Employers are responsible for summarizing how much their employees earned during a pay period by issuing a pay stub. Unlike a paycheck, which is used for the employee to cash in and get paid, pay stubs are documents that summarize the total payment.

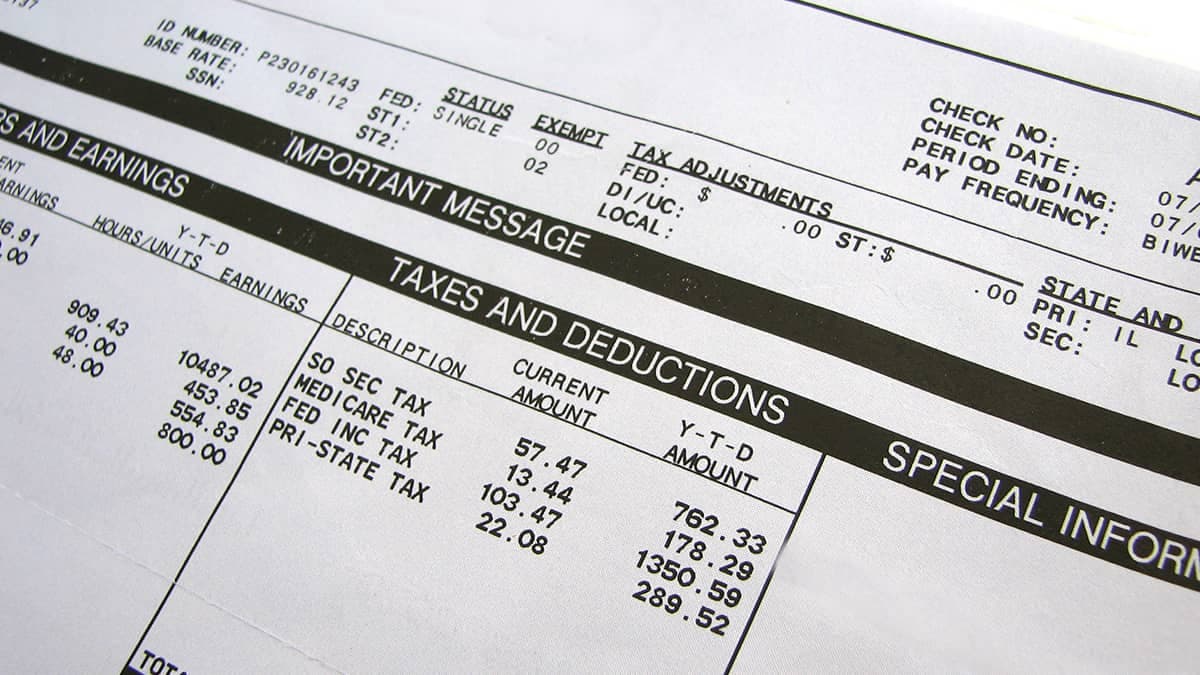

A pay stub may include information about the pay of the employee, that is not reported on the paycheck. Think of federal income taxes withheld up to date or other taxes like the Social Security and Medicare (FICA) taxes.

What to do with pay stubs?

Although there are many uses of pay stubs where it might be necessary to have, there isn’t anything that you have to do with it. Your pay stub is simply documentation that summarizes your pay. Other than this, there isn’t really use for pay stubs.

However, there are some cases where you will need your pay stub. When you’re applying for a new loan or mortgage, oftentimes, financial institutions want their applicants to present their pay stubs. Another use of pay stubs is related to taxes. When you don’t receive the information return you’re anticipating, such as Form W-2, use your last pay stub to fill out the substitute form, as you will need the information about your payments throughout the year.

How to get a pay stub?

Along with your paycheck, your employer needs to issue you a pay stub for every pay period. So, it’s something that you’ll get from your employer even without your demand. If your employer processed your paycheck, that also means your pay stub is processed. Usually, employers furnish their employees with both their paychecks and pay stubs. If you only received your paycheck, request your pay stub from your employer.