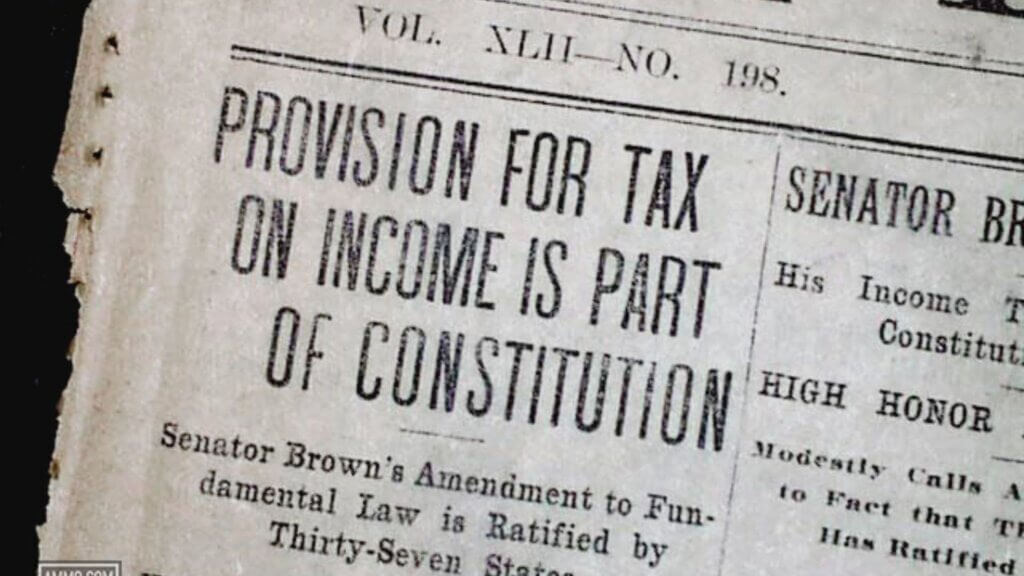

There was no income tax in America before the Civil War when President Lincoln introduced a temporary income tax to raise funds for the war effort. The Constitution gave Congress the right to tax citizens, but the concept didn’t take hold until after the Civil War and ratification of the 16th Amendment in 1913.

Income tax rates have played a crucial role in shaping the financial landscape of the United States throughout its history. From its inception to the present day, income tax rates have been a subject of debate, policy changes, and economic impact. This article will tell us more about the income tax rate history in the U.S., highlighting significant milestones, key policy shifts, and their implications on American society.

History

The concept of income taxation in the United States can be traced back to the Civil War era. In 1861, the federal government introduced the nation’s first income tax as a temporary measure to fund the war effort. This initial tax imposed a 3% rate on income above $800, with subsequent amendments expanding the tax base and increasing rates. However, the income tax was repealed in 1872, leaving the federal government reliant on tariffs and excise taxes for revenue.

The 16th Amendment and Modern Income Tax

It wasn’t until 1913 that the modern system of income taxation was established with the ratification of the 16th Amendment to the U.S. Constitution. This amendment granted Congress the power to levy taxes on income without the need for apportionment among the states. Under the new amendment, the first income tax law set rates ranging from 1% to 7%, with the top rate applied to incomes exceeding $500,000 (equivalent to around $13 million today, adjusted for inflation).

The Impact of Wars and Economic Changes

The outbreak of World War I prompted significant increases in income tax rates to fund the war effort. By 1918, the top rate had surged to 77%, reflecting the temporary nature of the increases during wartime. Following the war, rates were gradually lowered during the 1920s, only to spike again during the Great Depression. The Revenue Act of 1932 introduced a top rate of 63%, and subsequent legislation raised rates further to finance New Deal programs.

World War II ushered in another era of elevated income tax rates. The Revenue Act of 1942 introduced a top rate of 88% on incomes over $200,000 (approximately $3 million today), while the highest rate reached a staggering 94% during the war. These high rates persisted until the early 1960s when a series of tax reforms were implemented.

The Kennedy and Reagan Era Tax Reforms

President John F. Kennedy’s administration initiated a push for tax cuts in the 1960s to stimulate economic growth. The Revenue Act of 1964 reduced the top income tax rate from 91% to 70%. The subsequent decade saw a gradual decline in rates, but President Ronald Reagan’s landmark tax reforms of the 1980s made the most significant impact.

The Tax Reform Act of 1986 simplified the tax code and lowered the top income tax rate to 28%. However, it’s important to note that while the top rate was reduced, some deductions were eliminated or limited, resulting in a broader tax base. The Reagan-era reforms had both supporters who argued that lower rates would spur economic growth and critics who contended that reduced revenue could lead to budget deficits.

Recent Developments and the Path Forward

In the decades following the Reagan era, income tax rates experienced fluctuations due to changing political and economic landscapes. The Omnibus Budget Reconciliation Act of 1993, signed into law by President Bill Clinton, raised the top rate to 39.6%. The early 2000s saw a series of tax cuts under President George W. Bush, including reductions in the top rate to 35%. These tax cuts were temporary and set to expire after a certain period.

The 2010s brought about further changes. The American Taxpayer Relief Act of 2012 made some of the Bush-era tax cuts permanent while raising the top rate to 39.6% for high-income earners. The Affordable Care Act also introduced a Medicare surtax on net investment income for high-income taxpayers, further affecting effective tax rates.

The most recent significant change to income tax rates occurred in 2017 with President Donald Trump’s passage of the Tax Cuts and Jobs Act. This reform lowered the top individual income tax rate to 37% while implementing corporate tax changes. Proponents argued that these changes would stimulate economic growth, while critics expressed concerns about their impact on income inequality and long-term fiscal health.