You may be wondering, what is the difference between a 1120S Form and an IRS 1120 Form? In this article, we will cover the differences between these two tax forms. Before we move on, you should understand how each form is different and what to expect.

What is the IRS 1120s Form?

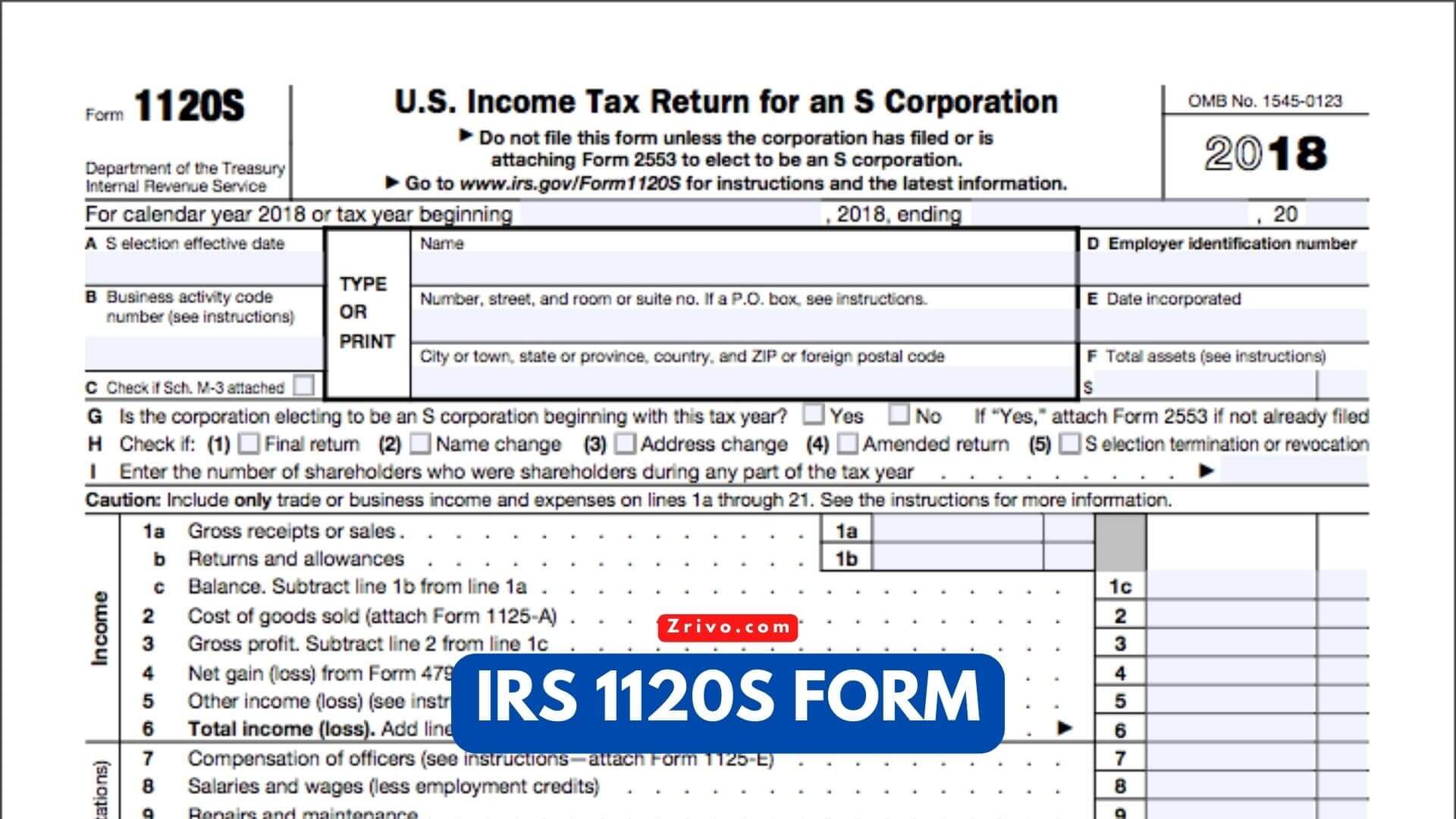

What is IRS 1120s Form? Form 1120s is the United States corporation’s income tax return. It is used to report the corporation’s income, gains, losses, deductions, and credits. Every domestic corporation must file a Form 1120, except those that are exempt from the corporate income tax under section 501(c)(3). Corporations that elect to be taxed as a corporation must also file Form 8832.

In most cases, the 1120S Form is used for U.S. corporations. It is similar to Form 1040 but contains more information. This is the main form used by corporations. However, the details of the tax return are very important. The 1120S Form contains information from line 2 to line 13.

The amended return should be filed whenever new or inaccurate information is discovered. In some cases, a missed small business tax credit can reduce the tax liability. If you have to file an amended 1120-S, you may need to get new or updated information about the business and its owners. In such cases, an expert can help you. A certified public accountant can help you. If you have questions about the IRS 1120S Form, you can find more information in this article.

What is the difference between 1120 and 1120S?

Form 1120 is the tax return filed by C corporations. The S-Corp tax form is only for information purposes. It reports a corporation’s net profit or loss for the year and flows through to the business owner. As an individual, you must report personal income tax on the income that is reported on Form 1040.

The S-Corp form is much simpler. It reports profits and losses to the IRS. This is important because S-Corps do not pay federal income tax. As such, they must report their earnings, losses, deductions, and credits to the IRS. This information is crucial in determining whether or not shareholders pay income tax. This is an important document because it tells the IRS whether the company should pay corporate taxes or pass the tax burden onto its owners.

While C corporations are required to file a Form 1120, S-Corporations do not. They pass their profits to their shareholders. The S-Corp Form 1120S generates Schedule K-1s for the shareholders. The individual owners use these forms to complete their personal income tax returns. A C corporation, on the other hand, pays corporate tax on Form 1120. The individual shareholder is taxed on their personal returns when they receive dividends.