Form 943—Employer’s Annual Federal Tax Return for Agricultural Employees is similar to the Employer’s Quarterly Federal Tax Return, Form 941.

While Form 941 is filed for every quarter, farmers who hire employees whether it be seasonal or not must file Form 943 for every year. Unlike an individual tax return, Form 943 must be filed by January 31st.

Form 943 a farmer files in 2024 by January 31st of that year for the 2023 taxes must also be paid by January 31st. However, if the farmer’s tax liability is $0 for that year, the filing deadline will be February 10, 2024.

2024 Form 943 is the same as any other Forms 943 in the past. Farmers must provide their total tax liability for each month during the tax year. Other than these, on Form 943, employers must provide information about income paid to employees and taxes withheld from their income.

Since the income paid to employees and taxes withheld from their income must be reported with a Form W2—Wage and Tax Statement, it also needs to be filed for every employee.

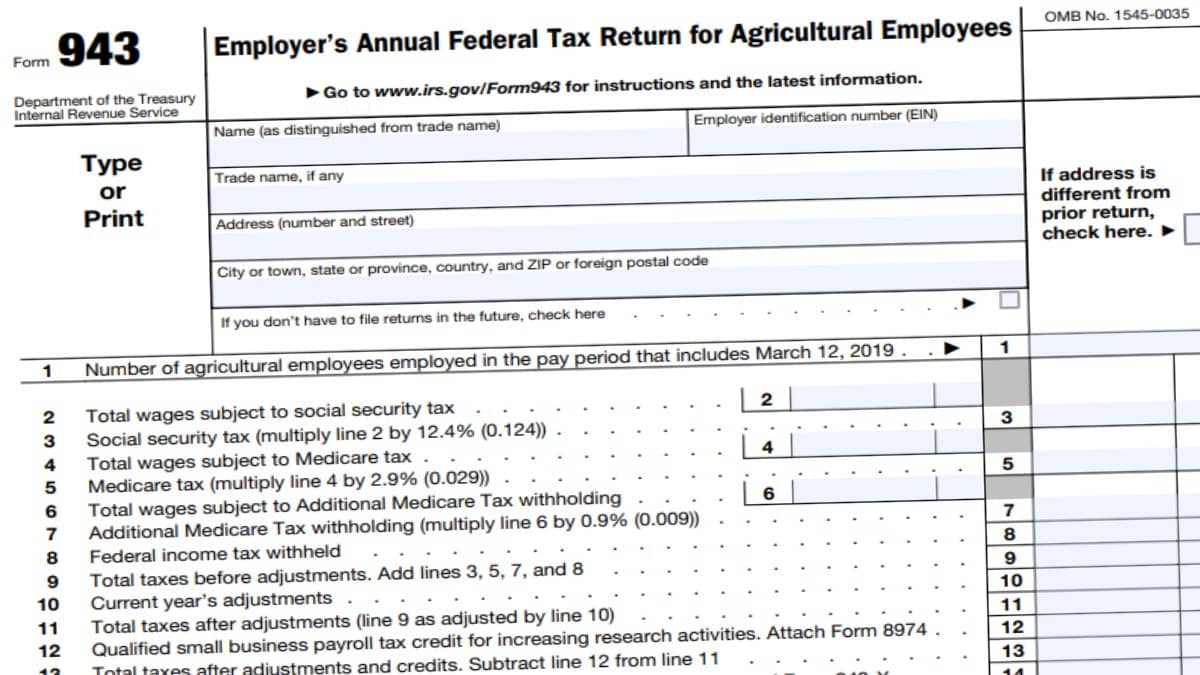

Content of Form 943

Everything that needs to be reported on Form 943 include the following.

- Total wages subject to Social Security tax

- Social Security tax

- Total wages subject to Medicare tax

- Medicare tax

- Total wages subject to Additional Medicare Tax

- Additional Medicare Tax

- Federal income tax withheld

- Total taxes before adjustments

- Total taxes after adjustments

- Qualified small business payroll tax credit (for the increasing research activities, Form 8974 must be attached)

- Total taxes after adjustments

- Deposits for 2023 (including overpayment applied from the previous year(s) and Form 943-X

- Total taxes after adjustments and credits

In the last part of Form 943, you will need to enter the balance due and overpayment if your deposits were more than your tax liability.

Filing 2021 Form 943

Form 943, just like any other tax return can be filed electronically. For this, you must purchase tax software. The IRS approved e-file providers all have their own pricing and features. We suggest picking one that suits your needs the most.

On the other hand, you always have the option to file a paper Form 943. Although it is suggested to file Form 943 electronically, you can opt to file a paper return if you know everything that goes into your annual tax return.

Form 943 Mailing Address

| State | Mailing Form 943 With Payment | Mailing Form 943 Without Payment |

|---|---|---|

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, and Washington, Wyoming | Internal Revenue Service PO Box 806533 Cincinnati, OH 45280-6533 | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, and Wisconsin | Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0006 |

| No Legal Residence or Principal Place of Business in Any State | Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |