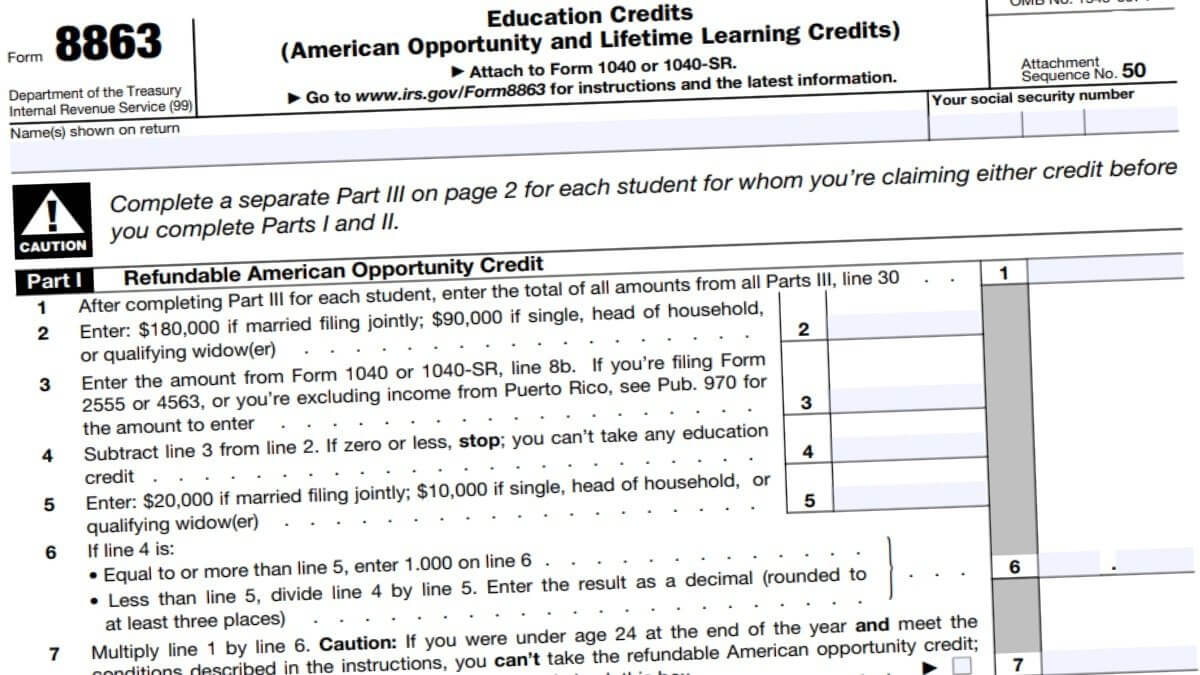

Form 8863—Education Credits must be claimed if a taxpayer is going to claim Lifetime Learning Credit on their federal income tax returns.

You can claim up 20% of the first $10,000 of qualified education expenses in Lifetime Learning Credit. This equals to $2,000 per tax return. Although this gives taxpayers a well amount to reduce their tax liability, this isn’t a refundable credit. So, the excess amount won’t be added to the taxpayer’s refund.

This tax credit can be claimed every year but can’t be claimed with the American Opportunity Tax Credit. You must choose either one on your tax return. Same as other tax provisions, claim the one that grants you the highest credit amount. The Lifetime Learning Credit is most likely to grant you the highest credit amount.

To claim this credit, not only you need to fill out Form 8863 and attach it to your tax return but get a Form 1098-T from the school you graduated or currently attending. This tax form is also known as the Tuition Statement. You shouldn’t have a hard time obtaining a 1098-T.

Assuming you already have this or will obtain it before filing a tax return, start filling out Form 8863 below.

Note: The credit amount is shown at the last two lines of Form 8863—depending on which tax credit you’re using the 8863.

Upon filing out Form 8863, make sure to attach it to the 1098-T—Tuition Statement and attach both forms to your tax return. Keep in mind that you can file Form 8863 electronically if you’re going to e-file taxes.