1042 form is one of the forms that you need to file as a foreigner working in the United States. This form is regarded as the foreign person’s source of income subject to withholding. This form is often used by foreigners working in the United States when they are taxed on their accounts.

However, unlike citizens of the United States, people who are not official citizens cannot waive their tax withholding. On the other hand, they can avoid the 30 percent withholding, which is mandatory, by filing other forms such as W-8BEN.

What Is Form 1042-S Used For?

Most foreigners working in the United States are subject to taxation due to their income in the country. Form 1042-S is filed to report the total amount of money paid to foreigners by institutions and businesses registered in the United States.

The foreigner definition here covers people who are not citizens of the United States but are working in the country and have a regular income paid by US businesses and institutions. This also covers foreign trusts, foreign estates, foreign corporations, and foreign partnerships, which are subject to income tax withholding.

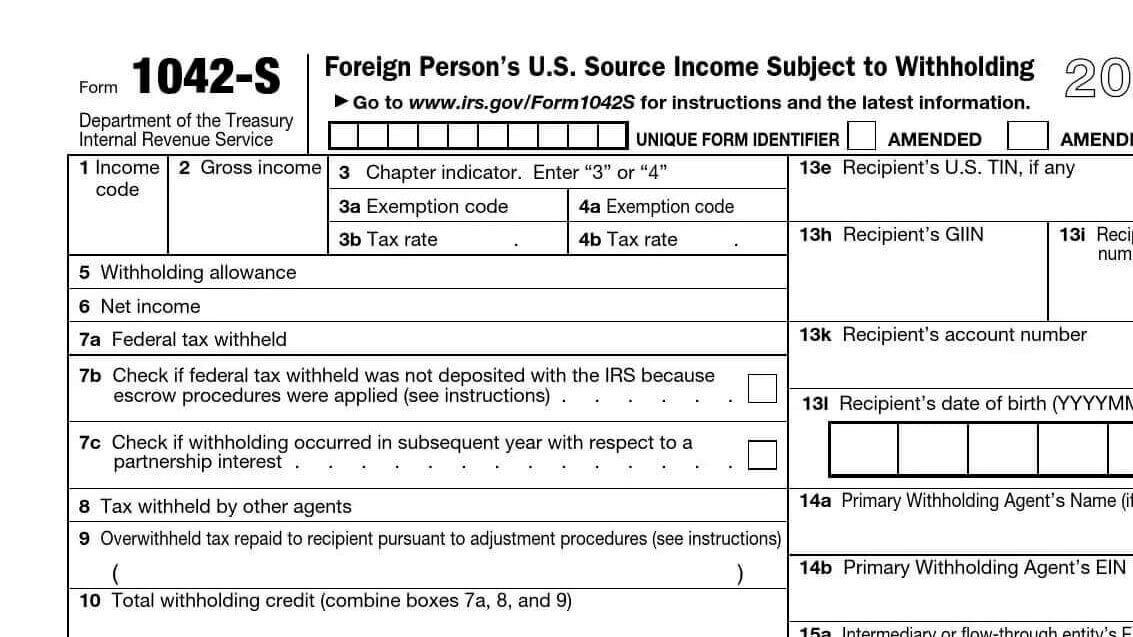

By completing and filing form 1042-S, the payee can enjoy the refund that they paid to these individuals and corporations. It is worth noting that you need to file a separate Form 1042-S for each type of income. These types of income may include examples, such as gambling winnings, pension income, income from real estate, dividends paid by American corporations, scholarships, and royalties.

1042 Form Instructions

You can find all the detailed instructions on the form itself, but there are certain considerations that we would like to share here. Payees can submit this file on their own without any assistance or cost. They can also hire a tax professional to let them carry out all the operations on their behalf.

If you filed the 1042 Form but failed to pay the deposit, you will be charged with interest and penalties. In addition to this, the late filing of the form can also lead to a penalty. The penalty is 5% of the unpaid tax, and this will be charged every month. The good news is that the monthly penalty cannot exceed 25% of the unpaid tax.