Medicare Supplement plans, also known as Medigap policies, help pay your share of out-of-pocket medical costs, such as copayments, coinsurance, and deductibles. These policies work alongside Original Medicare to fill in the gaps left by the program and are regulated by the Centers for Medicare and Medicaid Services. Medicare supplements don’t include prescription drug coverage, so you will need to sign up for a standalone Medicare Part D plan (Medicare Prescription Drug Plan) if you want this coverage. Medicare supplements follow the guidelines set by Medicare itself, and the policies are standardized. Each plan is labeled with a letter (Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, and Plan M), although some insurance companies offer unique versions of these plans. Medicare’s “Medicare & You” handbook and website provide detailed information about what is and isn’t covered by each type of policy.

Remember that Medicare Supplement plans are incompatible with Medicare Advantage Plans, standalone Medicare Prescription Drug Plans, employer/union group health insurance, or TRICARE (military retiree benefits). It’s also illegal for an insurer to sell a Medicare supplement policy if you already have Medicare Advantage or TRICARE coverage unless this coverage is ending. Additionally, a Medicare supplement policy can only cover one person; spouses must purchase separate policies.

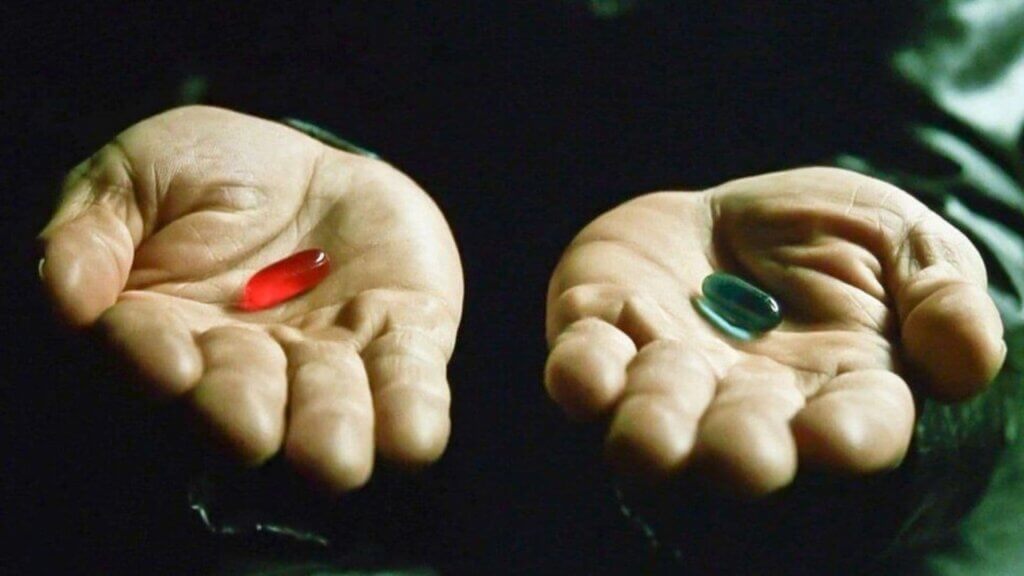

Medicare Supplement Plans v.s. Medicare Advantage

Medicare Advantage and Medicare Supplement insurance plans are two different types of health coverage for people with Medicare. Both are offered by private insurance companies, like Independence, but they differ in how they work. A Medicare Advantage plan bundles all the benefits of Original Medicare Parts A and B into one plan and often includes Medicare Part D prescription drug coverage. Medicare Supplement plans, also known as Medigap, are separate policies that help pay for out-of-pocket medical expenses that Parts A and B don’t cover. Some Medicare Advantage plans include dental, vision, and hearing benefits.

The biggest difference between Medicare Advantage and Medicare Supplement plans is that Medicare Advantage plans generally require you to use doctors and hospitals that are in the plan’s network. If you go out of network, you may have to pay more. Medicare Supplement plans, on the other hand, don’t have networks. People who are considering Medicare Advantage should be aware that they can return their policy within 30 days if they decide the plan isn’t right for them. However, this 30-day “free look” period does not apply to Medicare Supplement plans. In addition, people who switch from a Medicare Advantage plan to a Medicare Supplement plan will usually undergo medical underwriting, meaning their application could be rejected based on their current health status and pre-existing conditions.

Enrollment in Part D Prescription Drug Plans

The Medicare Supplement plans that are available today do not include prescription drug coverage, so you will need to enroll in a separate Part D Prescription Drug Plan. Medicare Supplement plans are individual policies and only cover one person; spouses must each purchase a separate policy. Most Medicare Supplement plans do not have network restrictions, so you can visit doctors and hospitals anywhere in the country. You can return your Medicare Supplement policy within 30 days if you aren’t satisfied with the coverage. Just be sure to keep your purchase receipt to prove that you returned it within the 30-day window.

Medicare Supplement Plans Comparison Chart

There are 10 different Medicare Supplement insurance (Medigap) plan types available in most states, each labeled with a letter of the alphabet. Although the standardized benefits of each plan type are the same across all insurance companies, premiums can vary. It’s helpful to compare each plan type’s benefits to find a policy that best fits your needs and budget.

For example, comparing Plan F to Plan G will help you determine which plan has the most comprehensive coverage for various Medicare costs. The monthly premiums of each plan can also vary based on your age, gender, health, and location. In addition, some insurance providers offer high-deductible versions of each Medicare Supplement plan, which require that you pay the higher Part A deductible ($2,700 in 2023) before your Medigap policy starts making payments. You should consider this option carefully since the higher deductible will increase your out-of-pocket costs.

| Medigap Benefit | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Plan A | Plan B | Plan C | Plan D | Plan F | Plan G | Plan K | Plan L | Plan M | Plan N | |

| Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up | + | + | + | + | + | + | + | + | + | + |

| Part B coinsurance or copayment | + | + | + | + | + | + | 50% | 75% | + | + |

| Blood (first 3 pints) | + | + | + | + | + | + | 50% | 75% | + | + |

| Part A hospice care coinsurance or copayment | + | + | + | + | + | + | 50% | 75% | + | + |

| Skilled nursing facility care coinsurance | – | – | + | + | + | + | 50% | 75% | + | + |

| Part A deductible | - | + | + | + | + | + | 50% | 75% | 50% | + |

| Part B deductible | - | - | + | - | + | - | - | - | - | - |

| Part B excess charge | - | - | - | - | + | + | - | - | - | - |

| Foreign travel exchange (up to plan limits) | - | - | 80% | 80% | 80% | 80% | - | - | 80% | 80% |

| Out-of-pocket limit** | N/A | N/A | N/A | N/A | N/A | N/A | $6,940 in 2023 | $3,470 in 2023 | N/A | N/A |