Form 1040-NR is the federal income tax return of nonresident aliens. As someone who’s not living in the United States but has a business, file Form 1040-NR to report the income you earned.

Form 1040-NR is pretty much identical to Form 1040 – US Individual Income Tax Return, but it’s for nonresidents aliens. The same as Form 1040, you will use the 1040-NR to report your income earned to the IRS and figure out how much owed to the IRS, your tax liability.

Form 1040-NR 2025 is filed in two ways. You can either file it on paper and mail it to the Internal Revenue Service along with the attachments or file electronically. So there is no difference between how Form 1040-NR is filed and other Forms 1040. It’s the same for all federal income tax returns. Keep in mind that the state you operate your business may also require you to file a state income tax return. Contact your state tax department to know which forms to use for that.

File Form 1040-NR on paper

Start filling out Form 1040-NR online for the 2025 tax season, 2024 taxes in order words, and print out a paper copy. Note that you must attach the other IRS tax forms on your return. If any tax forms are missing, you may have to amend your return as your return would be incomplete.

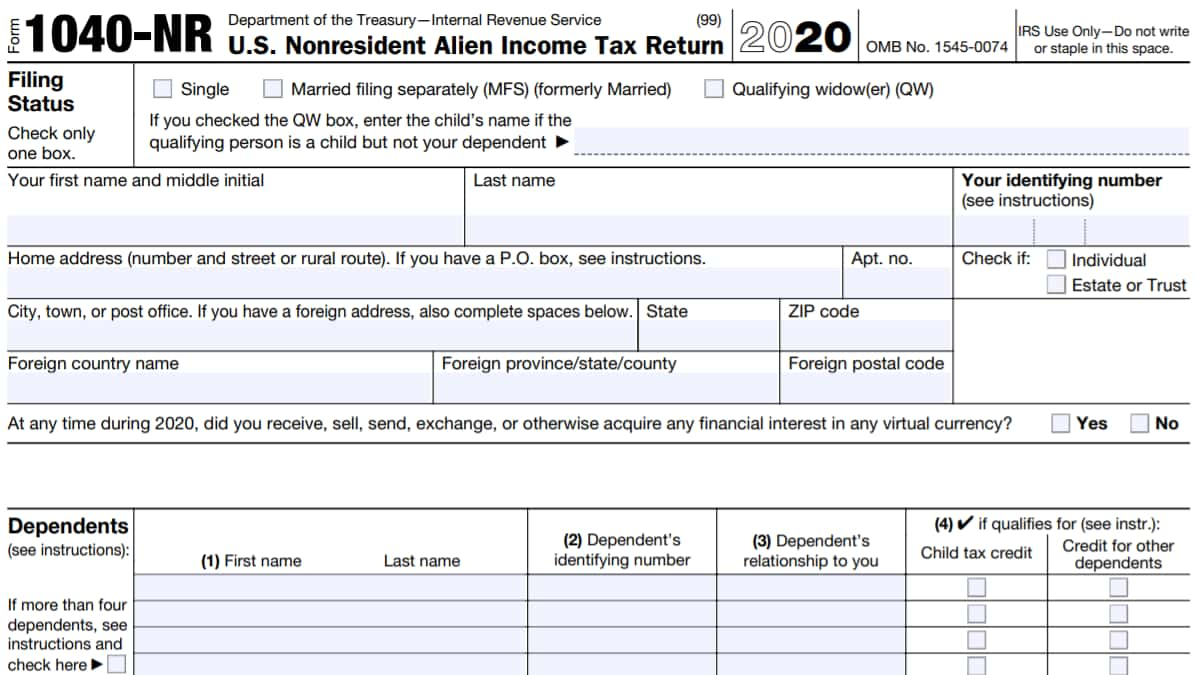

Fill out 2021 Form 1040-NR:

File Form 1040-NR electronically

Tax preparation services like TurboTax are there for all taxpayers to file their tax returns. Although many Americans and residents can file their returns electronically, most nonresident aliens have to pay to file their tax returns. This is because often, an SSN is required by taxpayers to file their returns electronically for free.

Assuming you’re self-employed like most other nonresident aliens, the price you’ll pay is more than a worker in the United States. The cost is between $20 and $120, depending on which tax preparation service you pick.

Key Information for Tax Year 2025:

- The filing deadline for Form 1040-NR for the tax year 2025 is generally April 15, 2024.

- Nonresident aliens must report all U.S.-sourced income, including wages, salaries, and business income, on this form.

- Tax treaty benefits might apply, which can affect the amount of tax you owe. You’ll need to refer to the specific tax treaty between your home country and the U.S.

- Certain deductions and exemptions available to U.S. citizens and resident aliens may not apply to nonresident aliens.

- You can find the instructions for Form 1040-NR on the official IRS website or seek assistance from a tax professional.

Filling out the 1040-NR Form: Step by Step

In this section, we will walk you through the process of filling out the 1040-NR form step by step, including important tips for accuracy and compliance.

- Personal Information:

- Name, address, and taxpayer identification number (TIN).

- Determining your residency status for tax purposes.

- Income Reporting:

- Reporting U.S. source income, including wages, salaries, and other earnings.

- Understanding the tax treaty benefits that might apply to your situation.

- Tax Calculation:

- Determining your taxable income and applying applicable tax rates.

- Claiming deductions and credits to reduce your tax liability.

- Additional Schedules:

- Schedule NEC for reporting income that isn’t effectively connected with a U.S. trade or business.

- Schedule OI for reporting other types of income, such as rents and royalties.

- Tax Payment and Refund:

- Exploring different methods for paying your taxes.

- Understanding the possibility of tax refunds based on overpayment.