The IRS Form 1099-B is the form used for Proceeds from Broker and Barter Exchange. Most taxpayers can easily get confused when the IRS forms are in question. However, if you are working with a broker or barter exchange, you do not have to worry about the IRS Form 1099-B at all.

Although the form is designed to report the income and losses of taxpayers, they do not have to file this form on their own. Instead, it should be filed by brokers and barter exchanges on behalf of the taxpayers. In this guide, we have provided detailed information on IRS Form 1099-B.

What Is Form 1099-B?

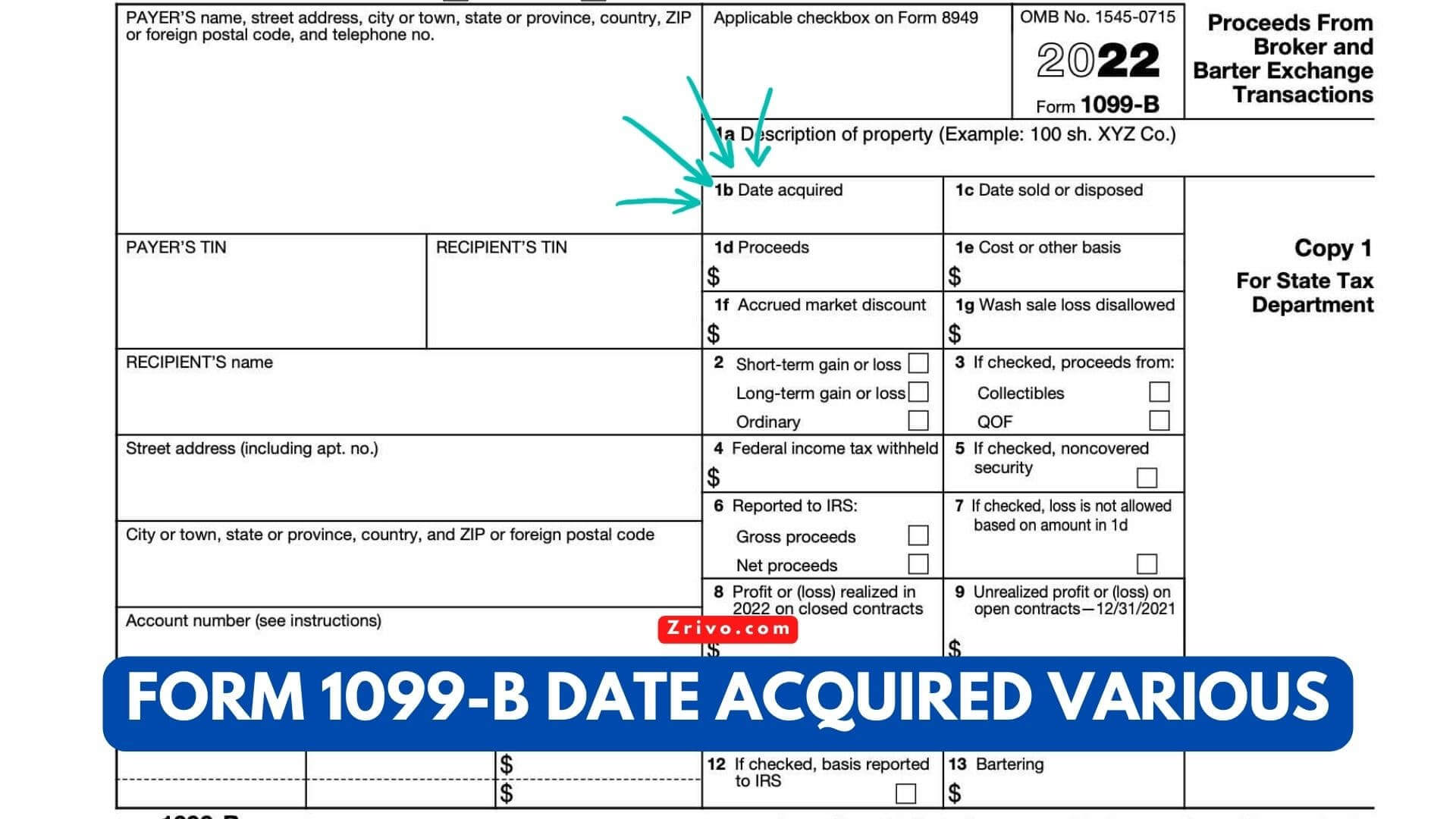

In other words, it is an IRS tax form, which is used by barter exchanges and brokerages in order to record the gains and losses of their customers in a specific tax year. Taxpayers do not have to file this form on their own, but they will need to use the filed forms while they are going to file Form 8949, which is used to calculate their losses and gains in advance. Later on, they will use the result in their Schedule D for their tax return.

What Is Form 1099-B Date Acquired Various?

Taxpayers who sold stock or similar properties in a tax year need to report this sale in their Schedule D. This is located in column B of the file and here, you need to provide the information under the Various section.

Although this form directly addresses your gains or losses in a tax year, you need to receive Form 1099-B from your broker or barter exchange to start the procedures. It is important to fill your Schedule D and Form 8949 correctly and file them on time to avoid any possible penalties or interest costs.