How to File an IRS Form 8889

Form 8889 must be submitted with your tax return if your income exceeds $1500. Your taxable income and the amount of taxes owed are calculated using the form. A schedule or document must be included with this form. Include all your programs and documents, along with any deductions and donations.

Contributions

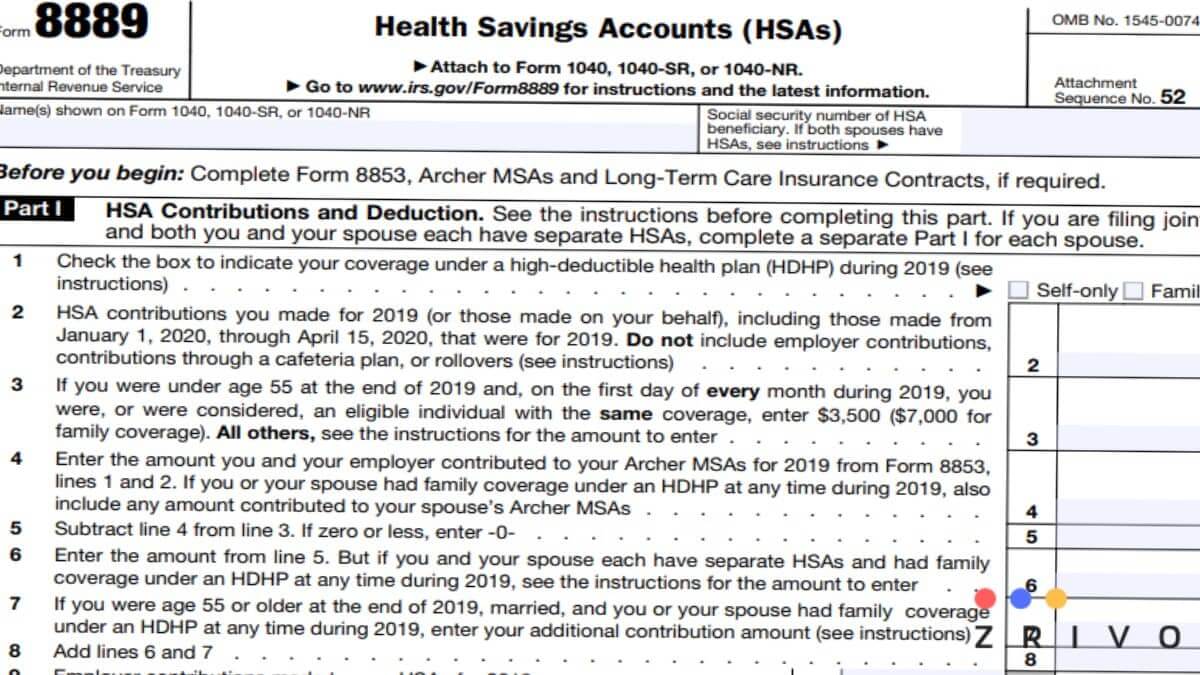

If you have an HSA, you must file an IRS Form 8889. This is a form that reports HSA distributions and HSA contributions. This form is filed with your federal tax return. The IRS provides detailed instructions on this form.

A health savings account is a health care plan to pay for qualified medical expenses. It’s an excellent way to save on healthcare costs and get a federal income tax break. You may have an HSA if you are covered under a high-deductible health insurance plan. You can contribute up to $1,750 each year to your account, reducing your taxable income.

You must file an IRS Form 8889 if you made 2021 HSA contributions. This form will calculate how much of your contributions are deductible. You must also disclose the number of distributions you took from your HSA. It will be a taxable distribution if you use the money for a non-qualified expense.

Deductions

If you’re a member of a health savings account (HSA), you can take advantage of federal income tax deductions. These benefits are available only to people who have HSA-eligible health plans. To receive them, you’ll need to fill out Form 8889.

This form calculates a tax deduction if you make deductible contributions to your HSA. You can also claim a tax deduction if you contribute money to your HSA after paying income tax. You’ll need to check with a tax professional to ensure you’re filing your tax return correctly.

The amount of contributions you can deduct depends on the size of your HSA and your annual contribution limit. Generally, you can deduct up to $1,750 in taxes, equivalent to six months of high-deductible health insurance for an individual. If you’re over 55, you can deduct an additional $1,000.

The IRS has released revised forms and instructions for Form 8889. If you need help with what to do, contact a tax professional.

Distributions

If you own a Health Savings Account, you are required to report distributions on IRS Form 8889. You must file the form with your federal tax return. Your information will help the IRS determine whether you’ve had qualified medical expenses. It also calculates the HSA deduction. If you are married, you must file a separate Form 8889 for each HSA.

The HSA is an investment account that allows you to make pre-tax or after-tax contributions. The funds are tax-free if you use them to pay for qualified medical expenses. However, you will be subject to a fine if you withdraw the funds for non-qualified medical expenses.

The HSA is similar to other tax-advantaged accounts, but they allow for tax-free growth and distributions. To benefit from the HSA, you need to be enrolled in a High Deductible Health Plan (HDHP).

An HSA allows you to save for your future healthcare needs. If you have an HDHP, you can contribute up to the standard annual limit. You can also make after-tax contributions, which will not appear on your W-2.

Attaching tax forms and schedules to Form 1040

If you are a US citizen, you must report income to Uncle Sam. This requires filing Form 1040. In addition to registering your payment, you must attach tax forms and schedules.

You may be required to use more than one Form 1040, significantly if your income exceeds the IRS threshold. There are several reasons why you need additional forms. You can find out more about what you need to file on the IRS website.

The new 1040 uses a building block approach to help you compile your financial information. You must include your income and the tax information you gathered in the previous year. In addition, you can claim deductions. The IRS offers several different schedules, including a schedule for self-employment income.

Some taxpayers may also need supplemental schedules to report business income and tax credits. These include the Earned Income Credit, available for qualifying families with children. There is also a tax credit for home improvements. You can also claim a tax credit for education expenses and honor federal taxes paid on fuel.

You must file Form 8889 if you or your employer made contributions to an HSA on your behalf, received HSA distributions during the tax year, or acquired an interest in an HSA because of the death of the account beneficiary.

Having said that, if you made contributions to an HSA during the tax year and will claim the HSA contributions deductions, file Form 8889. But, what is HSA deduction?

The HSA deduction is considered as above-the-line deductions. So, you aren’t required to itemize deductions to claim this deduction. You will claim this deduction on Schedule 1—Adjustments to Income on Line 12.

Start filling out Form 8889 to include it in your federal income tax return.

Online Fill Out Form 8889 2024 - 2025

The above Form 8889 is completely free to use and can be filled out on a computer, tablet, or even a smartphone. However, this is only for those who are going to mail their tax returns. To e-file Form 8889, check the Free File Fillable Forms as it’s available there.

Start filling out Form 8889 for the 2025 tax season (for 2024 taxes owed) by clicking the boxes and enter money amounts. Once you’re done, download it as PDF and print a paper copy using the printer icon found on the top right.

How to Attach Form 8889 to my Tax Return?

There isn’t a specific way to attach tax forms and schedules to Form 1040. Like most people, you can staple it in front of your 1040 along with other tax forms that report income. You’re going to also attach Schedule 1 on your Form 1040 if you’re claiming the HSA deduction. The number of forms may be too thick to staple. Simply, include all of your tax documents inside a large enough envelope if that’s the case.

So, there isn’t anything special you need to do to attach Form 8889 to your federal income tax return. Learn more about other tax forms you may need to file a tax return from here.