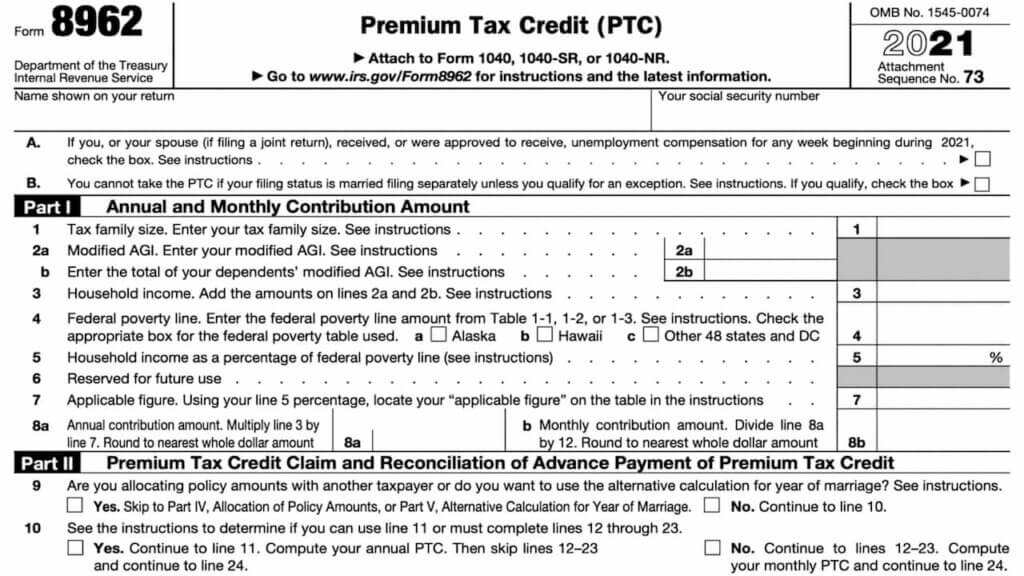

Those who qualify for the Premium Tax Credit, or APTC (Advance Premium Tax Credit), will use Form 8962 to report their credits. Form 8962 is provided free of charge and can be downloaded in PDF format on the IRS website.

As you may know, you need to be enrolled in a health insurance marketplace for at least a month to qualify for the APTC. You must also be eligible for a qualifying employer-sponsored plan. The open enrollment period is from November 1st to January 31st. If you don’t qualify for health insurance during this period, you may be able to enroll in a special enrollment period.

When you file your tax return, you will have to report the amount of the advance premium tax credit that you received. If you are unsure of the amount of the APTC, you may wish to check with the marketplace or your insurer.

The advanced premium tax credit (APTC) amount is based on the household’s income. The household income is calculated as a percentage of the baseline federal poverty level. The size of your family determines the amount of your tax credit. If your family size is greater than 400% of the Federal poverty line, you may qualify for the Premium Tax Credit.

Advance Payment of Premium Tax Credit

Using Form 8962, you can easily calculate the Advance Payment of Premium Tax Credit (APTC). The PTC is meant to help individuals and families afford health insurance. The amount of the PTC is determined by your family size and location. If you qualify for PTC, you may receive a refund.

However, if you do not qualify for PTC, you may have to pay back the amount of APTC you received. If your household income is over 400 percent of the Federal poverty line, you will not qualify for PTC. If your household income is below 100 percent of the Federal poverty line, you will qualify for PTC.

You may also be eligible for PTC if you are an alien resident. If your income is below the federal poverty line, you will be able to enroll in a qualified health plan through the Health Insurance Marketplace.

How to file the 8962 Form?

If you have health insurance, you must file Form 8962 by the end of the year. If you receive your health care from an employer, you may not have to file Form 8962.

Using Premium Tax Credit Form 8962 can be confusing at first. But there are a few steps you can follow to make sure you are reporting your credits correctly. In order to do this, you should understand how each field on Form 8962 works. Getting a basic understanding of each field will make it easier for you to report your credits.

First, you need to determine how much you qualify for. There are different guidelines for different situations. For example, if you are a single filer, you cannot qualify for the Premium Tax Credit. However, you may qualify for a low-cost Medicaid plan. You should consult IRS instructions if you are not sure whether or not you qualify for the PTC.

Then, you should allocate your policy amounts in Part III of Form 1095-A. This is the area that includes lines 21 through 32, column C. You should allocate amounts based on the size of your family.

How to Complete Form 8962?

The form is provided in PDF format and can be downloaded from our website. This can save time and is easier to complete than the paper version. Using an electronic form allows you to zoom in on the form and make sure you have filled out the forms correctly.

- The form has a table that helps you to fill in the monthly amounts. These monthly amounts are entered on lines 12 through 23 of Form 8962. The table also contains a SSN field that needs to be entered.

- Line 27 is used to determine the amount of APTC that is to be repaid. The excess APTC must be repaid if it is greater than the amount shown on line 25. If the amount on line 25 is more than the amount on line 24, the taxpayer must subtract the amount on line 25 from the amount on line 24.

- The table also includes the SLCSP percentage. You can determine if you qualify for the alternative calculation by examining the chart on the form instructions. If you are married, you can use the table to figure out the amount you should allocate for your spouse. If you have a dependent who is claiming a refund, you must not include his or her modified AGI on this form.

You can complete Form 8962 online and save it digitally. You may also choose to fill out the form in person. You can also ask an accountant or financial advisor to help you fill it out. They may also have a paper copy of the form.