Schedule K-1 is a tax form that reports a business’s income and expenses. It can be used by LLCs, S corporations, and partnerships. This form identifies how much each shareholder is entitled to and helps them calculate how much they will owe the government in taxes.

The IRS requires a Schedule K-1 from every business owner. The form reports ownership income, such as profits and losses. It is prepared by an accountant and filed with Form 1040 or 1120-S for S corporations and Form 1065 for partnerships.

The information on the K-1 is then reported on the owners’ personal tax returns, and the tax authorities check to ensure that the information reported on the form matches what was reported on the actual return.

How to file Schedule K-1?

The Schedule K-1 part of Form 1065 is a two-page document that comes from the Income and Expenses section.

- The first page contains the information that you need to file your Form 1065

- The second page contains a glossary of reporting codes.

- This form requires you to enter information about any partnership debts or liabilities.

- You should know that some debts are nonrecourse, and some are recourse. If you have recourse debt, the lender can pursue your personal property. The IRS provides guidance about the difference between these types of debt.

- You will need to enter information about the capital account of your business. The amount of capital in your business may change over the course of the tax year. For example, if you had a loss in the previous year, your capital account could be less than it was at the start of the tax year.

What Is Schedule K-1?

Schedule K-1 is one of the forms that many business owners file for tax purposes. These include S-corporations, partnerships, and trusts. It allows the owners of these entities to deduct their business income in a manner that is more favorable to them than if they were to report the payment in a traditional Form 1040.

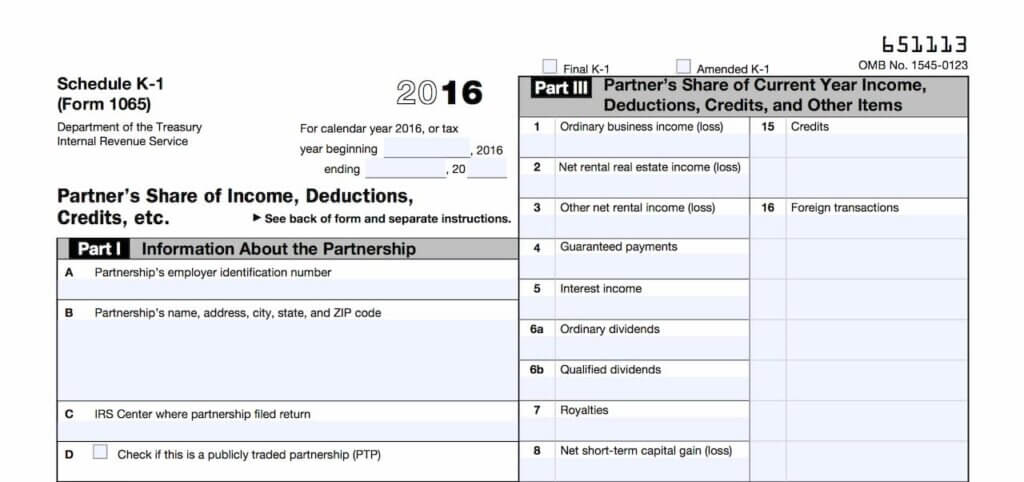

Forms used by partnerships

Schedule K-1 forms are used to report various information about a partnership. They are significant for businesses that form partnerships. To properly file the forms, you must organize all the pertinent financial data. You should also consult a tax professional for assistance.

The K-1 form contains three parts. Part I, Box M, is a technical question that asks if the partner has made any property contributions with built-in losses or gains. Similarly, Part II, Box J, describes the type of partner and the amount of their liability share.

The K-1 form is divided into several fields to record partnership assets and liabilities. It also includes a section for reporting the partner’s share of the income and profits of the enterprise. There are also several fields for deductions, credits, and other items.

Aside from providing important information about a business partnership, the Schedule K-1 forms protect partners against tax fraud. Each partner must complete a copy of the K-1 and file it with Form 1040. If a partnership fails to meet this requirement, it could face penalties.

In addition to the K-1 form, a Limited Liability Company (LLC) can file as a partnership. An LLC must issue K-1 forms to its members. However, this does not mean the LLC sends the form to the IRS.

Partners of a partnership can download the K-1 from a website or consent to have it delivered electronically. Historically, partners received the K-1 through mail or by hand. As of April 2018, partnerships can now provide K-1 forms through secure email. However, certain conditions must be met before a block can cease furnishing electronic K-1s.

When filing the K-1, partners should ensure that they are accurately calculating their income. This can be done with the help of a tax accountant. Moreover, having all the information on the K-1 formatted in a format that is compatible with your tax return can make the job easier.

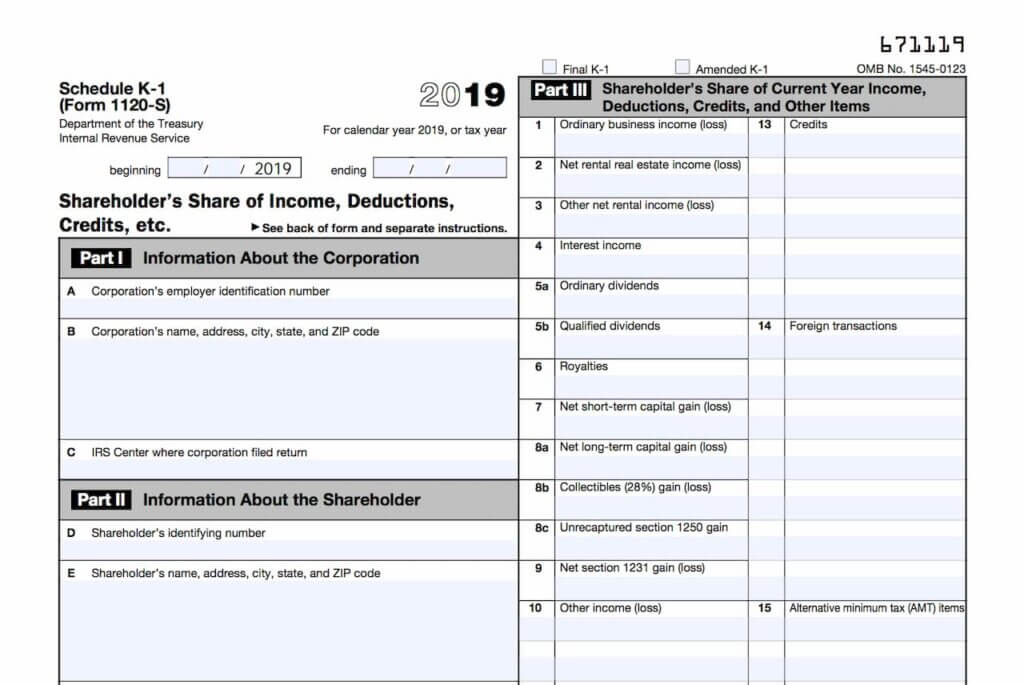

S-corporations

S-corporations on Schedule K-1 report a share of their income and losses to the IRS. These items are then transferred to the shareholder’s tax return. They are used to calculate federal income taxes. In addition, the results can be used to determine FICA taxes.

For S corporations, there are several different tax forms to use. One of the most important is Schedule K-1. This document is specific to each shareholder. It also includes a summary of the shareholder’s ownership interest in the enterprise.

Each shareholder must apportion their share of income from the S corporation using an apportionment percentage. The factors used to determine the apportionment percentage are based on the trade or business.

The schedule should also include information about investment expenses. Some businesses will use this line to report rental activities. If the S corporation has a rental property, it can use this line to show the rental income it received.

Many other types of income can be reported on a Schedule K-1. You should ensure that all of the information on the form is accurate.

The IRS will provide a list of forms you can use to report income and gains. You may have to file a separate tax return for the S corporation. However, there are a few exceptions.

Shareholder employees of the S corporation pay employment taxes in the same way as other employees. They file quarterly taxes and may have to submit Form 1040-ES, an employment tax return. A separate state tax return is usually needed if the S corporation has shareholders from another state.

The S corporation should also issue Schedule K-1s to each shareholder by the third month after the end of the fiscal year. Any Schedule K-1s missing by the deadline should be retrieved from the company’s accountant.

Individuals who work for the S corporation must earn a salary. Depending on the entity type, this is either paid in a lump sum or small payments. As with other employees, the compensation is subject to payroll taxes.

Trusts and estates

When filing a tax return, you should always pay attention to Schedule K-1. It is an official federal tax document that helps you to capture information about your business.

The form is used to report various kinds of income. In addition to ordinary business earnings, it includes short- and long-term capital gains, rental real estate, and interest income.

Schedule K-1 can be filed with your personal or business tax return. The information will help you calculate your tax liability. Some of the details on the form may also need to be reported on other forms.

This federal tax document reports the distribution of a beneficiary’s share of an estate or trust’s income. While this is not an actual tax deduction, the IRS requires a fiduciary to file a Schedule K-1 with the IRS on behalf of each beneficiary.

This document is not only used by the IRS but also by the beneficiaries. Each individual will receive a K-1 showing their share of an estate’s or trust’s income. They will then use this information to report it on their tax returns.

There are several reasons why a fiduciary should file a Schedule K-1. For instance, an individual beneficiary must report their share of an estate’s or trust’s net investment income.

A Schedule K-1 can also be used to report the distribution of an estate’s or trust’s share of credits and deductions. You will need to know how much money was taken out of your estate or trust to calculate the tax deduction you can claim.

To prepare your own Schedule K-1, you will need to know your taxpayer identification number, employer identification number, and social security number. Once you have these three numbers, you can enter them into the appropriate fields on the schedule.

There are two types of schedules – a business version and a partner version. If you are a partnership owner, you must complete Form 1065. During this process, you will generate a Schedule K-1 that includes your partnership’s profits and losses.

Tax benefit for owners of pass-through businesses

If you are running a pass-through business, you should know about the Schedule K-1 tax benefit. It is a tax form that captures the income and losses of the company. This information is then allocated to the owners based on their stake in the business.

Pass-through entities include sole proprietorships, partnerships, and S corporations. Each of these types of businesses will receive its corresponding Schedule K-1.

Whether you are a taxpayer, an owner, or an employee, you can receive the Schedule K-1 as part of your 1065 tax return. Tax software or a professional accountant can help you generate and file Schedule K-1 forms.

A pass-through entity’s Schedule K-1 is a tax form that reports the income, gains, and losses passed through to the owners. This information is then used to calculate the personal tax liability of the owners. Schedule K-1 includes financial data, such as real estate rental income, income from operations, and interest.

In addition to providing information on the business’ profits, this Schedule K-1 will also report the share of the gain allocated to each partner. This can be a complex calculation, so it is crucial to obtain assistance from an expert.

Several Schedule K-1 forms will be required to be filed by your business. These forms will include information on the partnership, such as its name, address, and tax center. You will also need to provide your EIN or taxpayer identification number.

For calendar year partners, your partner’s income will be a combination of partnership QBI for the entire fiscal year and partnership W-2 wages. On line 14 of Schedule K-1, you will report payments made to nonresident shareholders. Similarly, on line 13d, you will note the PTE Elective Tax Credit.

You will not be able to claim withholding credit on Schedule K-1 if you are a shareholder of an S corporation. However, you can claim a net income tax credit. Generally, residents are taxed on a pro-rata share of all income.

To understand more about Schedule K-1, download the PDF of the form and read the Partner’s Instructions for Schedule K-1.