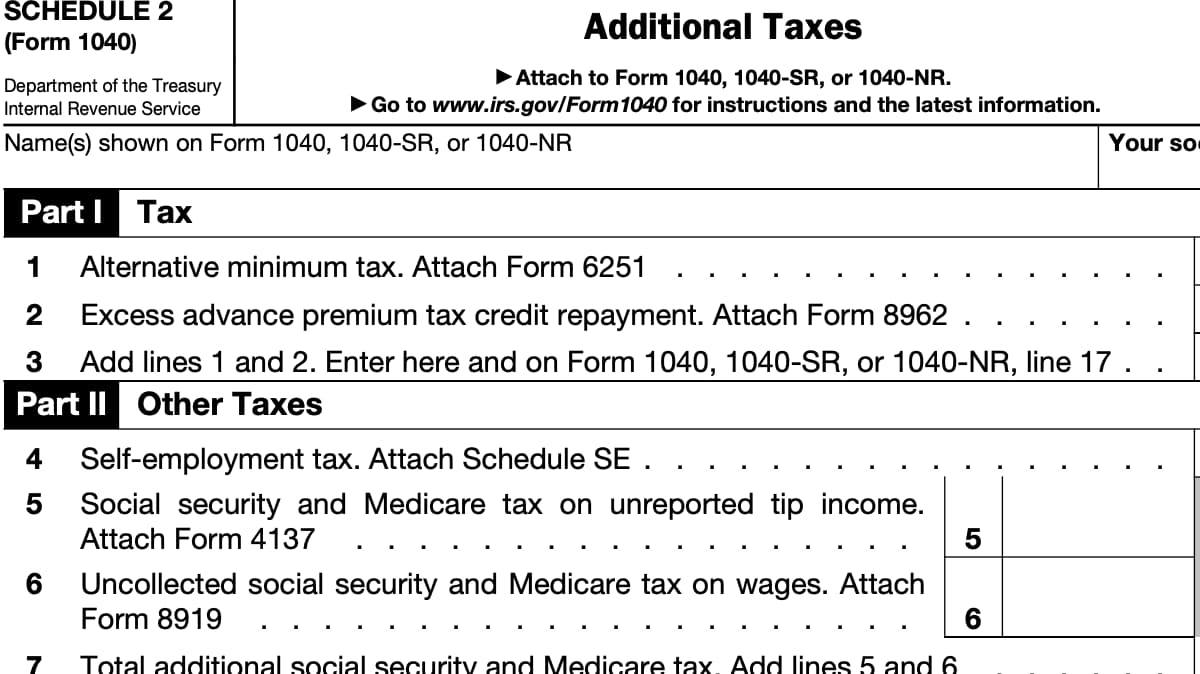

Schedule 2, Additional Tax, is the supporting document for reporting additional tax owed.

Before 2018, everything on Schedule 2 was pretty much included on your federal income tax return, but as many of the changes were made to simplify taxes, Schedule 2 was introduced.

Fill out Schedule 2 online

Start filling out an online paper copy of Schedule 2 to report additional taxes owed and the certain credit amounts received in excess of the amount you’re supposed to claim.

Why file Schedule 2

Schedule 2 is a must-file tax form if the following applies to you.

- You are a high income taxpayer that owes alternative minimum tax.

- You’ve received excess premium tax credit and need to repay now.

- You owe taxes in addition to the standard income taxes.

The above list shows the most common reasons why you might need to file Schedule 2. There also

While filling out Schedule 2, you’re more than likely to attach other tax forms, such as Form 6251 and Form 8962, depending on why you’re filing Schedule 2.

How to attach Schedule 2 to 1040

You can attach Schedule 2 to your federal income tax return by stapling it on the top right or left corner. Although this isn’t a tax form that needs to be scanned by the Internal Revenue Service, you can also keep it in the same packaging. As long as every tax form is in the package, you don’t need to do anything in addition to these.