Traders must record their trade details and establish the holding period and cost basis for each asset they sold. This information is then used to determine if the gain or loss is short or long-term. If you have sold or exchanged securities, real estate, or other capital assets, you will likely need to file Form 8949. The purpose of Form 8949 is to reconcile the amounts that you and the IRS report on each trade, ensuring that you don’t pay more taxes than you should. To do this, you’ll need to have a log of accurate cost basis data, compare that to the amounts reported by your broker on 1099-B and make any necessary adjustments. This can be a tedious task, but it’s important to be thorough so that you don’t pay more taxes than you should.

Form 8949 can be filled out in for reporting the following.

- Non-business bad debts

- Cryptocurrency trades

- Disposition of interest in QOF (Qualified Opportunity Funds)

- The worthlessness of a security

- The gains from involuntary conversions that are not used for business or trades

- The sale, trade, or exchange of a capital asset not reported on another tax form

- The sale of stock of a 10% owned foreign corporation adjusted for the dividends. (Only if the sale would otherwise generate a loss)

Reporting Cryptocurrency Activities on Form 8949

When it comes to trading crypto, filling out Form 8949 can be particularly difficult as you’re likely to see large differences in sales price and cost basis due to the size of the volumes you trade. However, there are online tools that can help you automate this process and reduce your workload.

If you trade cryptocurrency and other digital assets, you may also need to file Form 8949 with your tax return. Crypto exchanges and other trading platforms usually don’t issue Form 1099s, so you must maintain your own records of the transactions you complete. You can use an online tool to aggregate, normalize, and make your crypto transactions ready for tax filings, including form 8949. Such tools also integrates with most consumer and professional tax software programs.

The first step to filling out the form for crypto trades is to keep accurate records of your cost basis in each security sold, including wash sales. These records should be kept in a format that can easily be imported into tax software, which automatically ingests and normalizes your crypto trades for you. Then, you can use these tools to generate your Form 8949 for you.

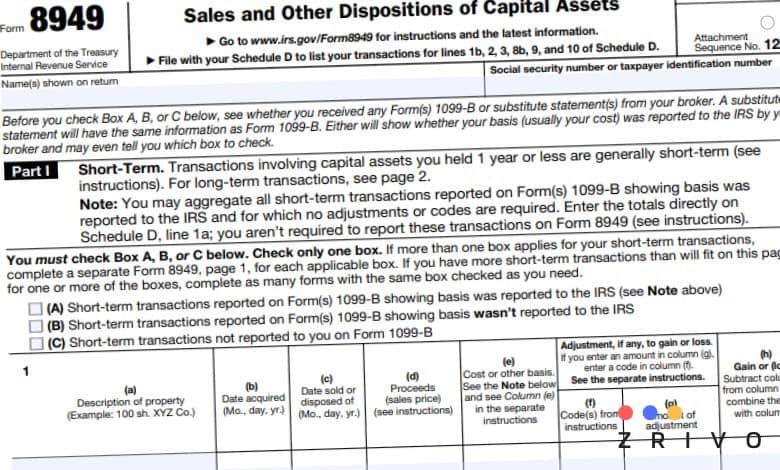

How to fill out Form 8949?

The IRS provides an interactive version of Form 8949 on its website, and it should be included in any tax preparation software you use. It’s used to reconcile the amounts reported to you and the IRS on your Form 1099-B or substitute statement with those you report on your return. It covers both short-term and long-term capital gains or losses.

You start by selecting whether your transactions fall into the short- or long-term categories, then filling out the appropriate sections of the form. Each transaction requires a description of the property, date acquired, sale date, proceeds, cost or other basis, and adjusted gain or loss. If you have more information to report than will fit on a single page, you must make separate forms for each category. Using the information from your broker’s 1099-B as a starting point is the best way to complete this form. However, the IRS expects traders to report details of wash sales and other transactions in greater detail than brokers can provide on a single 1099-B. This requires you to make adjustments across multiple fields of the form and can quickly become time-consuming.

The information you report on the form can be based either on your actual records or your broker’s records, but you must be sure to provide accurate and complete information. The IRS will not penalize you for errors but reject returns containing false or incomplete information. As with other IRS forms, Form 8949 can be confusing and complex. If you’re not confident you can handle filing your own taxes, consider getting help from a tax professional. They can drop off your return, file it for you, or work remotely.