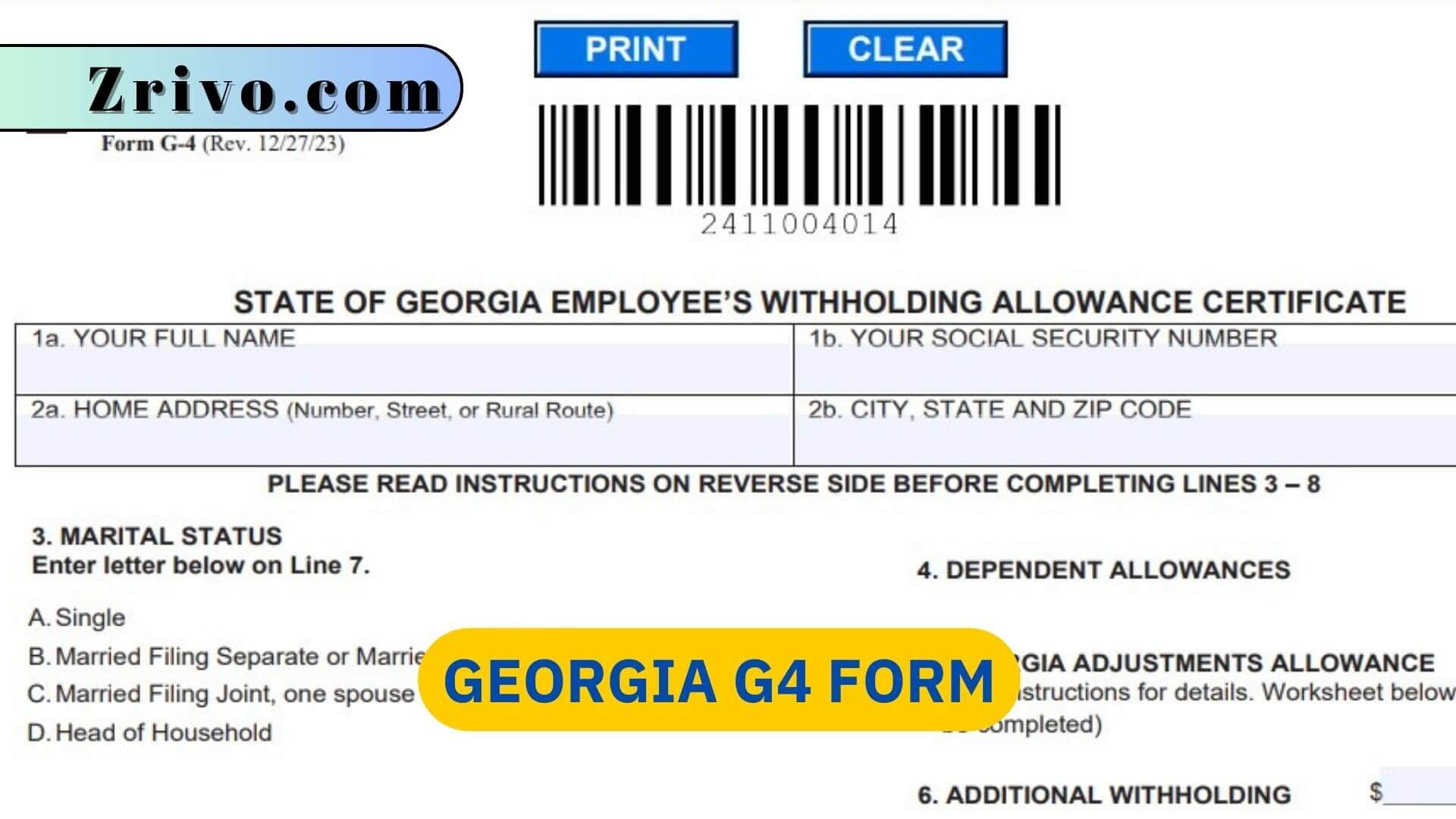

If you work in the state of Georgia, you must file a G4 form with your employer to report state income tax. You can complete the form on your computer or by hand. Once you have completed the form, sign it and send it to your employer. You can also submit it online through the state’s EFTPS system. Using the online system will ensure that your submission is received and processed quickly. You must register with the EFTPS system in order to use it. Once you have registered, you will receive a PIN in the mail within seven business days. You must use this PIN to log in and access the Georgia Tax Center.

How to File Georgia G4 Form?

To file an online G4 form, you must first create a free account and go through email verification. Once done, you can begin managing your templates by clicking on the Add New button and importing your State of georgia employee’s withholding allowance certificate from your device, cloud storage, or a secure link. Once the template is ready, you can use tools on the top and left-side panel to modify it according to your needs. These include inserting pictures, text, and fillable fields, highlighting or whiteout data for discretion, adding comments, and more.

How to Fill out a Georgia G4 Form?

To file your Georgia G4, you must provide information about your filing status and withholding allowances. You can do this by completing page two of the State of Georgia Withholding Certificate, Form G-4. You must check the box that indicates you qualify to claim exempt from withholding. This option is available if you filed a federal tax return last year and the amount of line 4 of Form 500EZ or line 16 of Form 500 was zero or if you expect to file a tax return this year and you will not have a tax liability.

In order to complete the Georgia G-4, an employee should first select a filing status (Married Filing Jointly, Married Separately, Single, or Head of Household). Then, they should enter their marital status and number of dependent allowances. If an employee would like to add additional allowances, they can refer to the worksheet on the state G-4 for a calculation.

Once completed, the employee should sign their name at the bottom of the page. Then, they should send the completed form to their employer. Finally, the employer must submit a copy of the completed Georgia G-4 to the Department of Revenue. Employers are required to honor any properly completed state G-4 claiming more than 14 allowances or exempt from withholding unless notified by the Department not to do so. In cases where an employer knows that a state G-4 is erroneous, the employer must not honor it and withhold as if the employee is single with zero allowances.

You must file your Georgia G4 form by February 15 of the current year. If you fail to file your form, you will be assessed a late payment penalty of $25 per month plus 5% interest on the amount due. You may also need to file additional tax returns for your business or individual income taxes.