If you get paid to do tax returns, you must use a Preparer Tax Identification Number (PTIN) when doing U.S. federal tax returns and asking the Internal Revenue Service for a refund. A PTIN can be obtained by contacting your state’s Department of Revenue. This is the basis for starting to learn how to renew your PTIN.

PTINs are assigned to tax return preparers and are required to be used on all tax returns and refund claims submitted to the Internal Revenue Service. Here’s everything you should know about the Preparer Identification Number.

What to Know about PTIN?

- Applicants must have an SSN in order to get a PTIN

- As a tax return preparer, your PTIN is a unique identification number. You cannot give it to anyone else. You can only give it to your employees and clients.

- You must obtain a PTIN before preparing a client’s tax returns.

- As long as you follow IRS rules, your PTIN will be confidential.

- To make sure your PTIN is secure, you must register it with the IRS.

- PTINs are issued by the Internal Revenue Service and are valid for a year.

- This number is not required for tax preparers who help clients format their returns.

How to Renew Preparer Tax Identification Number (PTIN)?

Those who manually prepare tax returns do need a PTIN. The PTIN can be obtained from the IRS website. The PTIN must be renewed by the Internal Revenue Service within 30 days before its expiration date.

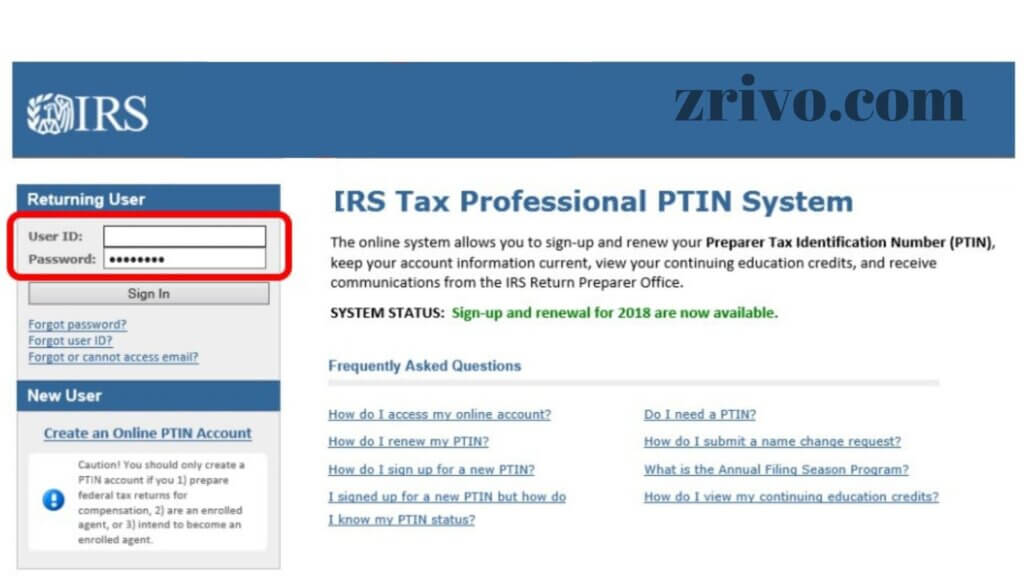

You can apply for a new PTIN online or by mail. Applying online is faster and more convenient. The application process takes about 15 minutes. Once you enter the IRS’s website, follow these steps:

- Create an account

- Set up a temporary password

- Enter your email address. Make sure to use the most current email address. This address will receive any correspondence regarding your PTIN.

If you need to renew your PTIN, the IRS will email you a renewal certificate. Afterward, you must update your records immediately. You must renew your PTIN before the end of the year.

If you have been convicted of a felony in the past, you might be ineligible to renew your PTIN. When applying for your PTIN, you must answer yes or no to the question, “Have you been convicted of a felony in the past 10 years?” If you answered yes, you must explain the crime and provide the IRS with details about it. For instance, felonies related to tax fraud or financial crimes may keep you from renewing your PTIN.