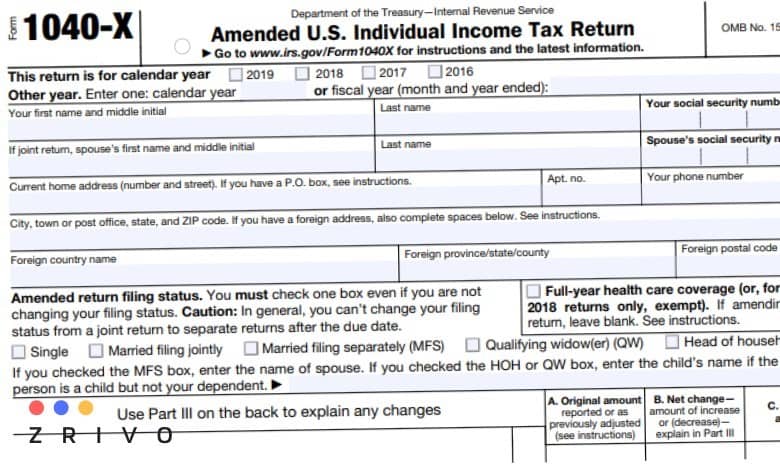

The 1040-X Form, officially named the “Amended U.S. Individual Income Tax Return,” is a document provided by the U.S. Internal Revenue Service (IRS) that allows taxpayers to make adjustments to their previously filed tax returns. If you realize that there was an error in your original tax return, the IRS 1040-X Form can be used to correct these mistakes. This might involve changing income amounts, deductions, credits, or tax liability.

When to File a 1040-X Form?

You should consider 1040-X Form filing if:

- You made a mathematical or clerical error on your original tax return.

- You overlooked or received new tax documentation after you’ve already filed.

- There have been changes to your filing status, income, deductions, or credits.

Where to File a 1040-X Form?

The location to file the 1040-X Form depends on where you reside and the specifics of your tax situation. For the most accurate and up-to-date address, always refer to the 1040-X Form Instructions provided by the IRS.

1040-X Form Deadline

You generally need to file the 1040-X within three years from the date you filed your original tax return or two years from the date you paid the tax, whichever is later. For tax returns filed before 2023, the deadline to submit an amended return is typically April 15, 2024.

1040-X Form Requirements

The key requirements to remember when amending your tax return include:

- Clearly indicating the year of the return you’re amending at the top of the 1040-X.

- Filling out each column: ‘A’ for original amounts, ‘B’ for net change, and ‘C’ for corrected amounts.

- Attaching any forms or schedules that change as a result of the amendment.

How to File a 1040-X Form: A Step-by-Step Guide

- Gather Necessary Documents: Before you start, ensure you have your original tax return and any new tax documents that weren’t included initially.

- Download and Print the 1040-X Form: You can find the form on the IRS website.

- Complete the Form: Refer to the 1040-X Form Instructions while filling it out to ensure accuracy. Make sure you fill out every section that applies to your situation.

- Write an Explanation: On the back of the 1040-X, there’s space to explain why you’re amending your return. Be concise but thorough.

- Attach any Necessary Documents: If you’re claiming a refund or credit, or if you’re updating a form or schedule, you’ll need to include the changed documents.

- Mail the Form: Once you’ve filled out the 1040-X and gathered your documents, mail them to the address listed in the 1040-X Form Instructions.

- Track the Status: After you’ve mailed your form, you can track its status on the IRS website.

1040-X Form: Frequently Asked Questions

How long does it take to process a 1040-X Form?

It typically takes the IRS 8 to 12 weeks to process a manually filed 1040-X Form.

Can I file a 1040-X electronically?

As of 2023, taxpayers can electronically file their 1040-X Form for the current tax year and some previous years.

1040-X Form: Common Mistakes

While the goal is to correct mistakes with this form, there are 1040-X Form Common Mistakes people often make when filing an amendment:

- Not Waiting for the Refund: If you’re expecting a refund from your original return, wait until you’ve received it before filing a 1040-X.

- Forgetting to Sign: Just like with your original return, the 1040-X needs your signature.

- Miscalculations: Always double-check your math. Refer to the 1040-X Form Instructions if necessary.

1040-X Form: Tips for Filing Accurately

- Be Thorough and Detailed: When explaining why you’re amending your return, provide clear details.

- Double-Check Figures: Mistakes can be costly. Ensure all numbers are accurate.

- **Use the 1040-X Form Instructions: This guide is invaluable for filling out the form correctly. Keep it on hand as you work.

Common 1040-X Form Mistakes vs. Tips for Filing

| Common 1040-X Form Mistakes | Tips for Accurate Filing |

|---|---|

| Filing the 1040-X Form too soon | Wait until you’ve received your initial refund or notice before amending. |

| Forgetting to sign and date the form | Always double-check the signature and date sections before sending. |

| Not including supporting documentation | Ensure all relevant forms, schedules, or evidence are attached to support changes. |

| Incorrectly filling out the columns | Follow the 1040-X Form Instructions carefully. ‘A’ for original amounts, ‘B’ for net change, and ‘C’ for corrected amounts. |

| Not explaining changes in detail | Use the space provided on the form to clearly and concisely explain each amendment. |

| Miscalculations or typos | Double-check all figures and consider using tax software or consulting a tax professional for assistance. |

| Sending the form to the wrong address | Refer to the IRS instructions for the correct mailing address, which may vary depending on your location and the specifics of your tax situation. |

In conclusion, the 1040-X Form is a valuable tool for taxpayers to correct errors on previously filed tax returns. It’s crucial to be diligent, refer to the instructions, and ensure you’re providing accurate information to avoid further complications. If in doubt, consider seeking advice from a tax professional.

e-Filing Form 1040-X

Under the IRS guidelines, Form 1040-X cannot be filed electronically. A paper Form 1040-X must be filed and mailed to the IRS. While it must be mailed, you certainly aren’t required to fill out one on paper. Form 1040-X can be filled out below. Click on the boxes you want to enter amounts and check the boxes.

If this is your first time filing a Form 1040 on your own, you may want to read Form 1040 instructions first.

Same as filing a regular Form 1040, you will provide information about your:

- Income and Deductions

- Tax Liability

- Payments

- Refund and Taxes Owed

- Dependents

Generally, most would think filing Form 1040-X takes longer than filing a regular tax return. This isn’t really the case though. What will consume your time is gathering tax documents, not filing Form 1040-X. Having said that, you should prepare your documents first, then start filing Form 1040-X.

Online Fillable Form 1040-X

Start filling out Form 1040-X below. This is suitable for those who are going to mail their tax forms to the IRS. Since the IRS only accepts mailed amended tax returns and e-filing isn’t an option, this is what you need.

Use the buttons on the upper right corner to print out or download. The information you entered on Form 1040-X below will be attached to it. You can then mail it to the IRS.

Form 1040-X Mailing Addresses

| State or Situation | Mailing Address |

| Alabama, Connecticut, Delaware, District of Columbia, Georgia, Kentucky, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0052 |

| Alaska, Arkansas, California, Hawaii, Illinois, Indiana, Iowa, Michigan, Minnesota, Ohio, Oklahoma, Washington, Wisconsin | Department of the Treasury Internal Revenue Service Fresno, CA 93888-0422 |

| Arizona, Colorado, Idaho, Kansas, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0052 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0052 |

| Notice received from the IRS | To the address shown in the notice |

| Received reimbursement for a hurricane loss | Department of the Treasury Internal Revenue Service Austin, TX 73301-0255 |

| Form 1040-X with Form 1040-EZ or Form 1040NR | Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 |