Employers file Form W-2, Wage and Tax Statement at the end of the year. It reports wage, salary, and other compensation paid to employees along with the taxes withheld from their income. The employers will give this tax form to their employees so they can file their federal income tax returns.

Since employees rely on their employers to obtain this tax form, it must be filed by January 31st. If filed late within 30 days after this deadline, the employer will have to pay a $50 penalty per W-2. If filed at a later date after the 30 days until August 1st, the penalty will be increased to $100. With that said, employers, make sure you file Form W-2 by January 31st to avoid penalties.

As for filing Form W-2, it can be filed both on paper and online. However, if you have 250 or more Forms W-2 to file, filing online is mandatory.

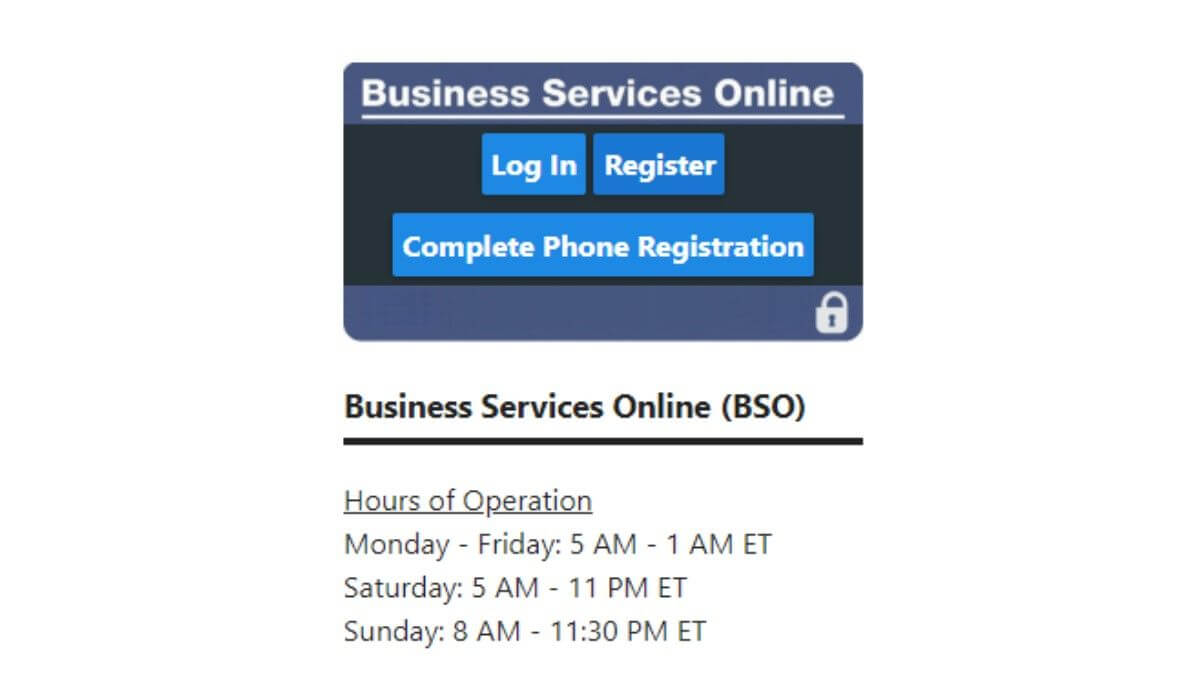

Although there are many ways to file Form W-2 online with certain tax software like TurboTax, we suggest filing on Social Security’s Business Services Online. It is free of charge and not only you will be able to file Forms W-2 but also verify employee’s identity. Here is how you can use Business Services Online to file Forms W-2.

File Form W-2 on BSO

To file Forms W-2 online on Business Services Online, you first need to register and create your unique User ID. Click here to open the registration page of BSO.

Enter your personal information on the registration page. Now proceed to the phone registration. From there on, you can start filing Forms W-2 for free.

Furnishing the Employees With Form W-2

The Social Security’s Business Services Online allows employers to print out filed Forms W-2 and download. If you wish, you can download all the Forms W-2 you filed and send employees via e-mail. If any of your employees can’t get ahold of their e-mail, you can then print out their Form W-2 so they can file a tax return.

Keep in mind that you must file Form W-2 for all the employees that have worked for you during the course of the tax year. This also includes those who worked for a brief period of time and left.