If you are a taxpayer generating gross receipts of $25 million or more yearly, you will have to file Form 8990. This is the document that is required by the IRS to report your business income. Another reason to use Form 8990 is to calculate your business interest expense deduction. This form allows you to claim this expense, and it also allows you to carry it forward to future tax years. Keep reading our article for further Form 8990 Instructions.

Understanding Form 8990

The IRS has released draft instructions for Form 8990, which is used to report business interest expenses. This form calculates business interest expense for the current year and any carryover amount. If you’re a business owner, you should understand the instructions for Form 8990 to complete your tax return. There are some differences between the forms.

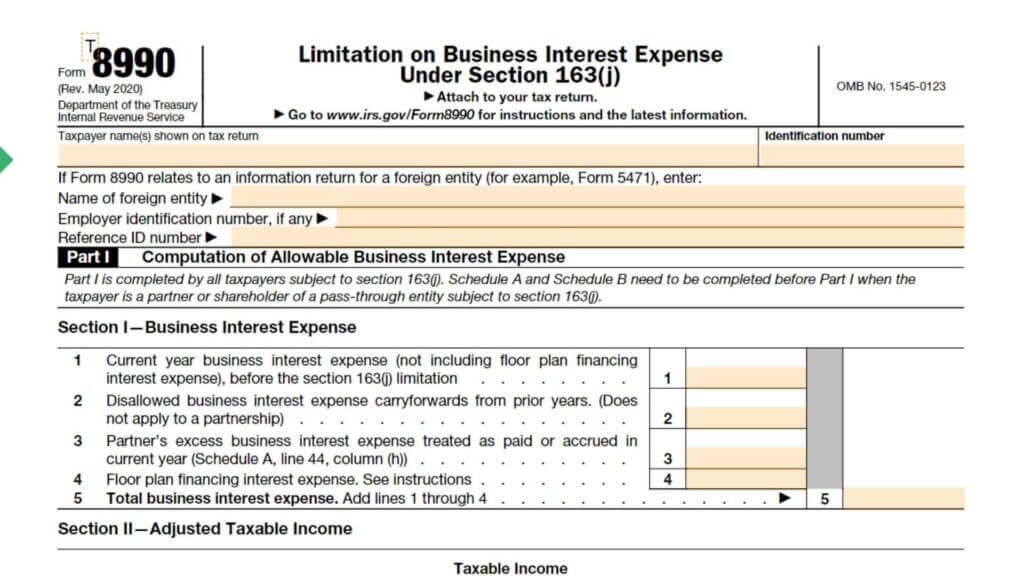

Form 8990 is divided into three sections:

- Part I for individual taxpayers,

- Part II for partnerships, and

- Part III for S corporations.

The form also includes two schedules. Schedule A excess details items, and Schedule B summarizes taxable income.

How To File Out Form 8990?

You can use an online service if you have little time or know how to fill out Form 8990. There are many advantages to using an online service for this purpose. In addition to making it easier to file, you can edit your documents easily. You can add text, pictures, check marks, signs, and other data to the forms. You can also rearrange pages and export the document. Once you have finished, you can print, email, or share it.

You can file this form separately or attach it to Form 1041 as a PDF. The IRS recently issued additional guidance on the deduction for business interest expenses. This new guidance makes it easier to calculate the amount of business interest you can deduct.

However, not all people want to use such third parties. They may not rely on such services on the internet. If you don’t want to use such services, you can visit the related page of the IRS for Form 8990 Instructions.

Step-by-Step Instructions 2024 - 2025

1. Gather Your Financial Information

Before you start filling out Form 8990, collect all the necessary financial data for the tax year. This includes information about your business interest income and expenses.

2. Download the Form

Visit the IRS website and download the most recent version of Form 8990 for 2024.

3. Personal Information

Provide your personal details, including your name, social security number, and address.

4. Part I – Aggregate Business Interest Income and Adjusted Taxable Income

- Calculate your Aggregate Business Interest Income.

- Determine your Adjusted Taxable Income.

5. Part II – Calculate Your Business Interest Expense Deduction

Use the provided tables and instructions to calculate your deduction accurately.

6. Part III – Special Rules for Partnerships and S Corporations

If applicable, follow specific guidelines for partnerships and S corporations.

If you’re a partner or shareholder in a pass-through entity, allocate the deduction appropriately.

8. Part V – Carryforward of Disallowed Business Interest Expense

Understand the rules for carrying forward any disallowed interest expenses for future years.

9. Part VI – Other Information

Provide any additional information as required by the form.

10. Sign and Date the Form

Make sure to sign and date your completed Form 8990 before submission.

2023 vs. 2024: Changes in Filing Requirements

It’s essential to understand any changes in filing requirements between 2023 and 2024. The IRS may have updated thresholds or rules that could impact whether you need to file Form 8990.