In June 2023, the IRS announced that they were going to launch a filing portal special for the 1099 Form. This was announced in a status update and pleased many business owners who must file their 1099 Form until the last day of January every year.

Thanks to this new filing portal, the procedures will be accelerated, and taxpayers will be able to track their forms much more easily. According to the announcement, the new portal will be available as of January 1, 2024. Thus, if you are planning to file your form in the next few days, you may want to wait a bit longer.

In this way, you can be one of the first taxpayers who are going to file their Form 1099 electronically. In addition, taxpayers will be able to fill out all of the forms, which also include Form 1099-NEC. The nonemployee compensation form is famous for being the most filed 1099 Form type.

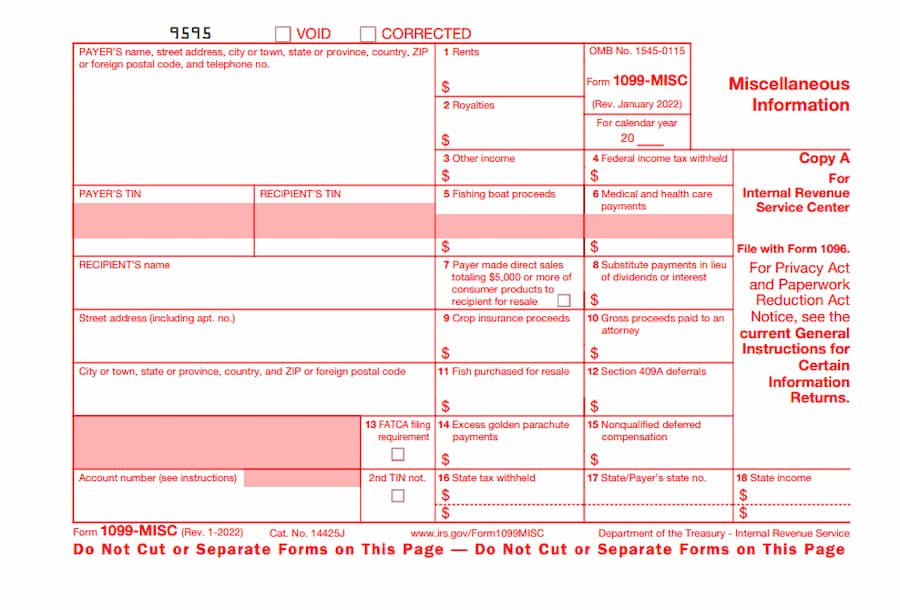

Comparison of Common 1099 Forms

Let’s compare the 1099-NEC, 1099-MISC, and 1099-DIV forms in a tabular format:

| Form Type | Purpose | Filing Deadline | Key Information |

|---|---|---|---|

| 1099-NEC | Independent contractor payments | January 31 2024 | Box 1: Total compensation paid |

| 1099-MISC | Miscellaneous income | January 31 2024 | Box 7: Total miscellaneous income |

| 1099-DIV | Dividends and distributions | February 15 2024 | Box 1a: Ordinary dividends, Box 3: Capital gains distributions |

The new portal for the 1099 Form had inspired by the SSA Business Services Online System.

According to the rumors, this new portal was modeled after the SSA Business Services Online System. If you are using this system, you will not have any challenges using the new IRS portal to file your forms.

On the other hand, if you have never used it before, have no worries. It is a pretty straightforward system that anyone can easily use. Considering these facts, we believe no one will have any problems while filing their Form 1099s electronically.

In addition, we are pretty sure that the IRS will provide the required resources and guidance about the use of their systems. So far, the IRS has released such documentation for all kinds of systems they offer to taxpayers. In this regard, the 1099 Form portal will not be an exception.

One thing unclear about the portal is the verification method. While it may be enough for you to upload information for the verification, you may have to use a key as well. On the other hand, this new portal will be compatible with the Combined Federal/State Filing program as well.

We have only a few months left until the launch of this new portal. If your form is already ready, you may not want to wait for this new portal. However, if it is not ready, you may want to wait for it and be one of the first taxpayers to enjoy the convenience offered by the IRS.

Considering that no announcement was made for the delay of the launch of the 1099 Form portal, we assume that the IRS will launch it on time. Even if there may be any problems with the launch, you will still have a month to file your forms without any problems.

Keep in mind that most 1099 Form deadlines are January 31, 2024. The only expectation is for Form 1099-MISC, with the deadline being February 28, 2024. The Form 1099 in question is set to be launched on January 1, 2024. If there is an update on the forms, since you filed the form for the previous, i.e., 2023 tax year, you will not have to worry about it at all.

Here is each of these Forms 1099 report and the purpose behind it.

1099 A—Acquisition or Abandonment of Secured Property

Form 1099-A is required to file for each borrower if a trade or business lends money in connection with the organization in partial or full satisfaction of the debt. This is only required to be filed if the lender has acquired an interest in property that works as security for the debt.

1099 B—Proceeds from Broker and Barter Exchange Transactions

If you’re a broker or barter and you:

sold stocks, regulated futures contracts, foreign currency contracts, debt instruments, options, securities futures contracts, commodities, etc.

or

received stock, cash, or other property from a corporation that you have a reason to know its stock acquired in an acquisition of control or had a change in the capital structure that needs to be reported using Form 8806.

or

exchanged services or property through a barter exchange

1099 C—Cancellation of Debt

Canceled debt is taxable. Therefore, it must be reported using Form 1099 C. If you have debt that is canceled, use Form 1099 C to add it to your gross income.

1099 CAP—Changes in Corporate Control and Capital Structure

If a corporation goes under a substantial change in capital structure, Form 1099 CAP must be furnished to shareholders. You may receive this tax form for the stocks you have.

1099 DIV—Dividends and Other Distributions

Investors will receive 1099 DIV for dividends and other distributions for their stocks. Same as any other information return, attach it to your federal income tax return to report this income.

1099 G—Certain Government Payments

Certain payments made to you by federal, state, or local governments will be reported using 1099 G. Generally, you will be furnished with Form 1099 G if you received:

- unemployment compensation

- state or local tax refunds, credits, or offsets

- agricultural payments

- taxable grants

- RTAA payments

1099 H—Health Coverage Tax Credit Advance Payments

Form 1099 H is filed for advance payments received during the year for qualified health insurance payments for the benefit of eligible TAA, PBGC, or Reemployment TAA. You also need to file Form 1099 H if these payments are made to qualifying family members as well or the payments cover them.

1099 INT—Interest Income

1099 INT is what you will receive from your bank or financial institution where you have an interest-bearing account. Same as most other information returns mentioned in this article, use Form 1099 INT to report the interest you earned during the tax year.

1099 K—Merchant Card and Third Party Network Payments

PSEs file Form 1099 K for payments made in settlement of reportable payment transactions for each calendar year. If you’ve had a settlement, you will receive Form 1099 K along with any payment card or third party network transaction in settlement of reportable payment transactions. Form 1099 K reports all the payments received from a third party network as well as payment card transactions.

1099 LTC—Long-Term Care and Accelerated Death Benefits

Long-term care benefits including accelerated death benefits must be reported using Form 1099 LTC. With the 1099 LTC, you must include governmental units, viatical settlement providers, and insurance companies.