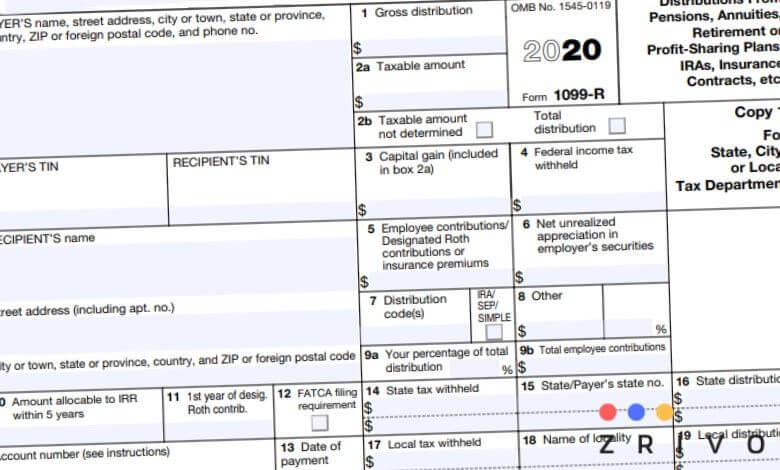

Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. or shortly known as retirement income is an IRS tax form that reports withdrawals made from a retirement account.

Your withdrawals will be reported to the IRS when you’re retired. Because of this, you will be issued a Form 1099-R. This tax form reports the income you earned through retirement. Even if your withdrawals aren’t taxable, you will be furnished with a Form 1099-R. If the taxable amount stated on Form 1099-R is zero, you don’t need to enter the amount to your tax return.

Form 1099-R works the same way as the other Forms 1099 or the W-2. It will state your income from retirement and taxes withheld from your withdrawal.

You can find the taxable amount on Line 2a. Line 2b, Taxable Amount Not Determined will be checked if the taxes withheld could not be calculated. If your Form 1099-R shows this, you must determine the taxable portion of the amount you withdrew. In this case, you must calculate the taxable amount yourself.

Other information found on Form 1099-R includes employee contributions or designated Roth contributions or insurance premiums, net unrealized appreciation in employer’s securities, and capital gain.

The information found on Form 1099-R is very limited and simple. The gross income and the taxable amount is what should concern you the most. You’re going to use these amounts when you file a tax return, so attach Form 1099-R to your tax return.

How to Attach Form 1099-R to Tax Return?

How you’re going to attach Form 1099-R to your tax return depends on how you file. If you’re filing a paper tax return, you must staple Form 1099-R to Form 1040 along with other tax documents. We suggest keeping the tax documents that report your income together. For example, put your Form 1099-R and other Forms 1099 together and keep Schedules, A, B, 1, 2, etc. separately.

On the other hand, those who file taxes electronically will need to attach Form 1099-R to their tax returns by importing the information. This is done automatically depending on the tax software you’re using to file a tax return.

If you haven’t received a Form 1099-R by February 14th, you can use the substitute form for Form 1099-R, Form 4852. But we suggest contacting the company you’re expecting the Form 1099-R to ask for your tax documents. The deadline to file Form 1099-R is January 31st. Although you technically should be able to file a tax return after this date, you must wait until February 14th to file Form 4852.