How to Use the 1040EZ Form

Using the 1040EZ Form on your tax return can be confusing, especially if you have multiple incomes. There are many factors to consider, such as your income, whether you are self-employed, and if you are eligible to claim a specific credit or deduction.

Earned Income and Making Work Pay tax credits are not allowed.

Despite its name, the 1040EZ is only sometimes the easiest way to file taxes. Although it is the smallest of the three IRS tax forms, it’s still quite a feat to rub this on your own, especially if you’re on a tight budget. The tax authorities have provided a few tools to make this task easier on the wallet.

For starters, the 1040EZ has a new and improved version of the long-time tax preparer’s favorite. In addition to doubling the earning limit on the Form, the IRS has added some useful tax-saving options to the table. This is separate from the requisite form filling. Fortunately, you can take advantage of these benefits without being a tax pro. You can file jointly as a single, married filer, or head of household.

You’ll also find that the EITC has been revamped to include several new and notable tax credit types. This consists of the child credit and retirement savings credit. For those with children, the EITC may be the most crucial tax credit you’ll ever need. To qualify, your kids must be under 17 and 65 at the end of the year. You must also have a combined household income under $100,000. And, of course, you must live in the United States to be eligible.

If you’re a low- to moderate-income earner, you’ll be happy to know that the EITC may be your ticket to a larger refund. If you don’t claim the credit, Uncle Sam will make you pay it for you. And, while you’re at it, consider using the EITC to qualify for other tax breaks that can boost your bottom line. If you’re looking for more information on the EITC, check out the following sites: EITC Central and EITC.com. These sites provide valuable information on all things IRS-related. They also feature links to state and local tax agencies with a wealth of tax information. Whether you’re filing your taxes or paying someone else to do it for you, the EITC has covered you. If you’re ready to file taxes, the best place to start is with the IRS’s free online filing service.

IRS no longer publishes Form 1040EZ

Until the end of the 2018 tax year, IRS Form 1040EZ was a simplified version of the entire 1040 form, which was a little shorter and had fewer tax deductions. The Form was available to taxpayers with basic tax situations, including those with no dependents and interest income. It was a short version of 1040, but it was not intended to offer valuable tax breaks.

To comply with the new Tax Cuts and Jobs Act, the IRS revised its standard Form 1040 to provide more opportunities for taxpayers to save money on their taxes. This redesigned Form 1040 now asks more questions, including how many qualifying dividends are paid and how much qualified business income you have. The new Form also allows for more tax savings, such as the Earned Income Credit.

The IRS has also removed some tax credits from 1040. Those that show up on the long Form can still be reported, but you must fill out different schedules. In the past, these tax credits were only available on the shorter 1040 form. The new Form 1040 will include the most popular tax credits.

In addition to the new Form 1040, the IRS has also changed how the Form is prepared. Instead of requiring you to attach several different IRS schedules to the return, you can use the software. These programs will help you navigate through the process of completing your taxes. It will also guide you through the questions it will ask you. You can also file your taxes online with the IRS.

The new Form 1040 is still a more straightforward tax form, but the number of tax deductions it includes has increased. Those with significant income may not qualify for this Form, but there are still various options to help you save on your tax bill. The new Form also has a higher earning limit, which is more than double the old Form 1040EZ.

If you have a complicated situation, you must submit additional schedules. You can submit your Form W-4, which is used to request a free return information package. You can also submit your employer’s Quarterly Federal Tax Return if your employer withholds federal taxes. You can also fill out the Tax Computation Worksheet if your income exceeds $100,000.

The IRS has a solid commitment to providing high-quality service to taxpayers. They continue to enforce the law with integrity and fairness and aim to make their services as simple and easy to understand as possible. In addition, they have many tools to help you find the correct tax information. They provide information on tax-exempt status, a tax account, and how to access your tax information.

Filing requirements

Whether you are an older taxpayer or a new taxpayer, you should know that the filing requirements for Form 1040EZ are much simpler than those for Form 1040. However, there are certain tax credits and deductions that you may not be able to claim with the 1040EZ. You may be better off using other forms, such as Form 1040A. These forms offer more tax-saving opportunities and allow you to claim more deductions.

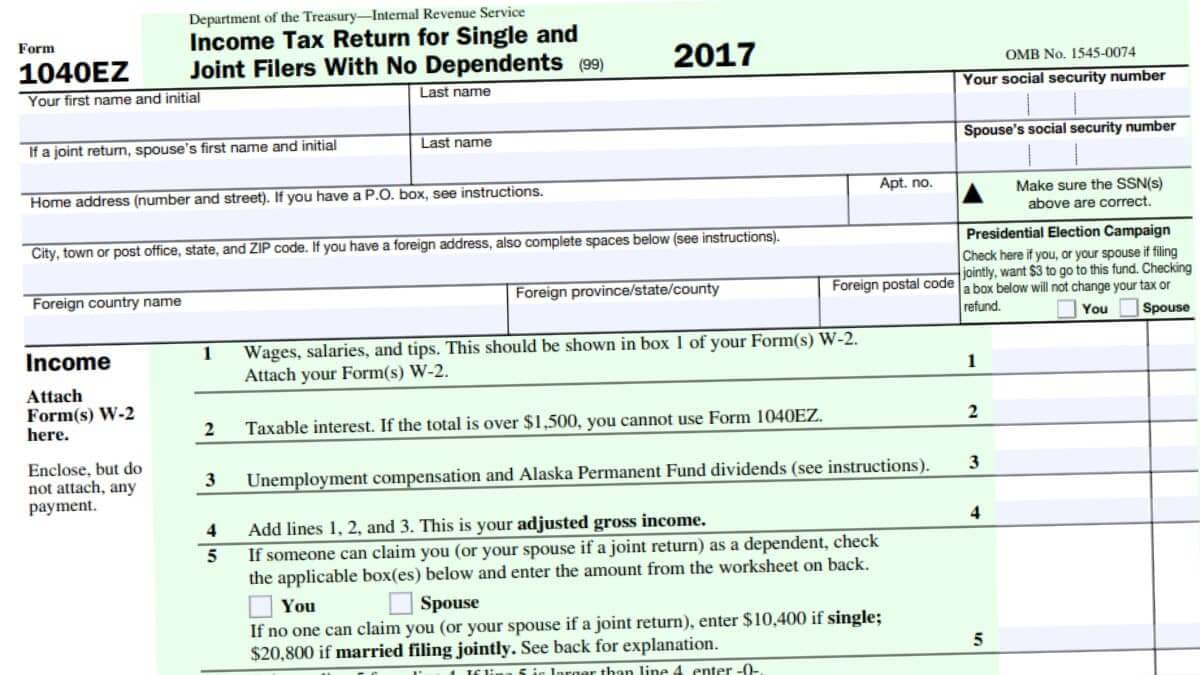

To file a 1040EZ, you will need to provide your personal information, including your full name, address, and social security number. You will also need to specify the amount of income you earn and the sources of your income. You will need to sign and date the Form and authorize a third party to speak with the IRS on your behalf. This is important for taxpayers unfamiliar with the process or having questions about their return.

Unlike the previous version of 1040, this Form allows you to claim the Earned Income Tax Credit (EITC). The EITC will take care of much of the tax burden if you are eligible. However, it is essential to note that the EITC is only available for qualified people to receive the Form.

To qualify for the EITC, you must be at least 65 years of age on the last day of the tax year, and your adjusted gross income must be less than the standard deduction. You must have received at least $600 in wages or salaries during the year.

If you are married and filing jointly, you and your spouse must meet the same age and income requirements. You will need to provide your spouse’s name and Social Security number when you fill out the Form. You will also need to include information about your income and taxable interest. If you have any taxable investments, you will need to attach an attachment to the Form, such as a W-2 or a Form 1099. If you do not have any taxable investments, you will not need to attach an attachment. You can file your tax return electronically, though it is still recommended that you file on paper, as this method is universally accepted.

Some of the forms you will need to use will be sent by your employer. These include a W-2, which will detail your federal tax withheld. You will also need to provide your bank account information, as well as your routing number. This number is used for direct deposit and is essential to your refund. If your bank account number is incorrect, you can lose your refund.

The filing requirements for Form 1040EZ are intended to make the tax preparation process easier and faster. The Form can be downloaded from the IRS website and is available at post offices and libraries. You can complete the Form in about half an hour, but the time spent will be reduced if you are already familiar with the process.

Form 1040-EZ is no longer in use as the Internal Revenue Service doesn’t accept it as a tax return. Therefore, the agency doesn’t renew the 1040-EZ for tax seasons beyond 2018. Since the Internal Revenue Service doesn’t accept it or renew Form 1040-EZ anymore, taxpayers must file Form 1040 or 1040-SR to file an income tax return.

The Internal Revenue Service removed Form 1040-EZ because it can no longer be filed. This is due to the changes after the Tax Cuts and Jobs Act of 2017. But what about Form 1040-SR? It’s basically the original 1040 with only texts being a bit larger. That said, it can still be used to file a tax return as the TCJA of 2017 doesn’t affect it.

If you’re single or filing jointly and have no dependents, you must file your federal income tax return using Form 1040. Get Form 1040 for the 2024 tax season from here.