Several federal resources and programs are available to assist lower-income families in the United States. These programs aim to provide financial support, access to healthcare, housing assistance, and more. Keep in mind that eligibility criteria may vary for each program, so it’s essential to check specific requirements. Here is a list of federal resources for lower-income families:

Child Care and Development Fund

The Child Care and Development Fund (CCDF) is the main federal source of financial assistance to help low-income families afford high-quality, licensed child care. The CCDF program serves families with children up to age 12 and pregnant women and working parents. It provides support to help lower family child care costs, which can put a strain on families’ finances and deter their ability to participate in work and training activities while also helping to stabilize the operations of child care providers.

Each year, states and territories must submit a three-year state plan for how they will use their CCDF funding to implement the goals of the Act. These state plans serve multiple purposes: they outline how States will remain in compliance with CCDF requirements, provide a roadmap for achieving CCDF’s purposes and goals, and help inform national efforts to build a better child care and child development services system.

Unfortunately, despite the best efforts of States and their Lead Agencies, limited resources and policies that do not fully meet the needs of children, families, and childcare providers continue to exacerbate the challenges facing CCDF. Specifically, high co-payments undermine the statutory objectives of CCDF by putting a financial burden on families and discouraging them from participating in work, training, or education opportunities. Low wages and difficult job conditions continue to make it difficult for childcare providers to grow and retain their supply of seats for CCDF-eligible children.

Additionally, inconsistencies in the application process and paperwork issues impede the flow of childcare subsidies to eligible families. For example, studies show that families who have to wait too long to receive their redetermination may withdraw from the program entirely before their case can be reviewed and their eligibility reinstated. Similarly, families who experience difficulty accessing a childcare provider that accepts CCDF payments are three times more likely to drop out of the program altogether.

Food Stamp Program

The Supplemental Nutrition Assistance Program, known to most Americans as food stamps, is a monthly benefit that helps eligible households purchase the food they need to thrive. It is the largest hunger-fighting program in the country, and more than 41 million people used SNAP benefits in 2022.

The program is run jointly by the federal government and individual states, which determine eligibility and issue monthly allotments to participating households on an Electronic Benefit Transfer (EBT) card. EBT cards can be used to buy food at grocery stores and other approved outlets. Depending on state rules, SNAP benefits can also be used to purchase certain household items and services, like health care and energy bills.

Household members must meet the program’s income and other requirements to qualify for SNAP. Generally, applicants must have a gross income below 165% of the poverty guideline, or $23,740 for a family of three. Those with higher incomes may still be eligible if their resources are below the resource limit and they pass the net income test. Households that include an elderly person or a disabled individual do not have to pass the net income test.

During the COVID-19 pandemic, Congress and the USDA gave SNAP participants additional benefits called emergency allotments. These allotments increased a recipient’s SNAP maximum allotment by an average of $95. The increases ended after the February 2023 issuance.

To apply for SNAP benefits, households should visit their local food bank or contact their SNAP office. Several types of documents are required, including proof of citizenship or refugee status, verification of shelter costs, utility bills, and the Social Security number for all household members. Those living in Puerto Rico, American Samoa, or the Commonwealth of the Northern Mariana Islands must also provide documents showing their income below their poverty level.

Temporary Assistance for Needy Families (TANF)

Known as welfare or social security in some parts of the country, the Temporary Assistance for Needy Families (TANF) program is an important source of income support for families living in poverty. It is a block grant program that replaced the Aid to Families with Dependent Children (AFDC) federal matching program, giving states a flexible amount of funds to use as they see fit to achieve the program’s four statutory purposes.

The TANF program provides financial help to low-income households, including childcare and job training payments. Most TANF programs require that adults in the household sign some kind of self-sufficiency contract, which typically includes a work or job search component. The TANF program also limits the number of months that a family can receive cash benefits.

In order to qualify for TANF, a person’s documented household income must be below a specific limit set by each state. Generally, the limit is less than half the average living cost in a given area. The TANF program can also require that a family participate in certain types of work activities or pay a penalty if they don’t do so.

In addition to money for basic expenses, TANF can be used to pay for things like child care, utility bills, gas for commuting to and from a job, food, and other household necessities. People applying for TANF must also meet a set of resource limits, which means that they cannot have more than $ 5,000 in value for one vehicle or $ 1,000 in countable resources such as checking accounts and savings accounts or stock and bond investments. Those who apply for TANF must agree to cooperate with their local child support services office.

New York State of Health

New York State of Health is an organized marketplace created by the Affordable Care Act where individuals, families, and small businesses can shop for, compare, and enroll in private health insurance coverage. It is also where you can find out if you’re eligible for financial help to reduce the cost of your plan. Enrollment for the 2023 year starts November 16 and ends January 31.

Families with low income may be able to get free or low-cost public health insurance through the Essential Plan or Child Health Plus. These subsidized plans aim to fill the gap for families and individuals who don’t qualify for Medicaid due to income or immigration status but who cannot afford private health insurance. Benefits include free or low-cost checkups, maternity and pediatric care, emergency services, prescription drugs, and dental options.

Another way to assist with healthcare costs is through the HEAP (Home Energy Assistance Program). This federally funded program assists low-income households with paying their home energy bills. You can learn more about this resource by visiting the New York State of Health website.

Many other government programs can help with other household expenses, such as utilities or food. For example, you can apply for Section 8 HUD vouchers to pay your rent if you live in a high-cost area or are on public assistance. You can also receive assistance paying your telephone bill through Lifeline or Link-Up, which offers discounts and credits on landlines and cell phones for low-income residents. You can also apply for SNAP, which provides nutrition benefits to help keep your family healthy and on the road to self-sufficiency.

Low-Income Housing Tax Credit

It can be difficult to find affordable housing if you earn below the median income for your area. This is why the government created the Low-Income Housing Tax Credit to encourage rental owners and developers to construct or renovate properties that are affordable for low-income residents. The program provides a federal tax credit to investors who finance a project. The credits can be claimed over a fifteen-year period and can offset the cost of construction, renovation, or purchase of land for the development of a rental property.

The State Low-Income Housing Tax Credit (SLIHC) is modeled after the federal 9% LIHTC and 4% “as-of-right” credit programs. The credit provides a dollar-for-dollar reduction in the state’s property taxes to investors in qualified low-income housing. The state program can be used for new construction, substantial rehabilitation or moderate rehabilitation of existing rental housing, and acquisition of land for use in affordable housing development.

To qualify for the credit, a developer must meet several requirements. These include income tests and rent limits. The income tests ensure that the units are affordable for households earning below a certain percentage of the area median income. Rent limits ensure that the rent does not exceed 30 percent of the household’s income.

The federal government allocates the credits to each state, which then awards them to developers through its state housing finance agency or other allocating agency. The credits can then be sold to individual investors or, more commonly, to tax-credit syndication funds. Investors then claim the credit against their federal income tax liability based on the size of their investment. The tax credits are subject to recapture if the project fails to comply with its conditions.

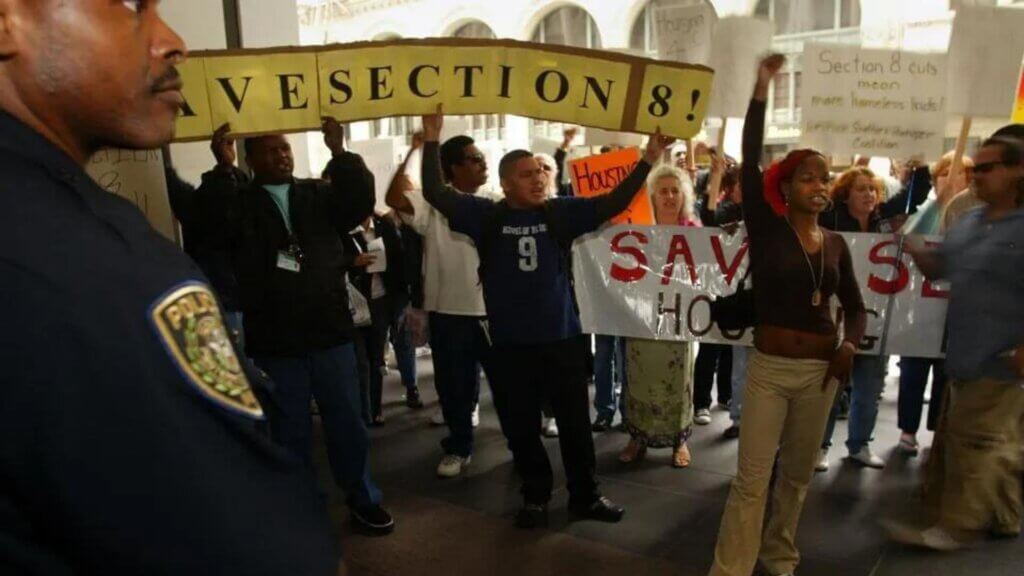

Section 8 Housing Choice Voucher Program

The Section 8 Housing Choice Voucher Program, often referred to simply as Section 8, is a federal housing assistance program in the United States. It is administered by the U.S. Department of Housing and Urban Development (HUD) and provides rental subsidies to eligible low-income individuals and families, allowing them to afford safe and decent housing in the private rental market.

Rental Assistance: Section 8 provides rental assistance in the form of vouchers that eligible participants can use to subsidize a portion of their rent payments. Participants are typically required to contribute 30% of their income towards rent, and the voucher covers the remaining portion up to a specified limit known as the Fair Market Rent (FMR).

Eligibility: Eligibility for the program is primarily based on income, family size, and U.S. citizenship or eligible immigrant status. Generally, applicants must have income at or below 50% of the median income for their area to qualify.

Application Process: To apply for Section 8, individuals and families must contact their local Public Housing Agency (PHA). PHAs are responsible for administering the program at the local level. The application process may involve providing documentation of income, family composition, and other factors.

Waiting Lists: Due to high demand and limited funding, many PHAs have waiting lists for Section 8 vouchers. Applicants may have to wait for an extended period before receiving assistance.

Portability: Section 8 vouchers are portable, meaning that participants can use them to rent eligible housing units anywhere in the United States, not limited to the jurisdiction of the issuing PHA.

Housing Inspections: Housing units rented under the Section 8 program must meet HUD’s housing quality standards. PHAs conduct inspections to ensure that the properties meet these standards before participants can move in.

Tenant Responsibilities: Participants are responsible for paying their portion of the rent on time, maintaining the rental unit in good condition, and complying with program rules and regulations.

Landlord Participation: Landlords who wish to participate in the Section 8 program must agree to certain terms and conditions, including rent limits and property maintenance standards. Payments are typically made directly to the landlord by the PHA.

Income Recertification: Participants’ income and family composition are reviewed periodically, typically on an annual basis, to determine continued eligibility and the appropriate level of assistance.

Special Programs: There are special voucher programs within Section 8, such as the Family Unification Program (FUP) and the Veterans Affairs Supportive Housing (VASH) program, which serve specific populations, including families at risk of homelessness and veterans experiencing homelessness.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a federal tax credit in the United States designed to provide financial assistance to low-to-moderate-income working individuals and families. The EITC is intended to encourage and reward work by supplementing the earnings of those who have jobs but may not earn enough to meet their basic needs or support their families. Here’s an overview of the Earned Income Tax Credit:

Targeted at Low-Income Workers: The EITC is specifically targeted at individuals and families with low to moderate incomes. Eligibility is primarily determined by income, filing status, and the number of qualifying children in the household.

Refundable Tax Credit: The EITC is a refundable tax credit, which means that if the credit amount exceeds the amount of federal income tax owed, the excess is refunded to the taxpayer. This makes it particularly valuable for lower-income individuals and families, as it can provide a significant financial boost.

Qualifying Children: The EITC offers different credit amounts based on the number of qualifying children in the household. Qualifying children must meet specific criteria, such as age, relationship to the taxpayer, and residency.

Income Limits: The income limits for EITC eligibility change annually and are adjusted for inflation. Generally, to qualify for the EITC, a taxpayer’s earned and adjusted gross income must fall below certain thresholds, varying depending on filing status and the number of qualifying children.

Phase-In and Phase-Out: The EITC has a phase-in and phase-out range. As a taxpayer’s income increases, the credit amount gradually increases until it reaches a maximum. Beyond that point, the credit begins to phase out, reducing as income increases further until it reaches a minimum credit amount.

Benefits: The EITC can provide substantial benefits to eligible individuals and families. The credit amount depends on income, filing status, and the number of qualifying children. Families with more qualifying children generally receive a larger credit.

Filing Requirement: To claim the EITC, taxpayers must file a federal tax return, even if they are not otherwise required to do so. They must also meet the eligibility criteria, including income and the presence of qualifying children.

Impact: The EITC has been shown to positively impact reducing poverty rates and improving the financial well-being of working families. It provides additional financial support to help families cover basic living expenses.

Anti-Poverty Measure: The EITC is considered one of the most effective anti-poverty programs in the United States. It has bipartisan support and has been expanded several times over the years.

Awareness and Outreach: Government agencies and nonprofit organizations often conduct outreach efforts to inform eligible individuals and families about the EITC to ensure that those who qualify take advantage of this valuable credit.