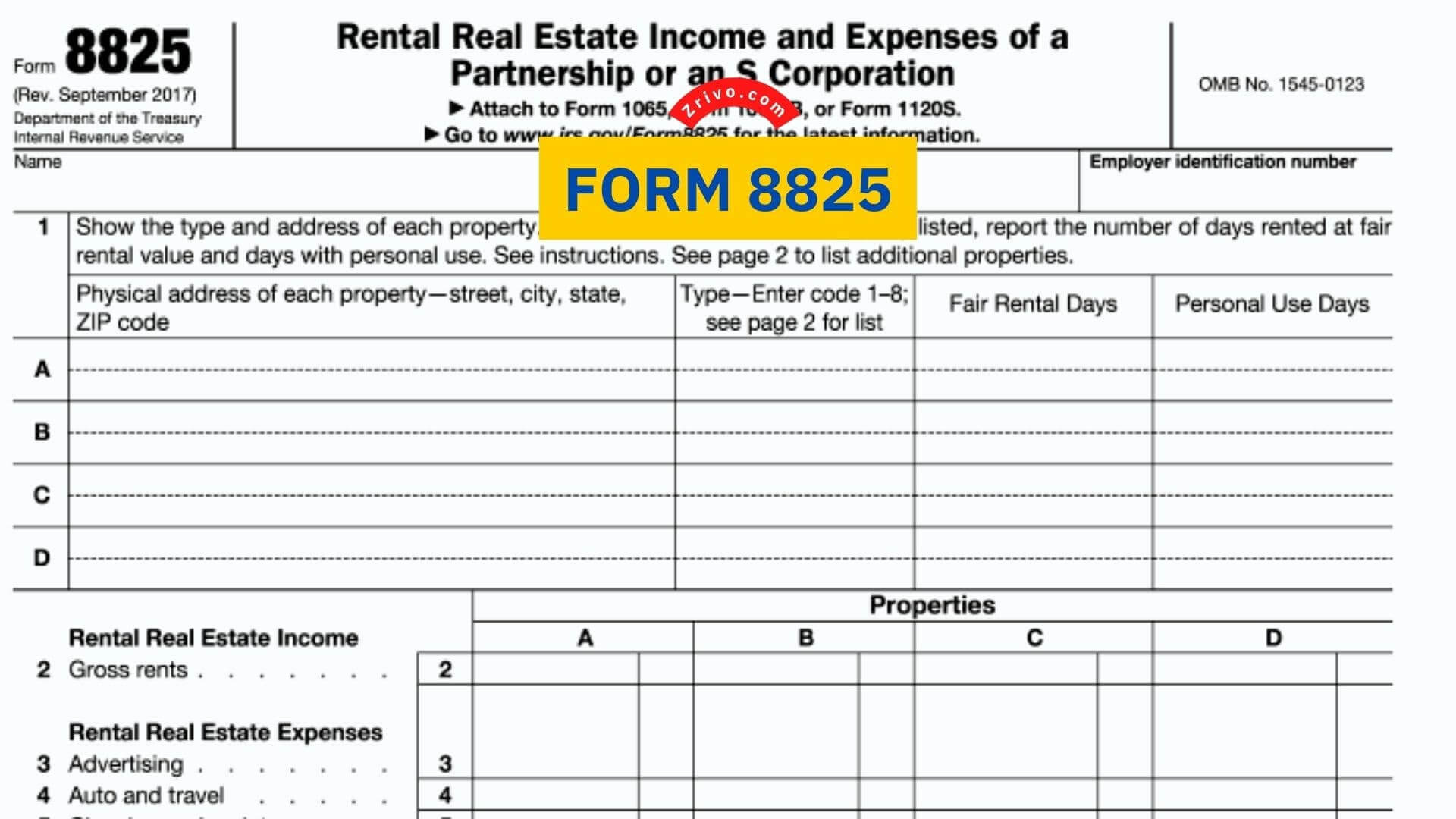

IRS Form 8825 is a tax form used to report the income and expenses incurred by rental properties. It reports the net income earned by a partnership, S corporation, or estate that engages in such activities. The form also reports deductible expenses and commissions.

Form 8825 is similar to Schedule E, which is a part of the individual income tax return. Individuals who rent property must account for the income from second homes on Schedule E. However, landlords who own property through a business entity do not use Schedule E. They only use Form 8825.

In addition to filing Form 8825, a business entity may also need to file Form 1065, which shows the profits or losses attributable to each partner. Depending on the property type, the amount of the tax owed on the property will depend on the net income and losses.

How to File Form 8825?

- When filing Form 8825, you must provide details about your business. This information can help you qualify for certain tax breaks. You will also need to provide details about your rental income, including the percentage of personal use.

- Before completing Form 8825, you must determine your property type. The IRS allows for a business to report up to eight properties.

- For each property, you will need to fill in line 18a through 21. If you own two or more properties, you must prorate your expenses.

- After you have entered your information on your Form 8825, you will need to attach Schedule K-1. This document reflects your share of net profits or losses from your partnership’s rental activity. The document will also show your share of low-income housing credits and depreciation.

Consider hiring a professional to help you complete Form 8825. They will be able to make sure your information is accurate and that you are compliant with the laws of the United States.

You may be required to report your rental income on a schedule if you own a second home. To do this, you must determine how much of the rental property is used for personal use and how much is rented to others. You will also need to enter the cost of the property on Line 14 of Form 8825.

- Form 8825 is meant to be attached to Form 1120S, Schedule K-1. In this way, you will be able to separate your property earnings from your other business revenues. As a result, you may be able to claim Section 179 deductions for leased property.

- A rental real estate activity credit should be reported on lines 15c and 15d of Schedule K. A loss should be reported on line 2 of Schedule K. Also, a gain should be entered on line 19.

Form 8825 is an important part of your tax filing. The information you provide will ensure that you will get a fair deal on your taxes.