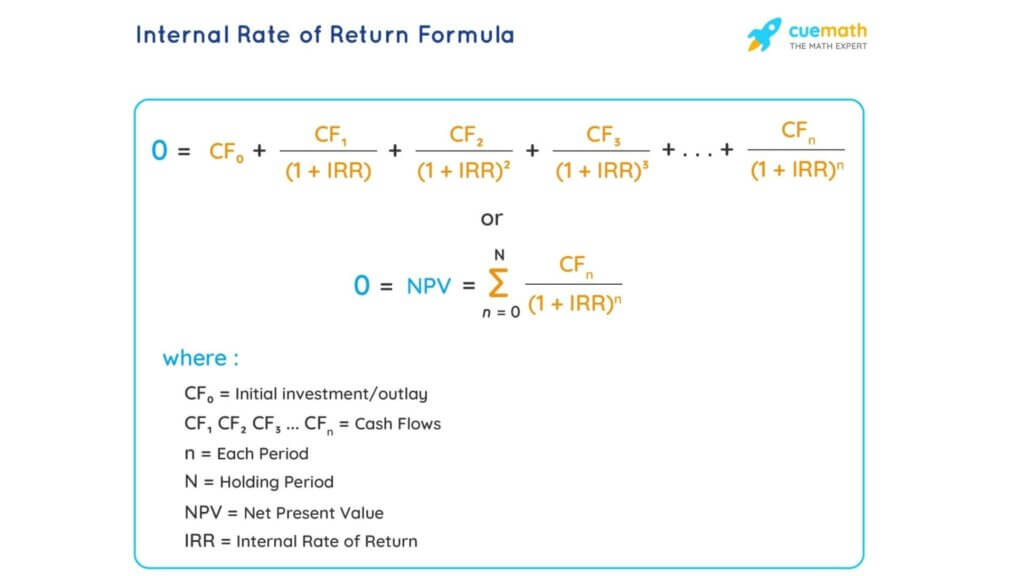

The IRR is calculated by evaluating a set of negative and positive cash flows that occur at regular intervals. The calculation tries to find an interest rate that will make the net present value of all costs and benefits equal to zero. The internal rate of return (IRR) is the discount rate at which a project’s net present value (NPV) is equal to zero. It is the rate of return that a project would earn if it were able to offset all its costs with its positive cash flows.The IRR is an important financial metric that can be used to compare and evaluate business investments. It is a key component of the net present value (NPV) formula, and a positive IRR indicates that an investment will be profitable. The IRR is often used by venture capital firms to identify promising startups and growth companies to invest in, and it is also common in corporate finance settings.

How to Calculate the Internal Rate of Return IRR?

To calculate the IRR, start by creating a spreadsheet with your cash flow data. You will need the payments (negative values) and incomes (positive values) that occur during the time period you want to analyze. These values should be formatted as dates so that the IRR formula can interpret them correctly. In addition, you will need to specify the number of time periods (daily, monthly, quarterly, annually) that the project will last for. You can also include a guess, which is an arbitrary number that helps the IRR function determine a result faster. The IRR formula uses an iterative process, starting with a guess and increasing it until it reaches an accurate result to within 0.00001 percent. If you do not provide a guess, Excel will use a default value of 10%.

IRR is a useful tool to assess the profitability of an investment or project, but it has limitations. You should consider other measures of profitability when choosing between projects, including the discounted cash flow (DCF) analysis and payback period. The IRR calculation can be difficult to understand, but this article explains it step-by-step. The more you understand how IRR works, the easier it will be to use as a screening tool for potential investments. If you want more advanced tools to evaluate an investment, consider using Excel’s XIRR or MIRR functions. These functions take into account a wider range of cash flow data and can produce more accurate results. They also support multiple payment periods, which can be useful for more complicated projects.