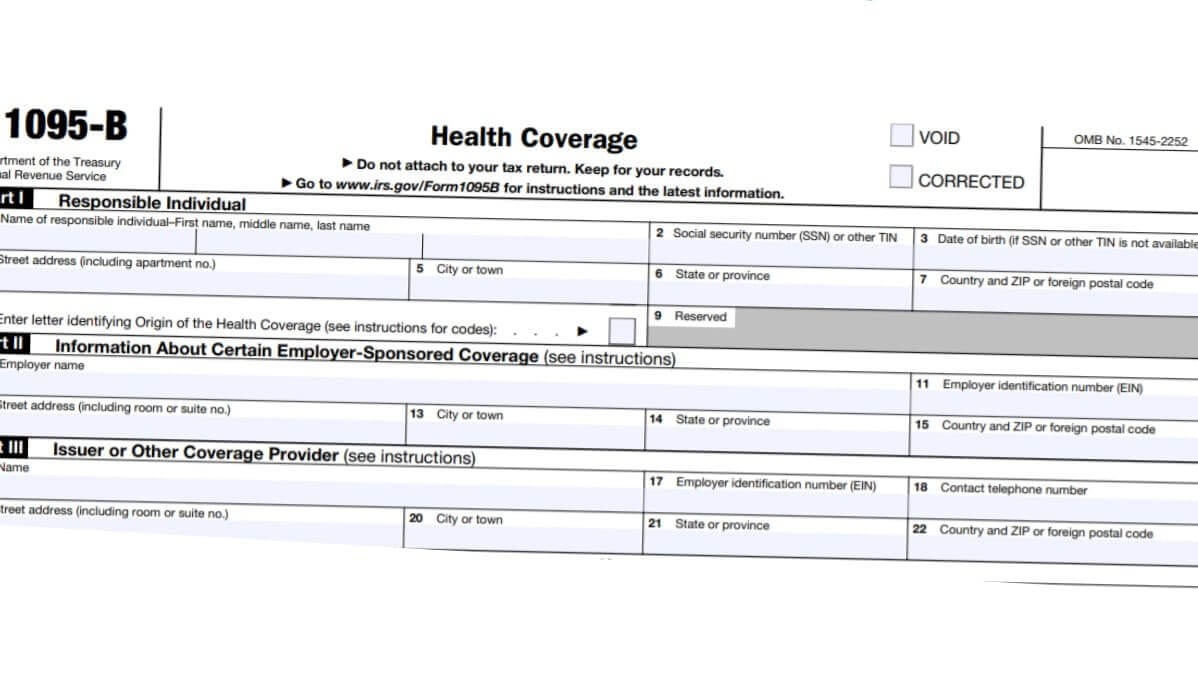

Fill out 1095-B Form 2024 to report minimum essential coverage to individuals covered and the Internal Revenue Service. It’s easy to complete Form 1095-B as you only need to enter information about the following.

- Your information

- Employer-sponsored coverage

- The issuer or other coverage providers

- Covered individuals

When filling out Form 1095-B, you might not have enough boxes for the 4th section. Staple as many forms as you need to complete the form and enter the names and other information of the individuals. This is for those who are filing Form 1095-B on paper. If you’re filing it through a tax preparation service, this shouldn’t be a problem of yours.

What is the 1095-B Form?

The 1095-B form is a tax document that provides information about an individual’s health insurance coverage. It serves as a record of the type of coverage individuals have had throughout the year, which is essential for tax-related purposes. The form is generated by certain entities, such as insurance companies or employers, and it outlines who was covered under the insurance policy and for which months.

Why is the 1095-B Form Important?

The 1095-B form plays a crucial role in the Affordable Care Act (ACA), also known as Obamacare. Under the ACA, individuals are required to have minimum essential health insurance coverage. The form helps individuals prove that they meet this requirement, thus avoiding potential penalties when filing taxes.

Who Issues the 1095-B Form?

Insurance companies, government programs like Medicaid, and certain employers with self-insured health plans are responsible for issuing the 1095-B form. It is the sender’s responsibility to ensure that the recipient – the taxpayer – receives the form on time.

| Information | Details |

|---|---|

| Form Number | 1095-B |

| Purpose | Report minimum essential health coverage |

| Issued by | Insurance providers, government programs, self-insured employers |

| Usage | Tax reporting, healthcare verification |

| Filing | Not required to file with tax returns |

| Importance | ACA compliance, tax penalty avoidance |