Form W-2 is the Wage and Tax Statement form for employers to report wage, salary, and tips paid to employees and federal, state, and local income taxes from these payments. Employees need their W-2 to file their federal income tax returns as it reports the majority of the income they earned. Without Form W-2, employees won’t be able to report the income they earned.

For this reason, employers must fill out a copy of Form W-2 for each employee that’s working. Regardless of how much an employee has earned, employers should fill out a copy of Form W-2 but an employer is only mandated to fill out a Form W-2 if the wages are paid in excess of $600 under the IRS guidelines. Employees then can file their tax returns after getting the W-2.

Fill out 2021 Form W-2 Printable

Employees need their W-2 so employers must file Form W-2 timely. The deadline to file Form W-2 is January 31. An employer who files Form W-2 after this deadline will incur late-filing penalties which start from $50.

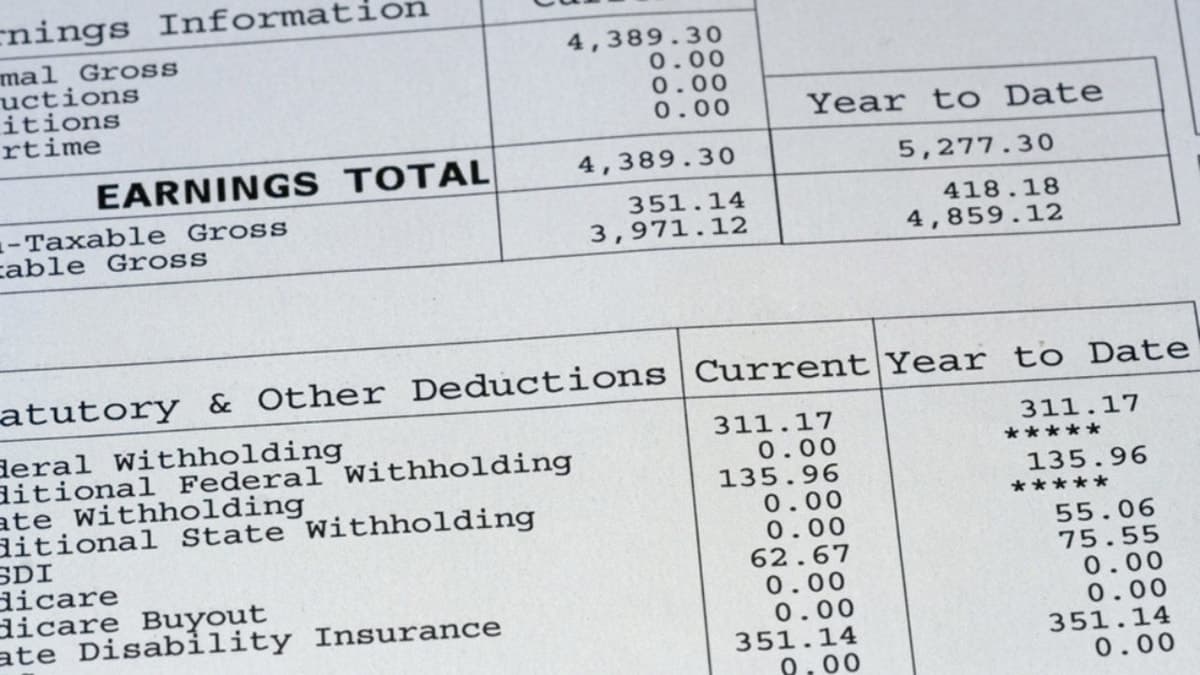

There are several ways to file Form W-2. Filling out a printable copy of Form W-2 is one of those options which is convenient enough considering what needs to be reported on the form. The content of Form W-2 include but not limited to:

- Wages, salaries, and tips paid

- Federal, state, and income taxes withheld

- Social Security and Medicare wages/taxes withheld

- Employer reimbursements

It’s also possible to file Form W-2 with the Social Security Administration and print out a paper copy to furnish employees. Given a copy also must be filed with the SSA, filing Form W-2 online and printing out a paper copy is a lot more convenient than entering the money amounts on paper. Otherwise, you’d also have to mail Form W-2 to the Social Security Administration. The reason why the SSA needs Form W-2 is simple. The agency needs to see the amount of Social Security and Medicare taxes withheld from the employees’ income.

To file Form W-2 online and get a printable copy of it, head over to Business Services Online and start filing it. It’s completely free to file Form W-2 as it’s an online tool provided by the Social Security Administration. In addition to filing Form W-2 and getting a printable copy, employers can also verify the Social Security Number of employees.