An Employer Identification Number, also known as a Federal Employer Identification Number or an Employer Tax Identification Number, is used to identify a business and to track its income and expenses. It is also used to track the ownership of a company’s assets. If you own a business, this number is crucial for tax purposes.

The Employer Identification Number (EIN) is a post-incorporation identifier for businesses that have employees. A sole proprietorship, however, does not need an EIN. However, Form SS-4 is required for sole proprietorships.

You are starting a nonprofit organization and are wondering how to get an Employer Identification Number (EIN). Here’s everything you may want to know about applying for it.

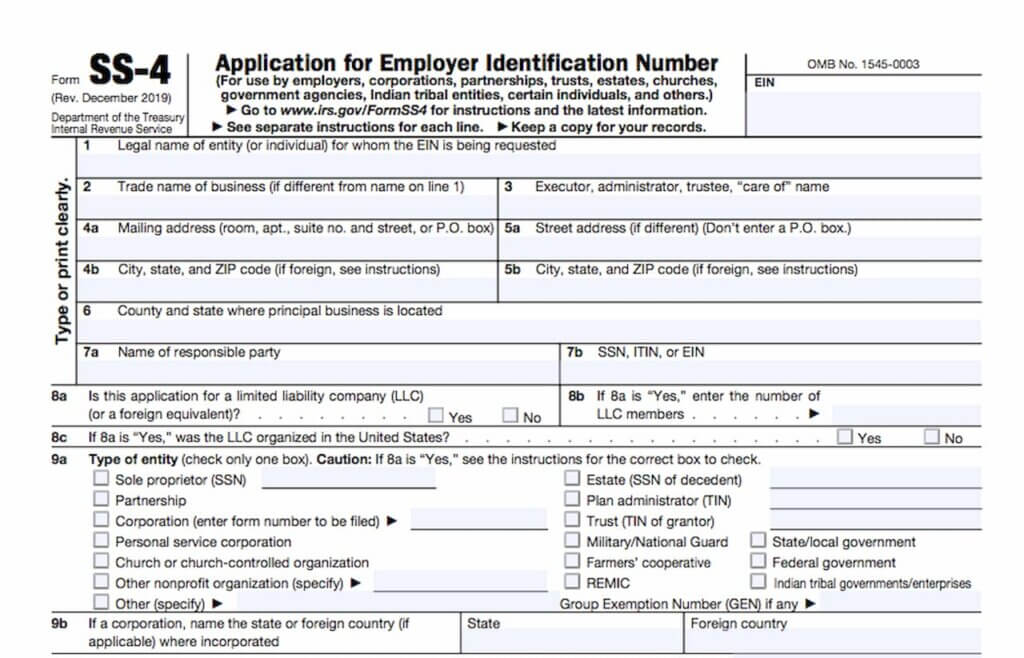

To apply for an EIN, you need to provide the legal name of your nonprofit organization, the mailing address, and a physical address. You can apply online or download Form SS-4 from either our or IRS’s website. Both methods are acceptable, but applying online is preferred as it is easy and fast. You can also call the IRS to request your EIN.

All you need to do is enter your business name, your nonprofit organization’s mission, and some personal information. After you receive your EIN, you can use it to file your Information Return 990 or Form 1023 with the IRS.

Can I Apply for a Nonprofit EIN Number through Fax or Mail?

Nonprofit organizations can apply for an EIN through fax or mail. These applications take between three and five business days. They are faster than filing online or completing a paper application.

However, both methods are not without their own set of risks. When applying by mail, for example, errors may occur, and the process can take a few weeks longer than it should.