Many entrepreneurs planning to start a non-profit corporation soon consider incorporating in Delaware, which has some of the most flexible business law and reporting requirements in the country. However, this may not always be the best option. From a liability perspective, it’s important to remember that even if a nonprofit is incorporated in Delaware, it can still be sued in the state of its operations (most often the founder’s home state).

A Delaware non-profit corporation may be eligible to apply for tax-exempt status if it meets certain requirements. These include having a purpose that is consistent with public benefit, not making loans to directors and officers, keeping detailed records of meetings, and dedicating assets to another nonprofit upon dissolution. The IRS requires nonprofits to file a Return of Organization Exempt from Income Tax (Form 990) each year. It is also important to keep in mind that your nonprofit may need a business license in the cities where you plan to operate.

Choosing a Name

One of the first steps in forming a nonprofit is to choose a name for your corporation. Make sure the name is available by searching it on the state’s website before you register it. You must also find a registered agent who will receive legal papers for the nonprofit. This person should have a physical street address in Delaware and must consent to the appointment. Small nonprofit corporations often select their director or officer as the agent.

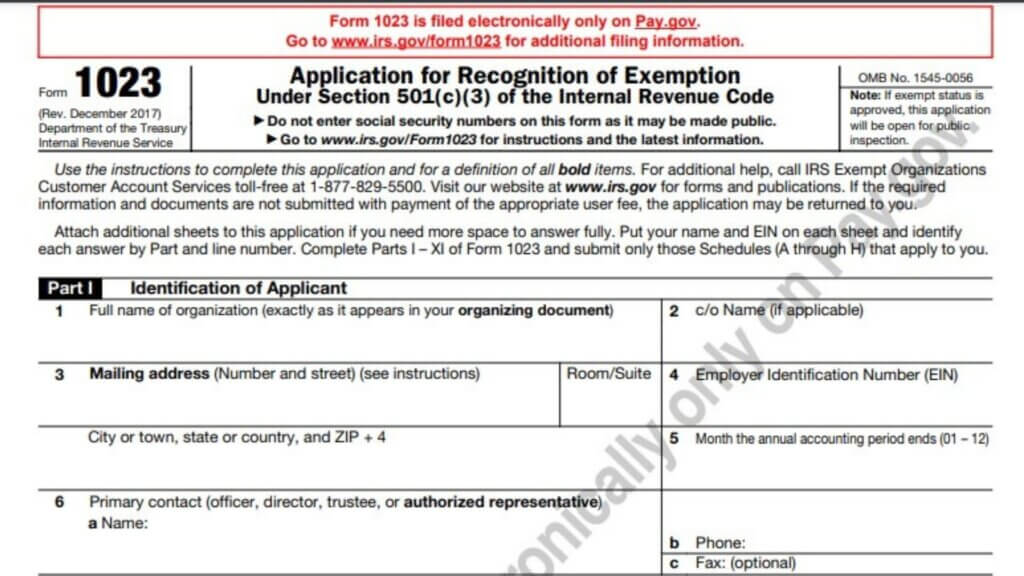

Fill out a Form 1023

The first step in creating a non-profit corporation is to file an Article of Incorporation with the Delaware Secretary of State. A non-stock corporation can apply for 501(c)(3) tax-exempt organization status with the IRS by filing Form 1023. The DGCL includes provisions relating to non-stock corporations that will facilitate this application.

No-Business License Needed

Unlike New York, Delaware does not require nonprofits to obtain a business license before they can solicit funds in the state. However, the nonprofit must still pay local business taxes and any other fees associated with the services it provides. It must also file a Certificate of Authority with the state if it plans to do business in other states. In addition, the nonprofit must obtain any permits required by local and county agencies.

Applying for an EIN

If you are starting a nonprofit corporation in Delaware, you will need to apply for an Employer Identification Number (EIN). The EIN is a unique nine-digit number that identifies your nonprofit. It is similar to a Social Security number for individuals. You can obtain an EIN by filing online. The process is simple and takes about 15 minutes to complete. You can also apply by fax or mail. If you choose to do this, be sure to include a copy of your Articles of Incorporation and a letter from the person who will act as your registered agent.

Record-Keeping

Nonprofits are required to keep detailed records of all income and expenses. These records must be accurate, and they should be kept in a safe place. You can keep your records manually in a binder or use a computerized software program. In addition to keeping good records, nonprofits are required to follow specific guidelines to retain their tax-exempt status. Failure to meet these requirements can jeopardize your organization’s public and private grants eligibility.

Applying for a FEIN

Another important step is obtaining a Federal Tax ID number (FEIN). The FEIN is a unique nine-digit number assigned to businesses that is used for tax purposes. To obtain an FEIN, you must file Form SS-4. The easiest way to do this is online, but you can also fax or mail in the application. It usually takes about four business days to receive your FEIN.

Insurance

Another important consideration is determining what type of insurance your non-profit needs. There are different requirements at the state, local, and federal level. You may need liability or workers’ compensation insurance, depending on your industry. In addition, you must obtain any necessary licenses or permits. Setting up a separate bank account for your nonprofit corporation is also important. This will help to prevent commingling of funds and to keep your personal finances and the nonprofit’s finances separated.