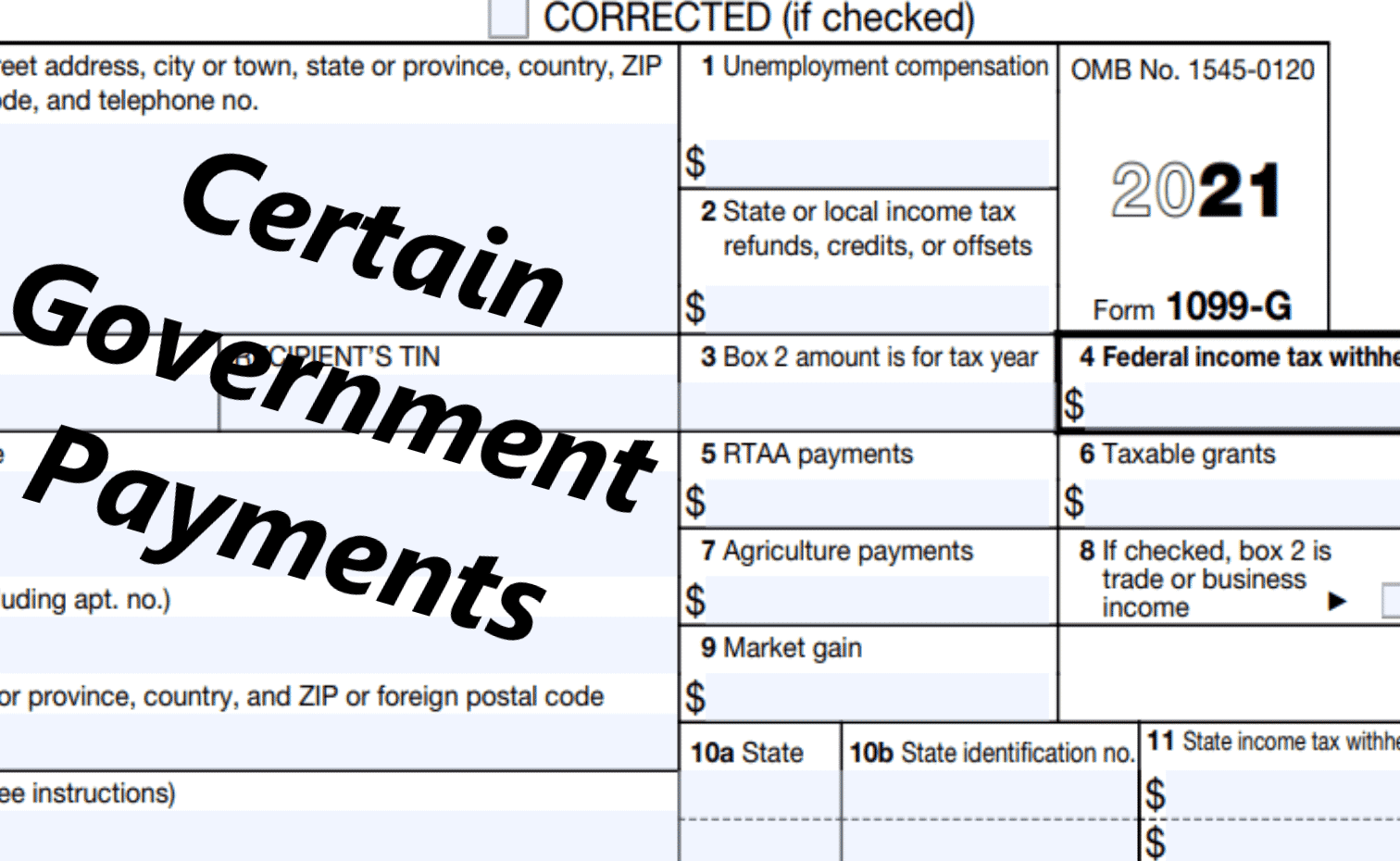

Form 1099-G—Certain Government Payments. Use your Form 1099-G to file your federal income tax return in the 2025 tax season. 1099-G reports the government payments made to individuals.

Although the use of Form 1099-G isn’t very common, considering the millions of Americans who applied to receive unemployment compensation, 2025 is going to be the year where it’s used the most.

The COVID-19 pandemic had certainly had its role in our society. Both federal and state governments have come up with financial solutions to protect those who’ve been impacted by the pandemic. This resulted in many taxpayers receiving financial aid from the government. While millions of Americans received unemployment compensation, a 1099-G is going to be sent to them by January 31st reporting this income.

The use of Form 1099-G isn’t limited to unemployment compensation though. Individuals will receive this tax form reporting the income paid to them by the government. Only certain payments made by federal, state, or local governments is reported on Form 1099-G.

Content of Form 1099-G—Certain Government Payments

If you received either one of the following payments from the government during the tax year, you will receive a Form 1099-G.

- Agricultural Payments for Farmers

- RTAA (Reemployment Trade Adjustment Assistance) Payments

- State or Local Credits, Offsets, Refunds

- Taxable Grants

- Unemployment Compensation

Unlike other information returns, there isn’t a limit on Form 1099-G. With that said, you will receive Form 1099-G even if you receive $10 from the government. The limit applies to most Forms 1099. For example, the income paid to an individual or business must be at least $600 to file Form 1099-MISC.

As to what to do with your 1099-G, attach it to your tax return. The amount of income you’ve earned reported on 1099-G must be added to your gross income.

You will then attach your 1099-G to your federal income tax return. Whether you file a tax return electronically or mail a paper tax return, Form 1099-G must be attached. Learn more about attaching Form 1099-G to Form 1040. This article also shows how you can attach other tax forms and schedules to your federal income tax return.