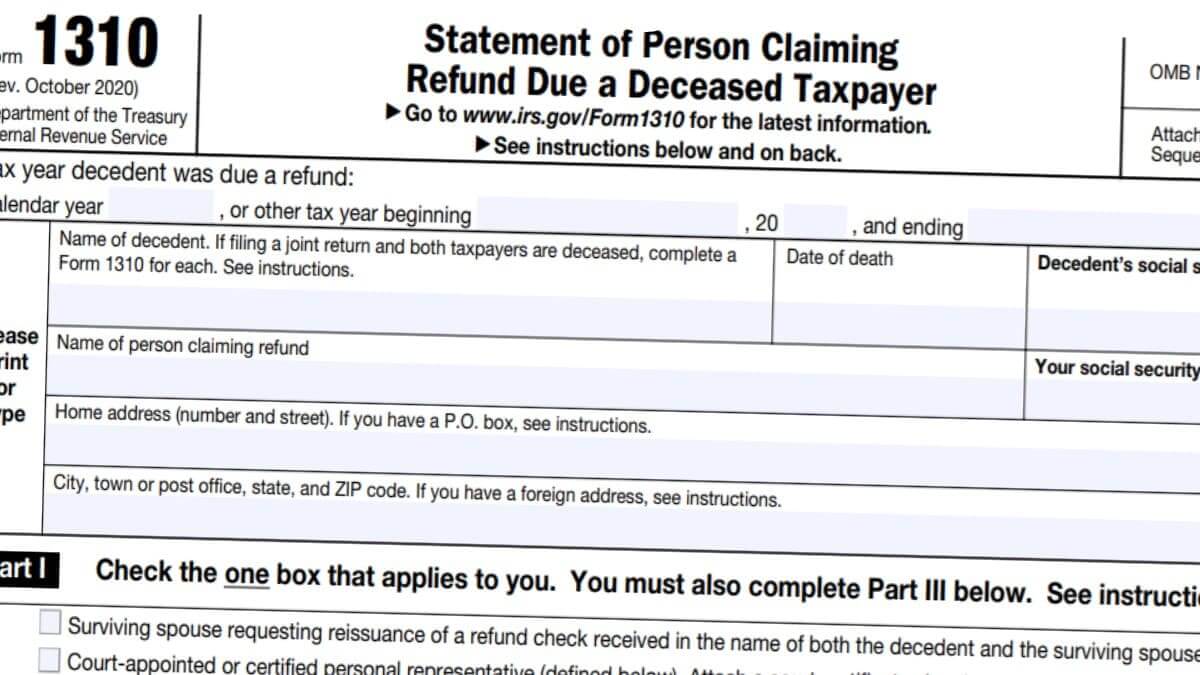

IRS Form 1310, officially titled “Statement of Person Claiming Refund Due a Deceased Taxpayer,” is a crucial document used by individuals seeking to claim a tax refund on behalf of a deceased person. This form serves as a vital tool in the process of settling a decedent’s financial affairs, allowing designated individuals to receive tax refunds that were due to the deceased taxpayer at the time of their death. Form 1310 plays a significant role in ensuring that rightful heirs or representatives can access funds owed to the decedent, while also providing the Internal Revenue Service (IRS) with the necessary information to verify the claimant’s eligibility to receive the refund. The form’s importance extends beyond mere financial transactions, as it represents a key step in the complex process of managing a deceased person’s estate and fulfilling their final tax obligations. By providing a structured means of claiming refunds, Form 1310 helps to streamline the often complicated and emotionally challenging task of handling a loved one’s financial matters after their passing.

What is IRS Form 1310?

IRS Form 1310 is a document designed for claiming a tax refund on behalf of a deceased taxpayer. It allows eligible individuals to request the release of funds that were due to the decedent at the time of their death. The form serves as a crucial tool for the IRS to verify the claimant’s right to receive the refund and ensure proper distribution of the deceased person’s tax overpayments.Key features of Form 1310:

- Enables claiming of refunds for deceased taxpayers

- Provides necessary information for IRS verification

- Helps in the proper settlement of a decedent’s tax affairs

Who Must File Form 1310?

Form 1310 must be filed by certain individuals claiming a refund on behalf of a deceased taxpayer. However, not all situations require the submission of this form. The following categories of claimants must file Form 1310:

- A person, other than the surviving spouse or personal representative, claiming a refund for the decedent’s estate1.

- A court-appointed or certified personal representative claiming a refund on Form 1040-X or Form 8431.

- A surviving spouse requesting reissuance of a refund check received in the name of both the decedent and the surviving spouse1.

It’s important to note that Form 1310 is not required in certain situations:

- A surviving spouse filing an original or amended joint return with the decedent does not need to file Form 13101.

- A personal representative filing an original Form 1040, 1040-SR, 1040-NR, or 1040-SS for the decedent, with the court certificate of appointment attached, does not need to file Form 13101.

How to Complete Form 1310?

Step 1: Gather Necessary Information

Before filling out the form, collect all relevant information, including:

- Decedent’s personal information

- Tax year for which the refund is due

- Your relationship to the decedent

- Court appointment documents (if applicable)

Step 2: Complete the Header

Fill in the following information at the top of the form:

- Decedent’s name and Social Security number

- Your name and Social Security number

- Tax year for which the refund is claimed

Step 3: Select the Appropriate Box in Part I

Choose one of the three options in Part I that best describes your situation:

- Box A: Surviving spouse requesting reissuance of a joint refund check

- Box B: Court-appointed or certified personal representative

- Box C: Other person claiming refund for the decedent’s estate

Step 4: Complete Part II (if applicable)

If you checked Box C in Part I, you must complete Part II:

- Answer questions about the decedent’s will and court appointments

- Indicate whether you will distribute the refund according to state laws

Step 5: Sign and Date in Part III

All filers must complete Part III:

- Sign and date the form

- Provide your phone number (optional)

Step 6: Attach Required Documents

Depending on your situation, you may need to attach:

- Court certificate showing your appointment as personal representative

- Proof of death (keep for your records, do not attach to the form)

Step 7: Submit the Form

File Form 1310 according to the instructions:

- If attaching to another form, follow the instructions for that form

- If filing separately, send it to the same IRS center where the original return was filed

Form 1310 Mailing Address

Mail Form 1310 using USPS. Do not use Private Delivery Services such as FedEx, UPS, etc.

Put Form 1310 in a large enough envelope and mail it to the address the original tax return was filed. If you or the decedent filed an electronic return, use the 1040 mailing address to submit the 1310.