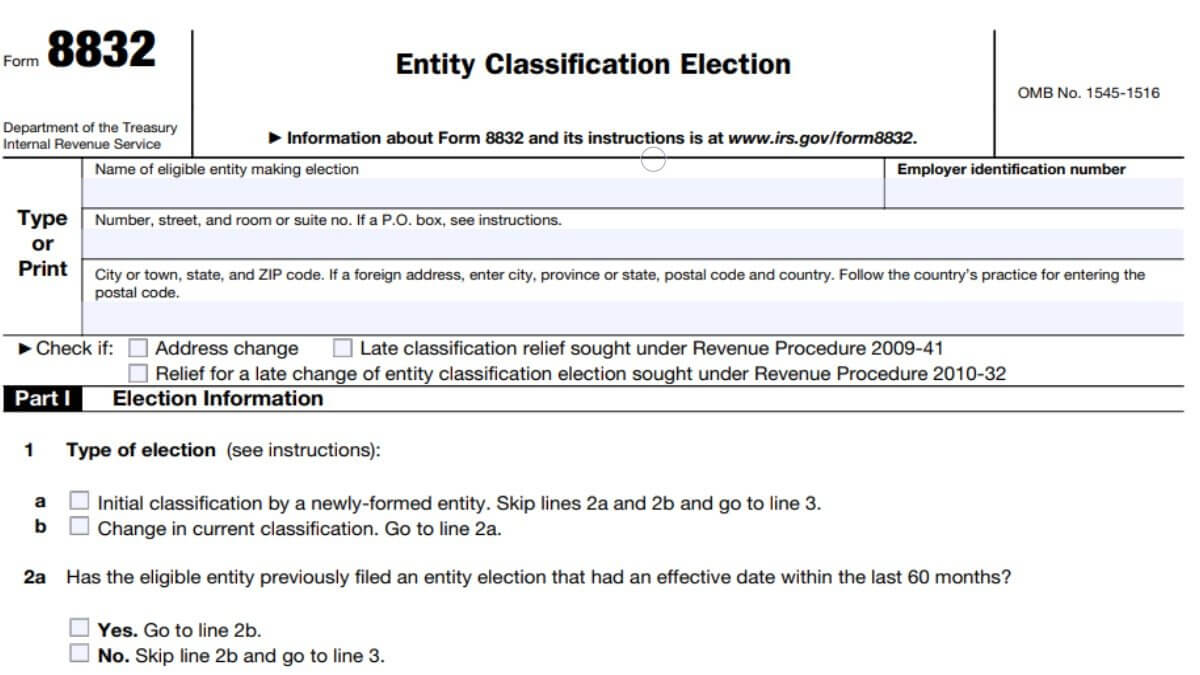

Form 8832—Entity Classification Election is the IRS form for eligible entities to set the tax classification for federal tax purposes. The tax classification of an eligible entity can be a corporation, partnership, or entity disregarded as separate from the entity’s owner.

However, before an entity files Form 8832, there is one thing that needs to be cleared out.

If the entity is going to be an S corporation for tax classification purposes, Form 2553 must be filed if the election is under section 1262(a). That said, Form 2553 must be filed for entities who are becoming an S corporation under section 1262(a). Read this article to learn more about Form 2553—Election by a Small Business Corporation and fill out one online.

Fill Out Form 8832

Form 8832 is a fairly simple tax form that can be filed under an hour or so. That’s of course assuming owner(s) of the entity who’s making an election to change or determine the tax classification is present.

Start filing out Form 8832 below to make an election to transition or decide on the tax classification of the entity.

Mail Form 8832 once you’re done to the following IRS mailing address depending on your state of residence or principal place of business.

| State of Residence/Principal Place of Business | Mail it to: |

|---|---|

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Utah, Washington, or Wyoming | Department of the Treasury Internal Revenue Service Center Ogden, UT 84201 |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, West Virginia, or Wisconsin | Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999 |